Stocks surge to six-year peak

KSE-100 index breaches 49,000 barrier with gains of 2,000 points

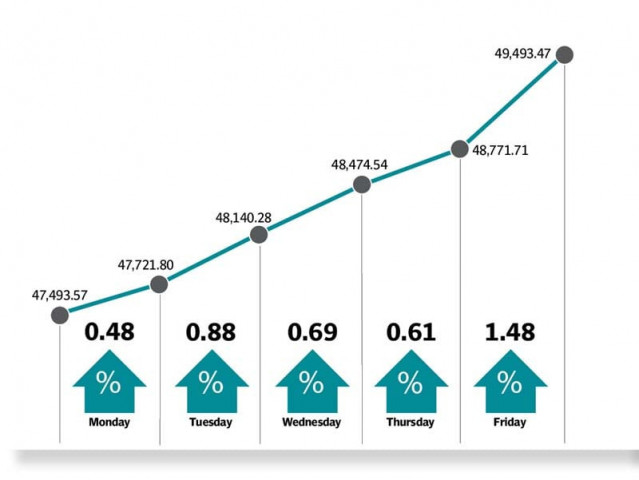

Pakistan Stock Exchange (PSX) shot up to nearly 49,500 points with fresh gains of 2,000 points in the outgoing week as it took cue from robust corporate earnings, consistent rupee appreciation and central bank’s assertion about easing inflation.

Recent State Bank of Pakistan (SBP) Governor Jameel Ahmad’s remarks that the central bank had met the end-September deadline for a forward book target of $4.2 billion agreed with the International Monetary Fund (IMF) gave a further boost to the market.

The bourse breached the psychological barrier of 49,000 points in the last trading session of the week and hit a six-year peak.

At the beginning of the week, the bourse commenced trading on a positive note, reflecting the previous week’s bull-run, which came despite a surge in international crude oil prices due to the Middle East conflict.

The market maintained its uptrend next day as well when the index crossed the 48,000 barrier over stronger rupee and likely privatisation of struggling state-owned enterprises (SOEs).

The bullish trend continued on Wednesday over the IMF’s 2.5% growth projection for Pakistan. The Special Investment Facilitation Council (SIFC)’s initiatives and renewed focus on China-Pakistan Economic Corridor (CPEC) projects ahead of prime minister’s visit to Beijing also lifted the index.

The market marched further north on Thursday as investors expected the government to make some big decisions for the privatisation of SOEs. They also took strength from the unstoppable surge in the rupee’s value.

On the last day of trading week, the KSE-100 climbed over 700 points in a remarkable rally that took the market above the psychological barrier of 49,000. The rally was sparked by a robust economic outlook and investor optimism about corporate earnings.

The market closed at 49,493 with a surge of 2,000 points, or 4.2% week-on-week (WoW).

JS Global analyst Muhammad Waqas Ghani, in his market review, wrote that the KSE-100 index rebounded to a six-year high, closing the week at 49,493, up 4.2% WoW. Average daily turnover rose 29%.

“Recovery in key macro indicators was the major reason for the renewed interest. The rupee continued to display a persistent uptrend, concluding the trading week at Rs278/$ in open market compared to Rs300/$ a month ago,” he said.

He attributed the positive performance to SBP’s measures to oversee the forex market and enforce regulations against the unauthorised currency dealers.

According to SBP’s data, workers’ remittances amounted to $2.21 billion in September 2023, depicting a month-on-month (MoM) rise of 5.3%.

Moreover, he said, news related to the much-awaited gas price hike was doing rounds during the week. In addition, the September sales volume for passenger cars and light commercial vehicles reached 8,300 units, a six-month high and up 10% MoM.

The improvement could be attributed to the easing of curbs on raw material procurement. “Sales, however, continued to decline on a year-on-year basis, registering a 26% decrease.”

During the week, Pak Suzuki Motor announced that it was considering delisting from the PSX, which triggered activity in its stock, the JS analyst added.

Arif Habib Limited (AHL), in its report, said that the market crossed 49,000 points, a level that was last seen in June 2017.

Stocks maintained the bullish trend on the back of robust company results that exceeded expectations of market participants. “Along with that, the record-setting, remarkable strengthening of the rupee against the US dollar for 27 consecutive sessions boosted investor confidence,” it said.

Furthermore, Pakistan won GSP+ extension for four years. Also, the SBP’s reserves rose $31 million to $7.6 billion in the week ending October 6, 2023. The rupee closed at Rs277.6 against the greenback, appreciating by Rs5.07, or 1.83% WoW.

Sector-wise positive contribution came from commercial banks (498 points), fertiliser (447 points), exploration and production (283 points), power (250 points) and cement (127 points).

The sectors that contributed negatively were technology (79 points) and chemical (21 points).

Foreign investors turned buyers during the week as they bought shares worth $1.41 million compared to net selling of $12.05 million last week.

Published in The Express Tribune, October 15th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ