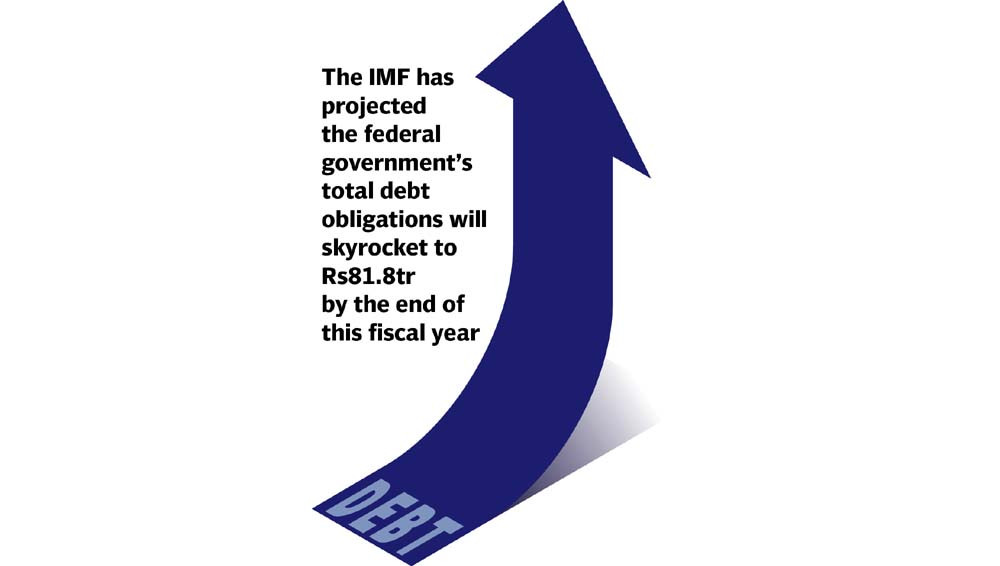

The International Monetary Fund (IMF) has projected the federal government’s total debt obligations will skyrocket to Rs81.8 trillion by the end of this fiscal year while budget deficit and interest payment costs will exceed approved allocations.

Due to unrealistic budgetary allocations, the IMF has now projected the size of Pakistan’s federal budget at Rs15.4 trillion, which is Rs1.1 trillion higher than that approved by the National Assembly in June this year, sources told The Express Tribune.

Government sources said that the global lender projected that the public and publicly guaranteed debt may increase to Rs81.8 trillion, or 77.3% of gross domestic product (GDP), by the end of current fiscal year in June 2024.

The lender revised upwards its debt projection for Pakistan during the recent review talks solely due to slippages in expenditures, they added.

Sources said that compared to the budget deficit target of Rs6.9 trillion, the IMF estimated that the deficit would peak at a record Rs8.2 trillion, a slippage of Rs1.3 trillion. The IMF’s fresh estimates are in line with its earlier projections.

They said that the key reason behind the higher-than-budgeted gap between expenditures and income was the unrealistic allocation for interest payments.

The lender estimated the cost of interest payments at a record Rs8.63 trillion. It was nominally higher than the IMF’s earlier estimate, said the finance ministry sources.

Two months ago, The Express Tribune had reported that interest expenses may exceed the budget allocation by over Rs1 trillion while the government was also facing external financing gap of at least $4.5 billion.

Interim Finance Minister Dr Shamshad Akhtar on Thursday announced that they had shelved plans to float $1.5 billion worth of Eurobonds.

Read: Pakistan set to become 4th biggest IMF debtor

In the budget, the Ministry of Finance had allocated Rs7.3 trillion for interest payments. But during the recent review talks, the finance ministry revised it upwards to Rs8.5 trillion, which was still Rs140 billion less than the IMF’s new projection, said the sources.

The IMF adjusted upwards Pakistan’s public and publicly guaranteed debt position, both in absolute terms and in terms of the size of the economy. The lender has projected the government debt, both direct and guaranteed, at Rs81.8 trillion by June next year, said the sources.

Pakistan had enacted the Fiscal Responsibility and Debt Limitation Act (FRDLA) in 2005 to check the growing debt burden.

The debt and deficit ceilings under the FRDLA framework have proved ineffective in containing expenditure and the debt limit has been consistently breached over the years, according to a new report on the public investment management assessment.

The IMF released the report on Friday, which stated that the total public debt had trended upwards since 2010, consistently exceeding the 60% ceiling set under the FRDLA.

The federal government debt, excluding liabilities, was projected at Rs77.8 trillion by the IMF. The direct result of the mounting debt pile is the uncontrolled cost of interest payments.

Sources said that the IMF had estimated the cost of domestic debt servicing at Rs7.5 trillion, which was Rs1.1 trillion higher than the finance ministry’s budget allocation.

Similarly, the IMF estimated the cost of interest payments on foreign debt at Rs1.02 trillion, up Rs150 billion than the Ministry of Finance’s allocation.

Apart from higher spending, another key reason behind the higher interest cost is the central bank’s monetary policy under which the policy rate has been set at 22%.

Ministry of Finance spokesman Qamar Abbasi’s reply was awaited till the filing of the story.

The growing need for budget financing will leave virtually nothing for the private sector to borrow for running and expansion of their businesses. Sources said that the IMF did not see the budgeted Rs2.7 trillion in external financing fully materialising and estimated the amount at little over Rs1.2 trillion.

The lower availability of external loans for budget financing will mean more borrowing from commercial banks. The IMF projected that domestic financing may increase to Rs6.9 trillion as against the budget estimate of Rs4.8 trillion, said the sources.

Read more : Gloomy GDP projection

Overall, the IMF projected that the federal budget deficit would be off by Rs1.23 trillion against the plan approved by the National Assembly in June this year. According to the IMF projections, said the sources, the current expenditure in the current fiscal year may remain around Rs14.6 trillion, higher by Rs1.24 trillion.

But development spending is projected at Rs782 billion, which is Rs168 billion less than the allocation approved by the National Assembly. Resultantly, the size of the budget, for the first time, will cross Rs15.4 trillion.

The global lender has kept the overall primary balance unchanged at 0.4% of GDP, or Rs401 billion, which will require massive revenue efforts and a squeeze on subsidies.

Published in The Express Tribune, November 19th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ