SIFC pushes for IMF nod on Rs1.27t energy debt

Energy ministry proposed settling the debt without increasing tariff and without having any impact on budget

The Special Investment Facilitation Council (SIFC) on Friday directed the authorities concerned to urgently secure the International Monetary Fund’s (IMF) approval for the clearance of Rs1.27 trillion energy sector unpaid debt aimed at avoiding any further increase in electricity and gas tariffs to retire the debt.

If the cost of circular debt is passed on to the consumers, the electricity tariff will go up by Rs24 per unit, hitting Rs66 per unit. Similarly, gas tariff may also go up by Rs5,800 per metric million British thermal unit (mmbtu) for all consumers, which is more than double the existing rates.

The energy ministry has proposed settling the debt without increasing the tariff and without having any impact on the budget.

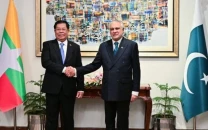

The instructions to immediately secure the approval of the IMF were given to the finance and energy ministries during the 9th meeting of the SIFC, which was also the last meeting of the civil-military body before the general elections.

The finance ministry has already shared the plan with the IMF and now it needs to pursue the lender to give its stamp of approval soon.

The total energy sector circular debt stands at Rs5.725 trillion as of Nov 2023. This includes Rs2.7 trillion power sector debt and over Rs3 trillion gas sector debt. The energy ministry has proposed to retire Rs1.268 trillion out of this, or 22% of the stock.

The SIFC was apprised that the proposed Rs1.27 trillion circular debt retirement plan had neither any financial impact on the budget nor would it burden the consumers of gas and electricity in the shape of higher prices to recover the debt.

In the past, the power sector circular debt was either settled through budget or the consumers were forced to pay for the cost of inefficiencies of the energy sector. The electricity consumers are still paying Rs3.23 per unit to pay interest on the power sector circular debt –a situation that may also arise in the gas sector if the issue was not taken head on, according to a cabinet member.

A senior government functionary said that considering the existing inflationary pressures, the circular debt could no more be passed on to the consumers in the shape of price increase.

The IMF has in the past been criticised for making the electricity prices unaffordable for the majority of the consumers under its failed strategy to retire the debt through price increase. If this debt is not cleaned now, it may become a major stumbling block at the time of the next programme talks.

The petroleum sector circular debt is a new phenomenon, which has now become an impediment to Pakistan after rapid depletion of indigenous resources by 7% annually. The debt and inadequate revenue requirement determination and subsidised gas prices has now put the entire petroleum sector at stake after the power sector.

Compared to only 17% increase in the power sector circular debt, the gas sector’s unpaid debt has doubled to over Rs3 trillion in less than three and half years, becoming yet another new threat to economic stability of Pakistan.

In June 2020, the gas sector debt was Rs1.5 trillion, which by November 2023 increased by another Rs1.5 trillion.

The Rs5.7 trillion energy sector circular debt includes Rs1.2 trillion late payment surcharges, mainly in the gas sector. Out of the Rs3 trillion gas sector debt, 70% is owed to exploration and production firms.

Read: SIFC steps in to end differences over gas price hike

The details showed one-third of the gas sector debt, or Rs1.1 trillion is only owed to the Oil and Gas Development Company Limited (OGDCL), followed by Rs788 billion to the Pakistan Petroleum Limited (PPL) and Rs793 billion to the Pakistan State Oil (PSO). The plan proposes settlement of debt of only the public sector firms.

Many companies in the exploration and production sectors are not recording the late payment surcharges as receivables to avoid tax exposures.

The energy ministry is seeking Rs745 billion supplementary grant for only two days, which under the plan would go back to the coffers of the Q Block in the shape of dividend payments against the government’s shares in these companies.

The net impact on budget of the Rs1.27 trillion circular debt plan will come to Rs902 billion. Out of the Rs902 billion, the lion’s share of Rs556 billion, or 62%, will go to one firm – the OGDCL.

Of the debt settlement plan of Rs1.27 trillion, it is proposed to retire a little over Rs1 trillion of the gas sector circular debt, involving companies listed at the stock market and leaving a major impact on their share prices. The remaining over Rs255 billion will be spent on curtailing the power sector circular debt of Rs2.7 trillion.

The IMF’s endorsement and implementation of the plan is very critical before the caretaker government hands over control to the next elected government. There is no guarantee that the next elected government would implement the plan. Such attempts have twice been made in the past but each time the finance ministry scuttled it.

Energy ministry officials said that the grant of Rs745 billion was needed for only two days to trigger the entire process. The actual funds that would go back to the kitty in the shape of dividends and taxes would be Rs748 billion, they claimed in the plan submitted to the SIFC.

Once implemented, the gas sector debt will come down from over Rs3 trillion to Rs2 trillion. The power sector circular debt will drop to Rs2.5 trillion.

The energy ministryhas proposed a seven-tier plan to settle the circular debt in a manner that greases the system but has no impact on the budget.

An amount of Rs556 billion will go to OGDCL. The second highest amount will be given to the Government Holdings Private Limited (GHPL), which will receive Rs168 billion, followed by Rs146 billion for the National Power Parks Management Company (NPPMC) and Rs29 billion for the PSO. The Pakistan Development Fund Limited (PDFL) will get Rs82.7 billion.

As per the plan, the Sui Northern Gas Pipelines Limited (SNGPL) will disburse Rs386 billion to exploration and production (E&P) companies. An amount of Rs126 billion will go to the PPL, Rs10 billion to the GHPL and Rs250 billion to the OGDCL on account of the SNGPL’s payables.

The Sui Southern Gas Company (SSGC) will disburse Rs259 billion to E&P companies and out of which Rs112 billion will go to the GHPL and Rs147 billion to the OGDCL. The OGDCL’s private shareholders will receive Rs59.5 billion and the PPL’s private shareholders will get Rs23.8 billion.

The Central Power Purchase Agency (CPPA) will get Rs146 billion, including Rs100 billion of the supplementary grant.

The government fully owns the NPPMC and the GHPL. But its shareholding in the PPL was 75%, besides 85% in the OGDCL and 25% in the PSO. The OGDCL is expected to announce Rs467 billion in dividends, of which Rs397 billion will be the government’s share.

Without settlement of the past debt, the finance ministry would not be able to receive its future dividends, therefore, it is the time that the ministry and the IMF should act to clear the mess and save the consumers from further price hike, according to the energy ministry officials.

The PPL is projected to give Rs126 billion in dividends and Rs98 billion is expected to land in the government’s coffers. The GHPL will give Rs168 billion in dividends, the NPPMC Rs40 billion and the PDFL Rs28.7 billion. The PSO has been kept out of the dividend cycle.

The Federal Board of Revenue (FBR) will get Rs24.2 billion in the shape of income tax on dividend payments.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ