The National Electric Power Regulatory Authority (Nepra) has raised serious questions over an investment plan submitted by the National Transmission and Despatch Company (NTDC) as it seems “unrealistic” to address system constraints that have resulted in blackouts several times across the country.

The power-sector regulator pointed out that the blackout problem was mainly faced by southern parts of the country pertaining to transmission lines, therefore investment should be planned and injected in areas where system constraints existed. However, the plan lacked investment proposals for the south.

At a public hearing on Wednesday, the regulator noted that provincial governments had approached it for addressing constraints, therefore, they should be consulted about the investment plan.

In documents submitted to Nepra, NTDC announced a significant revision in its Transmission Investment Plan for fiscal years 2023 to 2025.

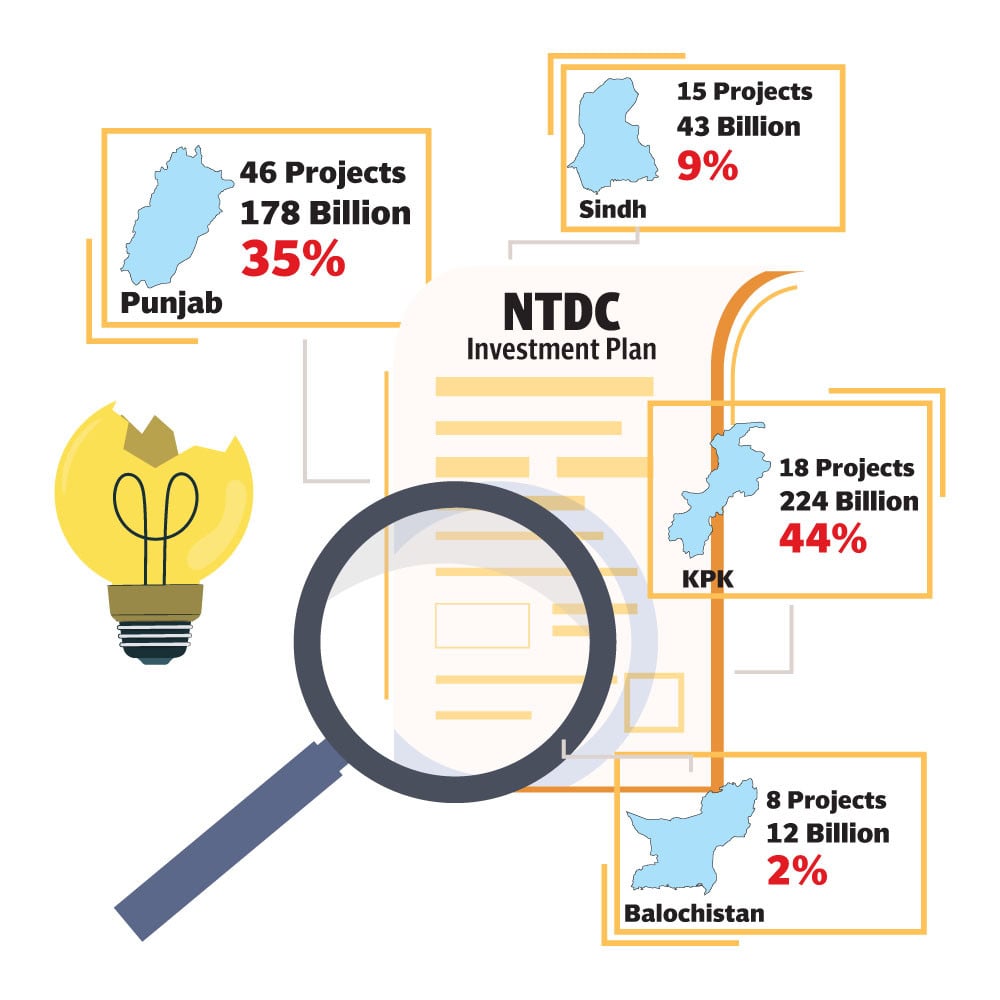

According to the plan, NTDC will execute 46 projects costing Rs178 billion in Punjab, which accounts for 35% of the total. In Sindh, it will undertake 15 projects at a cost of Rs43 billion, constituting 9%, in Khyber-Pakhtunkhwa it will implement 18 projects costing Rs224 billion (44%) and in Balochistan it will develop eight projects at a cost of Rs12 billion with 2% share.

The regulator voiced concerns over the low investment of 2% in Balochistan where “darkness prevails due to less supply of electricity”. It also noted that the people of Balochistan would pay the cost of projects in electricity tariffs along with consumers in other provinces.

Read: NEPRA faces scrutiny over electricity costs, capacity

Nepra also took up previous plans designed to address system constraints. NTDC officials informed the hearing that projects had already been identified for the removal of constraints but those could not be implemented so far.

Regarding demand forecast, they said that representatives of provinces had given their demand estimates for finalising the investment plan.

design: mohsin alam

However, the regulator argued that Balochistan had faced voltage and grid installation issues, which had not been resolved. It stressed that the investment plan should be finalised keeping in view system integrity, reliability and sustainability to ensure uninterrupted power supply to the consumers. During a presentation, it was informed that a critical component of NTDC’s strategy was the Transmission of Electricity (Right of Way) Bill. This draft legislation, prepared by NTDC’s Law Directorate, aims to address various issues including the crossings of railways, national highways and motorways.

The bill, which is currently pending legislation, has been forwarded to the Ministry of Energy for presentation in the legislature.

Read more : NTDC, AFD sign €180m agreement

It was highlighted that the Transmission Investment Plan was closely aligned with the Transmission System Expansion Plan, where each project was technically justified.

This plan takes into account the demand forecast of each distribution company and coordinates with them on project proposals. The planning process adheres to stipulations of the Grid Code 2023.

The investment plan encompasses various critical transmission projects, including power evacuation schemes for the upcoming generation projects, system reinforcements and stability improvements.

However, NTDC faces challenges to the Right of Way, encountering resistance from people affected by projects, the historical lack of compensation policies and inadequate legal frameworks. These issues have led to delays in project completion, penalties, loan problems with lenders and increased project costs.

The NTDC’s investment plan includes vital constraint removal schemes such as 500-kilovot Gatti, Muzaffargarh, Multan, 220kV Sarfaraz Nagar and addressing the under-utilisation issues of high-voltage, direct-current (HVDC) lines and power plants in the south.

However, the financial impact of system constraints cannot be precisely determined due to operational dependencies like fuel cost variations and actual electricity dispatch.

Cost overrun probe

NTDC is facing a cost overrun of Rs180.382 billion in 42 projects. However, it argued that the actual overrun cost stood at Rs27.6 billion after accounting for indexation of the foreign exchange component and PC-I revisions. The causes for these overruns include significant dollar escalation and the projected future expenditure on projects that have yet to start.

A significant factor affecting project costs is currency devaluation with a notable foreign exchange component.

The USD-PKR trend has led to substantial increases in project costs over various time frames, highlighting the challenges NTDC faces in managing its extensive infrastructure development plans amidst a volatile economic environment.

Published in The Express Tribune, November 23rd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719660634-1/BeFunky-collage-nicole-(1)1719660634-1-165x106.webp)

1732276540-0/kim-(10)1732276540-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ