Stocks slip over IPP contract concerns

KSE-100 index drops 216.06 points, settles at 85,453.22

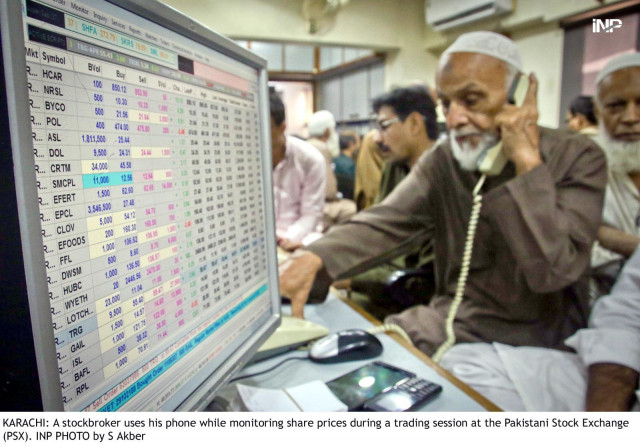

Pakistan Stock Exchange (PSX) came under pressure on Thursday as it snapped a record-breaking streak with the decline of over 200 points amid concerns over potential premature termination of independent power producers' (IPPs) contracts and news of no immediate $16 billion debt re-profiling by China.

In the morning, trading began on a robust note with the KSE-100 index reaching an impressive intra-day high of 86,013.46 points before midday. However, the momentum quickly reversed with wild fluctuations.

Anxiety surrounding the potential termination of IPP contracts and rupee instability dampened investor sentiment. Additionally, uncertainty over the International Monetary Fund (IMF) loan conditions, including the removal of energy subsidies and reforms in loss-making state-owned enterprises (SOEs), aided the bearish activity.

The index fluctuated throughout the day and it could not be able to maintain its position above 86,000. In the final trading hour, it dropped to the intra-day low of 85,425.74 points, wiping out all the earlier gains. The bourse closed near the day's low with modest losses.

"Stocks closed under pressure amid concerns over the government's premature termination of IPP contracts on tariff issues and the unresolved $16 billion China debt re-profiling case," said Ahsan Mehanti, Managing Director of Arif Habib Corp.

"Rupee instability and uncertainty over the outcome of IMF's tough conditions including an end to energy subsidies, the monitoring of government spending and the closure of loss-making SOEs played the role of catalysts in bearish close at the PSX." At the close of trading, the KSE-100 index registered a loss of 216.06 points, or 0.25%, and settled at 85,453.22.

Topline Securities, in its commentary, noted that the KSE-100 index experienced a battle between bulls and bears and the latter ultimately emerged victorious.

"Two independent power producers, Hub Power and Lalpir Power, published material information that shifted market sentiment as both IPPs would terminate their contracts early," it said.

Additionally, Hub Power announced that, pursuant to the terms of the agreement, the government of Pakistan and the Central Power Purchasing Agency-Guarantee (CPPA-G) agreed to settle the company's outstanding receivables up to October 1, 2024.

Key contributors to the index were Pakistan Petroleum Limited (PPL), Pakistan State Oil, National Bank of Pakistan, Pakistan Telecommunication Company and The Searle Company, which collectively added 245 points, Topline added.

Arif Habib Limited (AHL), in its report, stated that there was further consolidation around the 86,000 level. On the KSE-100, 54 shares rose while 42 fell with PPL (+4.74%), Pakistan State Oil (+3.28%) and National Bank of Pakistan (+3.58%) having the biggest upside contribution to the index gains

Positive developments were also expected with the arrival of a large Saudi delegation in the country, AHL added. JS Global analyst Mohammed Waqar Iqbal observed that the market opened on a positive note, but profit-taking emerged later.

"The presence of a Saudi delegation in Islamabad, along with statements regarding the Reko Diq project, sparked interest in oil sector heavyweights like PPL and Oil and Gas Development Company," the analyst added.

Overall trading volumes decreased to 503.75 million shares compared with Wednesday's tally of 596.05 million. The value of shares traded during the day was Rs27.9 billion.

Shares of 430 companies were traded. Of these, 149 stocks closed higher, 213 declined and 68 remained unchanged.

PTCL was the volume leader with trading in 52.2 million shares, gaining Rs1.32 to close at Rs14.52. It was followed by Hub Power with 46.6 million shares, losing Rs0.69 to close at Rs112.73 and PIA Holding Company with 25.5 million shares, gaining Rs1.85 to close at Rs20.35.

During the day, foreign investors sold shares worth Rs3.41 billion, according to the NCCPL.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ