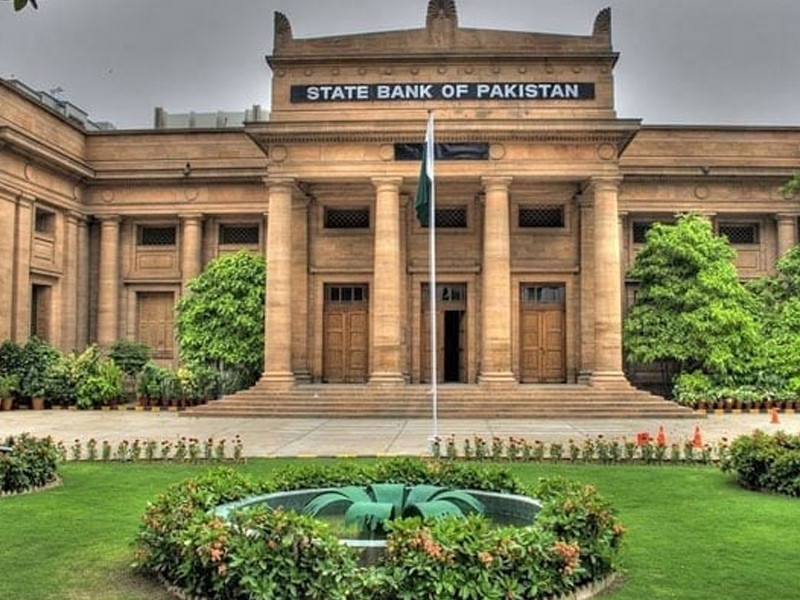

Industrialists and traders have praised the State Bank of Pakistan (SBP) for introducing loan schemes for Small and Medium-sized Enterprises (SMEs), agricultural financing, and commercial vehicle loans. They urged the SBP to strictly enforce banking ethics and the code of conduct, and to focus on staff training to create a more supportive environment for businesses to work comfortably with banks.

They stressed that banks should promptly initiate official awareness campaigns so more entrepreneurs can take full advantage of these loan facilities. They stressed that facilitating the welfare and development of small traders would stimulate economic activities.

Concerns were also raised about the challenges traders face when trying to open new bank accounts. They complained that many small traders reportedly have to visit banks repeatedly, often finding branch managers absent, while some staff members’ rude behaviour creates unnecessary barriers to business growth.

According to an SBP notification, financial institutions, including commercial and Shariah-compliant banks, can offer loans of up to Rs25 million for small enterprises and up to Rs200 million for medium enterprises, with a repayment period of five years. The risk coverage scheme aims to double the outstanding financing for SMEs to Rs1.10 trillion over the next five years.

Shaikh Muhammad Tehseen, President of the Federal B Area Association of Trade and Industry (FBATI), appreciated the SBP’s efforts but suggested that commercial banks should introduce financing schemes with lower mark-up rates to revitalise the country’s economy, rather than focusing solely on sectors like agriculture and technology. He also pointed out that many banks face surplus liquidity challenges, which result in heavy penalties. He argued that offering flexible financing schemes and soft loans to SMEs would not only resolve this issue but also generate revenue, create jobs, and increase tax contributions—a mutually beneficial outcome for all stakeholders.

While the introduction of risk coverage schemes for SMEs is a positive step, Tehseen highlighted that without a rational mark-up rate, the intended benefits may not be fully realised. He proposed that low-cost financing should first be offered to SMEs with strong growth potential, followed by support for struggling enterprises.

Hyderabad Chamber of Small Traders and Small Industry Vice President Shan Elahi Sehgal also appreciated the SBP and National Bank of Pakistan (NBP) for launching these loan schemes, noting their potential to stabilise the economy by providing critical support to SMEs. He said that these initiatives would greatly benefit small business owners, especially women entrepreneurs, by facilitating business expansion and contributing to national economic growth.

However, Sehgal expressed concerns over the lack of public awareness about these loan schemes. He pointed out that formal public awareness sessions are not being conducted, and in many cases, bank staff are not fully informed about the financing options, making it difficult for small business owners to access accurate information. This negligence, he warned, could hinder the effectiveness of the loan schemes intended to support the growth of SMEs and the agricultural sector.

1732256278-0/ellen-(1)1732256278-0-165x106.webp)

1725877703-0/Tribune-Pic-(5)1725877703-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ