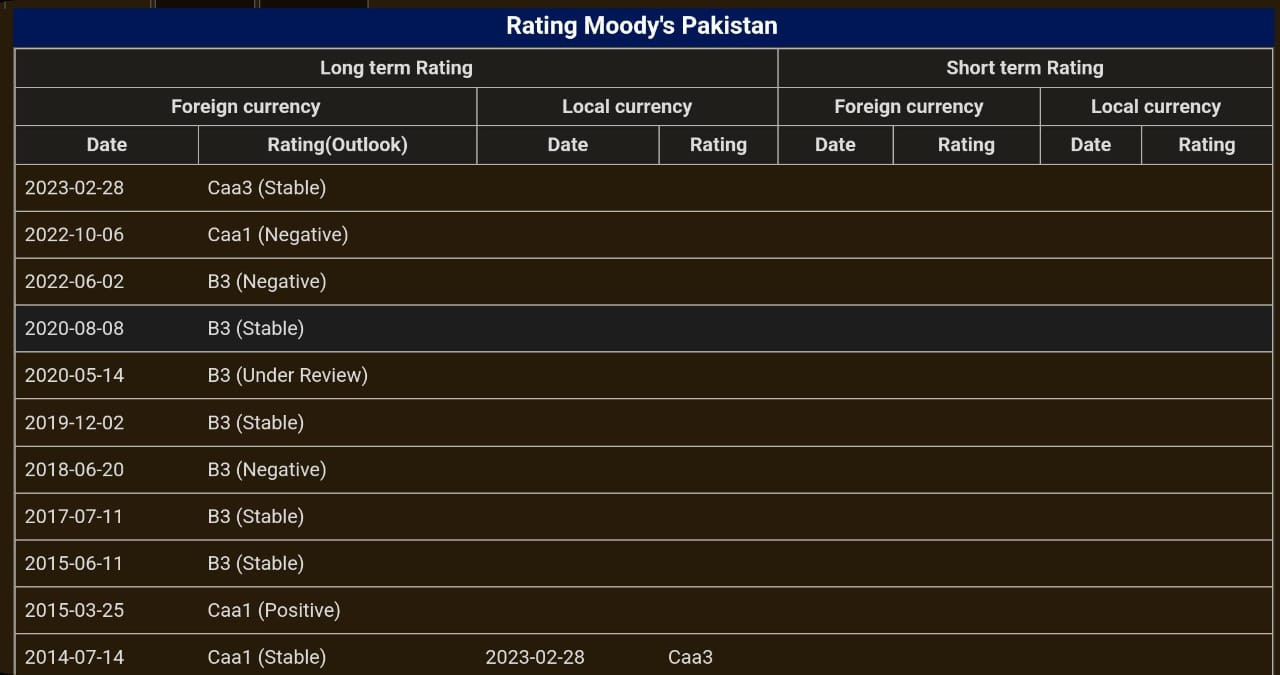

Moody's Ratings has upgraded Pakistan's local and foreign currency issuer and senior unsecured debt ratings from CAA3 to CAA2, while changing the country's outlook from stable to positive.

This decision reflects the country's improving macroeconomic conditions and moderately better government liquidity and external positions, despite remaining challenges.

The upgrade to CAA2 signifies a reduction in Pakistan's default risk, aligning it with the new rating level.

This improvement is partly attributed to the recent staff-level agreement with the International Monetary Fund (IMF) on a 37-month Extended Fund Facility (EFF) worth $7 billion, agreed on 12 July 2024.

The IMF Board is expected to approve the EFF in the coming weeks, providing further stability to Pakistan’s external financing sources.

Pakistan's foreign exchange reserves have approximately doubled since June 2023, although they still fall short of fully meeting the country's external financing needs.

The nation continues to rely on timely financing from official partners to address its external debt obligations.

Despite the upgrade, Pakistan's CAA2 rating continues to reflect very weak debt affordability, with interest payments expected to consume about half of government revenue over the next two to three years.

The rating also incorporates concerns about weak governance and high political uncertainty.

The positive outlook suggests that risks are now skewed to the upside.

It considers the potential for further reductions in government liquidity and external vulnerability risks, supported by the IMF programme.

Sustained reforms, particularly revenue-raising measures, could improve Pakistan's debt affordability and fiscal position.

The rating upgrade to CAA2 also applies to the backed foreign currency senior unsecured ratings for The Pakistan Global Sukuk Programme Co Ltd, with the outlook similarly set to positive.

Moody's has also raised Pakistan's local and foreign currency country ceilings to B3 and CAA2, respectively.

The two-notch gap between the local currency ceiling and the sovereign rating is driven by the government's significant role in the economy, weak institutions, and high political and external vulnerability risk.

Additionally, the gap between the foreign currency ceiling and the local currency ceiling accounts for incomplete capital account convertibility and relatively weak policy effectiveness.

1724850841-0/Untitled-design-(5)1724850841-0-165x106.webp)

1724746120-0/Untitled-design-(2)1724746120-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ