1728560884-0/Untitled-design-(5)1728560884-0.jpg)

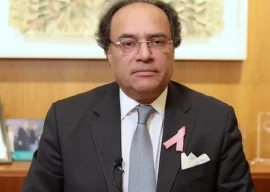

Finance Minister Muhammad Aurangzeb has announced that there is tax fraud and evasion worth Rs3,400 billion in the country, and a major crackdown will be launched against sales tax evasion. Those involved in sales tax evasion will be arrested.

He made this statement during a press conference alongside the Chairman of the Federal Board of Revenue (FBR). During the conference, slides of the tax returns of companies were presented, highlighting that many companies are involved in tax fraud worth billions of rupees.

Finance Minister Muhammad Aurangzeb stated that there is significant potential for tax collection. There is Rs3,400 billion worth of tax evasion and fraud in the country.

The cement sector alone could generate an additional Rs18 billion in taxes, the battery sector could yield Rs 11 billion, and the beverage sector faces a tax shortfall of Rs11 billion.

He further noted that only 14% of the 300,000 manufacturers are registered, and there is a tax shortfall of Rs18 billion in the textile weaving sector. In the iron and steel sector, Rs29 billion is being lost due to excessive input tax claims.

A massive fraud is occurring through the input tax adjustment system.

Minister Aurangzeb emphasized that individuals involved in tax fraud can be arrested, with penalties including up to five years of imprisonment for tax evasion of Rs1 billion and up to 10 years for larger amounts.

At the event, FBR Chairman Rashid Langrial stated that companies have committed large-scale tax fraud in their sales. The tax returns presented are entirely fraudulent and false.

While the names of these companies are not being revealed at this stage when arrests are made, they will be based on solid evidence, and the names will be disclosed.

The Chairman of the Federal Board of Revenue (FBR) stated that the CFOs of companies are not the beneficiaries of tax evasion. CFOs are responsible for signing tax returns, and if there are incorrect sales tax returns, they should not sign them just because the owner tells them to.

He announced that arrests would be made within a week following legal procedures, urging the CFOs of companies to consult their lawyers and families before signing sales tax returns.

The Chairman emphasized that the data belongs to our system, but we have not been able to provide the necessary support to our assessing officers. He assured that they will provide support to assessing officers and take robust action.

The FBR Chairman announced a significant crackdown on sales tax evasion in the next 15 to 20 days, stating that individuals involved in sales tax evasion will be arrested.

He urged the CFOs of large companies not to input incorrect sales tax data, asserting that there is no larger fraud in the country than the sales tax input adjustment.

1728562807-0/milton-(2)1728562807-0-165x106.webp)

1728561450-0/diddy-(29)1728561450-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ