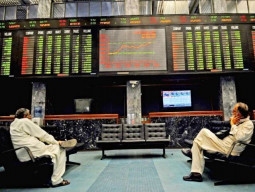

The Pakistan Stock Exchange (PSX) continued its bullish trend on Tuesday, with the benchmark KSE-100 index surging by 665.81 points, or 0.78% reaching an all-time high of 85,576.10 points during intra - day trading.

Trading began with a slight dip, with the index touching an intra-day low of 84,897.98 points.

However, the market gained momentum as the day progressed, reaching a new peak of 85,676.79 points.

The volume of shares traded reached over 85 million, reflecting strong investor interest in the market.

The total value of shares traded stood at Rs 8.06 billion.

Earlier yesterday, the Pakistan Stock Exchange (PSX) witnessed a historic rally, with the KSE-100 index surging to just under 85,000 points, fueled by strong performances in blue-chip oil stocks and overall optimism during the ongoing earnings season.

The market’s upward momentum was driven by a mix of local and global factors, including favorable financial settlements, rising global crude oil prices, and falling bank lending rates.

In early trading, the KSE-100 index hit an intra-day low of 83,303.54 points. However, as the day progressed, the index rallied significantly, reaching an intra-day high of 85,047.81 points before settling at 84,910.30 by the end of the session—a gain of 1,378.34 points, or 1.65%.

A major catalyst for the rally was Pakistan Petroleum Limited’s (PPL) settlement with Iraq's Midland Oil Company, resulting in a $6 million inflow for the company.

The anticipation of strong quarterly results for oil companies also played a crucial role in boosting investor confidence.

Moreover, discussions around the privatisation of state-owned enterprises (SOEs), along with the global rise in crude oil prices, further strengthened the market's bullish sentiment.

"Stocks closed at an all-time high, led by blue-chip oil shares, amid speculation around the earnings season. The settlement between PPL and Iraq’s Midland Oil was a key trigger for the rally," said Ahsan Mehanti, Managing Director of Arif Habib Corp. He also pointed to broader factors like falling bank lending rates and the government's deliberation on SOE privatisation as additional catalysts.

Blue-chip companies such as Oil and Gas Development Company (OGDC), PPL, Fauji Fertiliser, and Engro Corporation were the primary contributors to the index’s gains.

According to Topline Securities, these companies added 752 points to the index, with OGDCL gaining 7.66%, PPL rising by 6.82%, and Fauji Fertiliser up by 2.53%.

This broad-based buying, especially in exploration and production (E&P) and fertiliser sectors, continued to drive market sentiment.

Arif Habib Limited (AHL) noted in its report that the KSE-100 index’s performance was "an aggressive start to the week" and hinted that near-term support had risen to 84,000 points. Analysts expected the market to continue its upward trend, with higher prices anticipated in the coming sessions.

Trading volumes also surged during the day, with overall activity increasing to 449.5 million shares from 381.5 million on Friday.

The value of shares traded rose to Rs 30.2 billion. Out of 448 companies that traded, 218 closed higher, 167 fell, and 63 remained unchanged.

PPL emerged as the volume leader, with 40.8 million shares traded, gaining Rs8.09 to close at Rs 126.69.

Hub Power followed with 28.1 million shares, although its stock fell by Rs 3.64 to close at Rs 121.70. Fauji Cement also saw a significant volume, gaining Rs 1.05 to close at Rs 28.

Foreign investors were active buyers during the session, purchasing shares worth Rs 784.2 million, according to data from the National Clearing Company of Pakistan Limited (NCCPL).

1728386780-0/BeFunky-collage-(38)1728386780-0-165x106.webp)

1721987069-0/diddy-tupac-(1)1721987069-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ