Current account sees November surplus

Export growth, import management lead to positive shift, FDI inflows increase by 7%

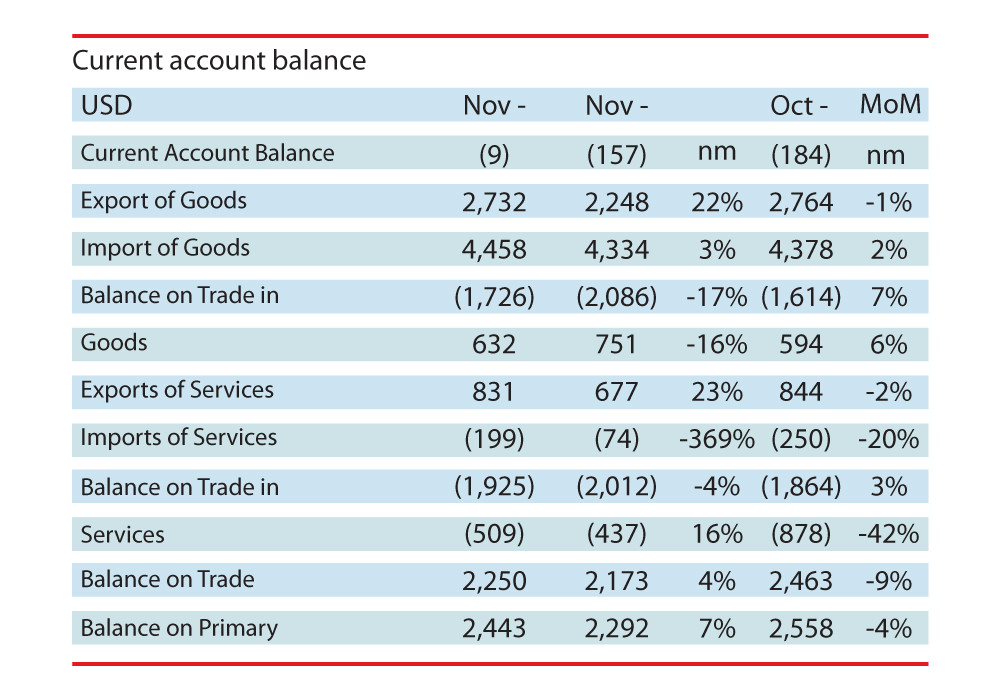

Pakistan’s current account swung into a surplus of $9 million in November 2023, marking a positive shift after experiencing a deficit in the first four months of the fiscal year 2023-24. This signals an improvement in the country’s ability to handle international payments.

The State Bank of Pakistan (SBP) reported on Monday that the cumulative current account deficit (CAD) for the initial five months of FY24 witnessed a substantial decline of 64% to $1.16 billion, compared to the $3.24 billion recorded in the same period of the last fiscal year.

Speaking to The Express Tribune, Akseer Research Director, Mohammad Awais Ashraf, attributed the current account surplus to advancements in technology exports, export of government services, reduced interest payments, and lower profit repatriation by foreign companies from Pakistan to their overseas head offices in November 2023, compared to October 2023.

design: mohsin alam

Optimus Capital Management’s Analyst, Maaz Azam supported this view, highlighting a 42% improvement in the primary income deficit, particularly lower interest payments and comparatively reduced profit repatriation in November versus October. Additionally, a 20% month-on-month drop in the trade-in-service deficit contributed to achieving the current account surplus of $9 million in November, he said.

The export of technology increased by nearly 9% to $259 million in November, compared to $238 million in October. Other business services also saw a rise of almost 10% to $137 million, said Ashraf. However, the import of services decreased by 1.5% to $831 million in November, contributing to the current account’s positive balance.

On the downside, the import of goods slightly increased to $4.46 billion in November, compared to $4.38 billion in the prior month, while the export of goods ticked down to $2.73 billion from $2.76 billion month-on-month, indicating a marginal widening of the trade deficit in goods.

Similarly, workers’ remittances dropped 9% month-on-month to $2.25 billion in November, compared to $2.46 billion in October, affecting the overall balance of the current account.

Ashraf highlighted the challenges for the government, including maintaining lower imports of goods and services to manage the current account deficit. As the economy expands, there may be an increase in imports, necessitating a strategic approach.

Read Pakistan records $9m current account surplus in Nov

The government also faces the challenge of stabilising the rupee-dollar exchange rate, as heightened demand for dollars due to an uptick in imports could exert pressure on the exchange rate. Ashraf’s research house projects the full-year current account deficit at $2.7 billion for FY24, significantly lower than the central bank’s forecast of $4-4.5 billion. He believes that higher debt repayment obligations and low foreign exchange reserves will compel the government to keep imports on the lower side to avoid widening the current account deficit in the remaining seven months of FY24.

Arif Habib Limited, Head of Research, Tahir Abbas, noted a $9 million surplus in November, a notable improvement from the $157 million deficit in the same month last year. He highlighted a 22% improvement in the export of goods, reaching $2.73 billion in November, compared to $2.25 billion in the same month of the previous year.

Likewise, there was a marginal 3% increase in the import of goods, totalling $4.46 billion in the month, compared to $4.33 billion in the corresponding month of the preceding year.

He highlighted that the reduction in imports has not adversely affected exports, projecting the trade figures to sustain their current pace in the foreseeable future.

He emphasised the need for the government to focus on improving exports while keeping an eye on imports to maintain the current account within the targeted lower range. Abbas projected the current account deficit to remain in the range of $3.5-4 billion for FY24, close to the central bank’s projection of $4-4.5 billion for the year.

Foreign investments up

Foreign Direct Investment (FDI) also saw positive momentum, increasing 7% month-on-month and 12% year-on-year to $131 million in November, according to the central bank. The net FDI inflow reached $656 million in the first five months of FY24, up 8% compared to the same period in FY23.

China, Hong Kong, and the United Kingdom remained the top sources of FDIs, with the power, oil and gas exploration, financial business, and petroleum refinery sectors attracting the most FDI in the first five months of the fiscal year.

Published in The Express Tribune, December 19th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ