Polls, uncertainty, and productivity

Negative productivity growth rates coincide with timing of election years

Pakistan has continued to witness boom-and-bust cycles through its economic journey. Economists have written at length about twin deficits, structural anomalies in the country’s economic engine which continue to fuel import-based consumption.

Remittances, foreign direct investment (FDI), exports and foreign currency debt and deposits are key avenues to cover imports and debt obligations. Arguably, exports are the most important avenue to meet foreign currency needs. However, exports can materialise only if Pakistani products have a competitive edge in global markets.

Consequently, being productive (increase in output per unit of input) is a necessary condition to improve exports and help shape the overall macroeconomic environment, making it more conducive for investment and doing business.

A study titled “Sectoral Total Factor Productivity (TFP) in Pakistan” was published in January 2023 by the Planning Commission and the Pakistan Institute of Development Economics (PIDE).

The study was built upon 1,321 companies’ confidential audited financial data obtained from the Securities and Exchange Commission of Pakistan (SECP) covering 2010-2020. The idea was to calculate TFP growth of each company and carry out a bottom-up analysis by categorising companies across various sectors (circa 60).

One of the strengths of the study was its firm-level and expansive data. The number of firms (1,321) covered a large footprint of the industrial and economic landscape. Their 2019 combined sales stood at $80 billion, around 28% of gross domestic product (GDP), exports at circa $23 billion and employment base at more than 2 million. Given the importance of exports in the country’s external account figures and the significance of productivity to exports, it was felt that a bottom-up analysis of TFP growth estimate would help identify how Pakistan fared across various sectors of its economy in terms of productivity.

The study also covered the correlation between TFP and GDP growth. While conducting research, it was understood that countries with TFP growth of 3% and above generally grew at a GDP growth rate of 8% or above; whereas countries with TFP growth of less than 3% grew at a GDP growth rate of 7% or less, depicting a strong positive correlation.

Read Measures to boost FDI proposed

Further, the International Labour Organisation’s document titled “Driving up Productivity” also suggests a strong link between productivity and economic growth: “At country level, upsurges in TFP are closely linked to increases in economic growth. The correlation between the two variables is 91%, which shows the close relationship between the growth of an economy and the increase in its productivity levels. Overall, TFP gains reflect a more efficient utilisation of the potential of an economy, increasing its long-term economic growth.”

During the TFP calculation exercise, it was calculated that Pakistan’s TFP growth rate stood at 1.5% during 2010-2020. A number of salient observations about export-designated sectors, subsidised sectors’ TFP growth rates percolated from the analysis. However, there was one inconsequential observation which did not attract much attention.

The study calculated yearly TFP growth rates from 2010-2020, with erratic trends. However, the TFP growth rate turned negative in 2013 (-2.3%), 2014 (-1.3%), 2018 (-0.7%) and 2020 (-2.2%).

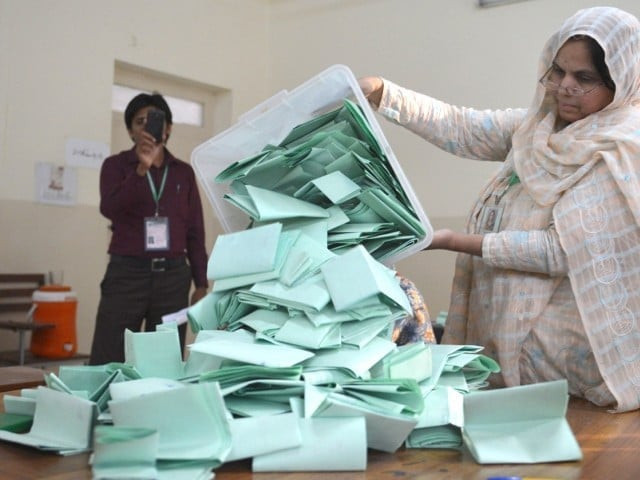

While the advent of Covid-19 was perceived to be the key reason for the negative TFP growth rate in 2020, rest of the years’ negative growth rates coincided with the timing of election years.

Intuitively, it is believed that TFP growth rates turned negative due to general macroeconomic uncertainty and concerns around policy continuity as elections approached. While this may be the case, more research would be needed to actually ascertain the causality of negative TFP growth rates around election years.

Having said, numerical derivations presented that productivity was negatively impacted around elections. If this is the case, then it would be fair to assume that productivity has continued to be adversely impacted in the calendar year 2023 as uncertainty around election date has dragged on.

Without making the contents of the article political, it must be said that it is highly likely that Pakistan’s productivity was adversely impacted from 2022 onwards; one hopes that 2024 would offer a more conducive environment for productivity to thrive.

Certainty around elections is clearly a step in the right direction for productivity to improve, however, would that be sufficient to buoy the perceived impact on the nation’s productivity?

Read Ministry launches PSDP portal to 'ensure transparency'

Conversely, lack of clarity on the medium to long-term governance of the country would arguably be disastrous, purely in the context of productivity enhancement and endeavours to augment exports. It would also allow elite capture to continue to operate by its old playbook, something which ought to be set aside in order to progress sustainably.

To help bolster productivity, at least two interventions come to mind which can be addressed by the present and future political administrations: First, if the federal government’s investment concept is to survive, then the Public Sector Development Programme (PSDP) must reduce the influence of political economy and ought to be perceived as investment to augment national productivity and facilitate the private sector.

At the moment, the mindset with which the PSDP is formulated is different: PSDP must be productivity enhancement focused. The aforementioned may also need an exhaustive exercise to relook at the way the Planning Commission is structured and functions.

Second, Pakistan should formally adopt the National Productivity Master Plan (NPMP) which was developed with the help of the Asian Productivity Organisation (APO) and the Korea Development Institute (KDI) in 2022-23. These are the same institutes which developed productivity master plans for Vietnam and Bangladesh.

NPMP, which cuts across the entire government, should be spearheaded at the highest level, updated to the extent needed and implemented in letter and spirit.

The Special Investment Facilitation Council (SIFC) working on investments and conducive business environment appears to be an appropriate forum where the Ministry of Industries and Production can leverage support for facilitative implementation of the NPMP.

As Pakistan’s frail economy treads myriad challenges, one thing is clear: There must be stability and certainty to nurture productivity. There ought to be quick and unwavering decisions which must be taken and maintained for the sake of productivity, competitiveness and consequently export-led growth.

The writer is ex-member (private sector development & competitiveness), the Planning Commission of Pakistan and has also worked with Citigroup in Pakistan, Qatar, Hong Kong and Singapore

Published in The Express Tribune, January 29th, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ