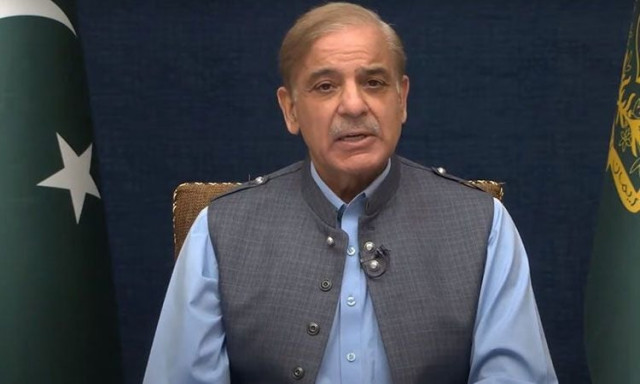

PM vows to deliver benefits to people

Shehbaz lauds inflation drop, Moody's upgrade

Prime Minister Shehbaz Sharif on Sunday expressed his satisfaction over the recent reduction in inflation rates and the upgrade in Pakistan's credit rating by Moody's, calling the anticipated further decrease in inflation in September a promising sign for the economy.

In a statement by the Prime Minister's Office, the PM commended the reported decline in inflation indicators released by the Pakistan Bureau of Statistics.

"The Consumer Price Index experienced a notable decrease in July 2024, bringing the inflation rate down to 11%. Economic experts' predictions of further inflation reduction by September are a positive indication for the country's economic health," he stated.

The prime minister stressed the importance of Pakistan's improved standing in the global financial community, saying that after Fitch, the international rating agency Moody's has also upgraded the country's credit rating.

This upgrade reflects Pakistan's improving economic indicators.

"Our administration remains firmly committed to implementing economic reforms. We are actively pursuing the right-sizing policy, which I am personally overseeing to ensure its success. The economic benefits of these reforms will soon be visible to all," the premier affirmed.

He also pointed out the major relief measures introduced by the federal and Punjab governments, particularly for electricity consumers, alongside the recent reduction in petroleum product prices.

"Our government is resolute in its mission to pass on all benefits to the common man. The diligent efforts of our economic and financial team are steering the nation towards economic stability," he added.

The PM also acknowledged the challenges faced by the public but assured that the government was working relentlessly to mitigate these difficulties and improve the lives of the people.

Moody's, one of the top global rating agencies, recently upgraded Pakistan's local and foreign currency issuer and senior unsecured debt ratings to Caa2 from Caa3. The agency attributed the upgrade to Pakistan's improving macroeconomic conditions and a moderately better government liquidity and external position.

"Pakistan's default risk has now reduced to a level consistent with a Caa2 rating," Moody's stated, highlighting the increased certainty surrounding the country's external financing sources following the staff-level agreement with the International Monetary Fund (IMF) in July for a $7 billion extended fund facility (EFF).

Previously, in February, Moody's had maintained Pakistan's long-term credit rating at Caa3, reflecting a higher probability of default and investment risks due to weak debt affordability.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ