Pakistan to face highest inflation

ADB report predicts fourth lowest growth rate among 46 regional economies

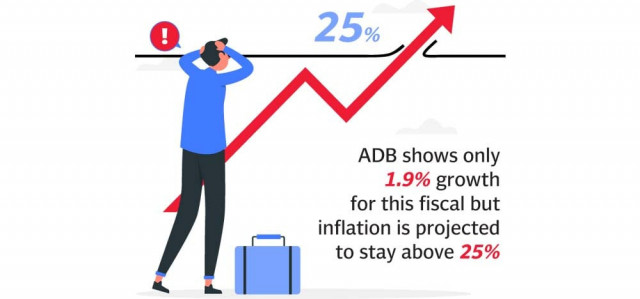

Pakistan’s economy stands out as an outlier in Asia, according to a new report that predicts the country will have the highest inflation rate but the fourth lowest economic growth rate among all 46 economies in the region.

The Asia Development Outlook, the flagship publication of the Asian Development Bank (ADB), has slightly revised downward the economic growth forecast to 1.9%, but it has significantly increased the inflation projection to 25% for the current fiscal year.

The report anticipates further increases in interest rates and calls for a fiscal consolidation plan that includes limited spending on defence and energy subsidies.

The report also points out that while the currencies of developing economies in Asia have marginally depreciated, Pakistan’s currency has seen a steep devaluation of 30%. Unlike other regional economies, Pakistan saw a decline in foreign remittances.

The ADB notes that there are exceptionally high downside risks to Pakistan’s economic outlook.

Previously, Pakistan’s economic outlook was relatively poor only within the South Asia region, but continued deterioration in economic conditions has placed the country near the bottom of Asia.

The report projects that “for FY2024, inflation is forecast at 25%, sharply higher than the earlier 15% projection.” This inflation rate is far higher than the target range set by the central bank and much higher than the target. It represents the highest inflation rate in Asia, significantly exceeding the projected 10% for any other economy.

In the last fiscal year, inflation is estimated to have accelerated to 29.2% in FY2023, faster than the previously forecasted 27.5% in April, according to the ADB.

The report emphasises that regional currencies have depreciated only marginally so far this year, by 3.7% on a GDP-weighted average basis against the US dollar. However, Pakistan’s currency experienced a significant 30% devaluation since January.

The ADB argues that administrative efforts to control the exchange rate led to the emergence of a parallel foreign exchange market with a substantial premium over the official exchange rate. This, in turn, led to a further tightening of foreign currency liquidity in the interbank market, as it encouraged the use of the parallel market for inward remittances and proceeds from service exports. Consequently, recorded workers’ remittances fell by $4.3 billion to $27 billion in FY2023.

While net personal transfers have increased by 13% in Nepal and 9% in Bangladesh from the same period in 2022, they have decreased by 17% in Pakistan.

The report suggests that normalized food supplies and lower inflation expectations, tempered by higher power and gas tariffs and likely currency depreciation, could ease inflation somewhat in FY2024. Nevertheless, Pakistan’s inflation rate is still expected to remain at 25% in FY2024, substantially higher than forecasted in April.

Economic Growth Rate

The ADB has slightly revised Pakistan’s growth forecast for this fiscal year to 1.9% from the earlier projection of 2%. This range is lower than the official target of 3.5% for this fiscal year.

The 1.9% growth forecast is dependent on the implementation of reforms, supportive macroeconomic policies, recovery from flood-induced supply shocks, and improving external conditions. Political stability following general elections later this year, if achieved, is expected to boost business confidence. The new standby arrangement agreed with the International Monetary Fund (IMF) to support economic stabilisation and rebuild fiscal buffers will also contribute to this confidence.

The ADB indicates that the economy’s near-term prospects will heavily rely on progress under the economic adjustment programme of the IMF. While uncertainty will linger, stabilisation measures will limit the growth of demand. Fiscal and monetary tightening will crimp demand, as will inflation remaining in double digits.

Fiscal Measures

The report also mentions fiscal tightening through raising revenues and containing spending. The FY2024 budget targets a primary surplus of 0.4% of GDP and an overall deficit of 7.5% of GDP, gradually declining over the medium term. Provincial spending will be cut by 0.4% of GDP, and spending on defence and energy subsidies will be limited while protecting priority social and development outlays.

Interest Rates

The ADB suggests that the central bank will likely raise the policy rate from the 22% set in July 2023 to gradually reduce inflation to its medium-term target of 5% to 7%. The central bank has agreed to achieve positive real interest rates, refrain from introducing new refinancing schemes, and contain refinancing credits.

However, significant inflationary pressures remain. Sharp increases in petroleum, electricity, and gas tariffs are expected under the program. As import and exchange rate controls are eased, the rupee could further weaken, raising the cost of imported goods. The current account deficit is projected to increase to about 1.5% of GDP in FY2024. Despite the larger deficit, international reserves should grow.

The ADB warns that downside risks to the outlook remain exceptionally high. Tighter global financial conditions and potential supply chain disruptions from any escalation of the Russia-Ukraine conflict will weigh on the economy. Persistent political instability amid the upcoming election season will remain a key risk to implementing reform toward growth stabilisation, confidence restoration, and sustainable debt. Disbursements from multilateral and bilateral partners will remain crucial for reserve accumulation, exchange rate stability, and improved market sentiment.

Published in The Express Tribune, September 21st, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ