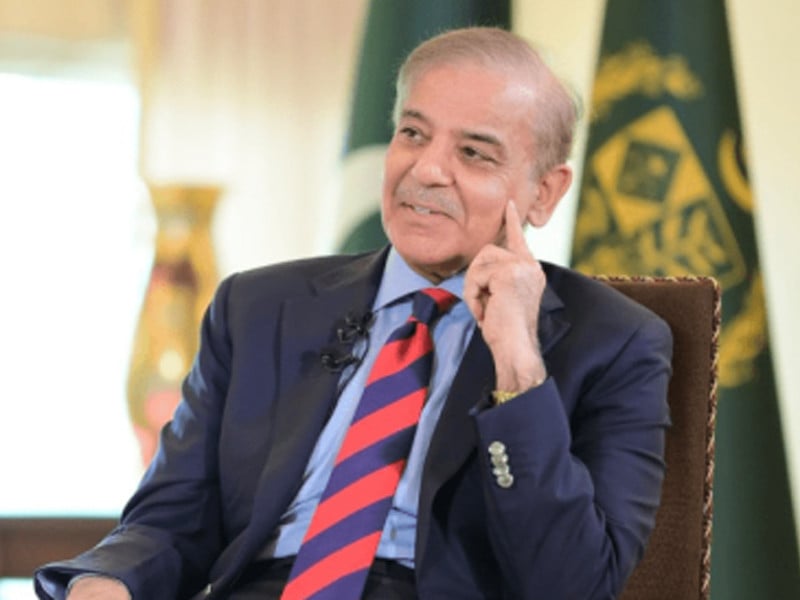

Prime Minister Shehbaz Sharif on Monday sought an early closure of a $1.2 billion Saudi loan deal and directed the tax machinery to present a plan this week to bridge a yawning gap in the revenue collection, in order to keep the International Monetary Fund (IMF) programme on track.

During a meeting on the outcomes of an unscheduled visit by the IMF mission to Pakistan, the prime minister was informed by the officials concerned that there were no major concerns but a few issues required early resolution.

The issues included the shortfall in the tax collection by the Federal Board of Revenue (FBR), external financing gap and the full implementation of the National Fiscal Pact, according to the participants of the meeting.

A press release issued by the Prime Minister's Office said that Shehbaz received a briefing from the finance ministry regarding the country's economy and the meeting with the IMF delegation, which visited Pakistan last week.

Pakistan has listed $1.2 billion oil on deferred payments by Saudi Arabia as part of its financing plan to bridge this year's IMF estimate of $2.5 billion gap. Sources said that the finance ministry told the prime minister that the Saudi facility had not yet been closed.

Shehbaz had already written a letter to the Saudi Arabia for the approval of the facility. Finance Minister Muhammad Aurangzeb would now follow up on with Saudi Arabia for an early closure, which was important for bridging the financing gap.

The FBR sustained a Rs190 billion tax shortfall in just four months of this fiscal year, which the its chairman attributed to underlying assumptions going off the mark. The sources said that Shehbaz directed the FBR to present an enforcement plan this week to cover the tax shortfall against the agreed targets with the IMF.

The development came on the heels of another FBR transformation plan that the prime minister had already approved. Last week, for the implementation of the transformation plan, the Economic Coordination Committee (ECC) approved a Rs32.6 billion incentive package for six months.

For the month of November, the IMF has set Rs1.03 trillion tax target and till Monday the FBR could only collect Rs390 billion. The tax machinery needs to generate about Rs610 billion in the remaining 12 days of the month to hit the goal post.

The Prime Minister's Office stated that Shehbaz Sharif directed for accelerating actions against tax defaulters, and reiterated his resolve to bring the tax evaders and their facilitators to book.

The prime minister was briefed that the IMF had taken a position on the issue of discontinuing gas connections to in-house power generation plants of the industries by January. However, the government had requested the IMF to review the deadline but the IMF did not agree.

The prime minister instructed for closing the issue by taking a final decision on the matter and also present a plan about the cost-benefit analysis of discontinuing the gas connections.

Pakistan has surplus electricity and surplus imported LNG too. The IMF wants the industries to shift to the national power grid, while the government is now of the view that the surplus imported LNG can be provided to the industries at the full cost.

The finance ministry briefed the prime minister about the implementation status on the IMF's condition of approval of the agriculture income tax laws by the four federating units by October 31st. The prime minister was told that Punjab had approved the law, but Sindh had not even presented it in the assembly. However, the prime minister was assured that Sindh would pass the law soon.

The IMF's condition is aimed at increasing the agriculture income tax rates to 45% -- equal to the federal personal income tax rates – but the Punjab law did not mention any rate. The Prime Minister's Office said that Shehbaz "praised Punjab chief minister and the provincial government for reforms in the agriculture sector".

After the end of its visit, the IMF had said that "based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF's Executive Board for discussion and decision".

Its mission chief stated that Pakistan and the IMF staff "agreed with the need to continue prudent fiscal and monetary policies, revenue mobilisation from the untapped tax bases, while transferring greater social and development responsibilities to provinces".

The Prime Minister's Office said that Shehbaz was briefed on the economic indicators and the current situation of inflation. The meeting was also briefed on the steps taken against tax evasion and those facilitating such theft. The prime minister stressed that public relief should be accorded priority on all other steps and they were taking all possible measures to fulfil public promises.

Prime Minister Shehbaz observed that due to a surge in exports and record remittances, the country's foreign reserves had increased. He added that the country's economy was on path to stability and due to the steps taken in this regard, the stock market was showing brisk business.

He said that foreign investment was a reflection of confidence in the government's policies. "The country's economy can progress well when all the stakeholders meet their responsibilities. All sectors should pay taxes to play their role in the national progress," the press release quoted Shehbaz as saying.

1731975305-0/Untitled-design-(40)1731975305-0-165x106.webp)

1731975060-0/Untitled-design-(39)1731975060-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ