Being an MP not an offense: govt tells CJP

Submits answer to a question posed by top judge in connection with NAB law amendment case

Obliquely criticizing the use of the word “parliamentarian” in a question raised by the Supreme Court in connection with the National Accountability Bureau (NAB) law amendment case, the counsel for the government has stated that being a parliamentarian in the country “is not a crime yet”.

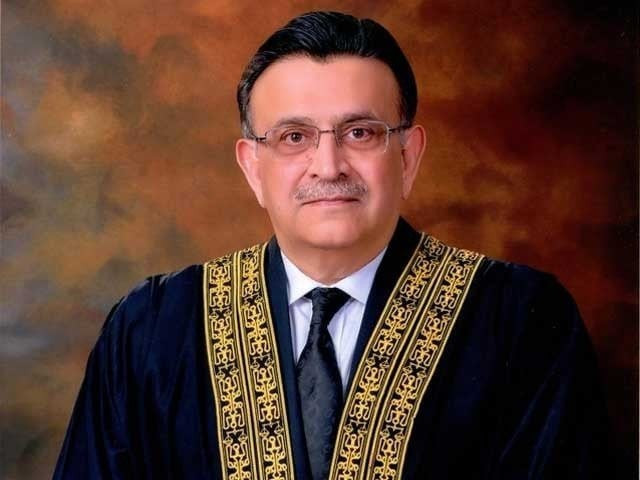

A three-judge bench led by Chief Justice of Pakistan (CJP) Umar Ata Bandial on September 5 reserved its verdict on a petition filed by former Prime Minister Imran Khan against the amendments made to the National Accountability Ordinance (NAO), 1999 by the PML-N led coalition government.

The CJP had directed the government to respond to a question which said: “If an accountability court were to send/transfer a reference against a parliamentarian for lack of its jurisdiction, then which would be a competent referee court to adjudicate the reference and under which law?”

Submitting a five-page reply to this question, the government counsel, Makhdoom Ali Khan, stated that, “Being a parliamentarian is not an offense in Pakistan yet.” The government’s counsel added that the answer to this question depended on the offense a parliamentarian is charged with.

He said if the alleged offence is that of misuse of power or involves alleged corruption of an amount less than Rs500 million, the NAB chief has the option to send the matter to the provincial anti-graft agencies for investigation under Sections 5-B and 5-C of the Prevention of Corruption Act, 1947 (PCA).

The NAB chief can also send the matter to police for an investigation of offences under Sections 161, 165, 405, 409, 420, 468 and 477A of the Pakistan Penal Code, 1860

He said if the offence alleged against a parliamentarian is for acquiring assets disproportionate to known sources of income—again falling outside the purview of NAO’s Section 9 or related to an amount less than Rs500 million—the NAB chief has the option of sending matter to the provincial anti-corruption agencies for investigation under Sections 5-B and 5-C of PCA.

The second option at the NAB chief’s disposal is that of sending the case to the Federal Board of Revenue (FBR), if the assets so held or acquired by a parliamentarian had not been declared in the income tax returns or wealth statements as required under the Income Tax Ordinance, 2001 (ITO, 2001).

Read also: NAB law ruling to cap high-stakes case

Thirdly, the alleged offence of money laundering can be tried under Section 2 of the Anti-Money Laundering Act, 2010 (AMLA, 2010).

The fourth option for the NAB chief is to refer the issue to the Election Commission of Pakistan (ECP) for an inquiry into whether or not a parliamentarian had declared their alleged assets in the statements filed with the ECP under the Elections Act, 2017.

“If the matter is under trial and the court seized of the case is of the opinion that no offence triable under NAO, 1999 is made out, it may with the assistance of NAB transfer the case to the appropriate court, tribunal, forum, agency, authority or department,” the response added.

They include an anti-corruption court or a special judge for an offence allegedly committed under the provisions of PCA (read with Pakistan Criminal Laws (Amendment) Act, 1958); the relevant court of a special judge for offences committed under ITO, 2001; the relevant court of sessions for trial of offence of money laundering under AMLA, 2010; or the court of sessions for prosecution and trial of any misdeclaration in the returns filed with the ECP.

The response said if an offence of a fiscal nature was alleged against a parliamentarian, for matters not under trial, the NAB chief could refer the matter to the FBR for the evasion of federal duties and taxes. He can also refer the case to the provincial revenue authorities for the evasion of provincial taxes.

“In case of trial, if the court seized of the case is of the opinion that the offence is of a fiscal nature, it may with the assistance of NAB transfer the case to the appropriate court, tribunal, forum, agency, authority or department, as the case may be.

“These may include special courts for trial of offences under the ITO, Sales Tax Act, 1990, Federal Excise Act, 2005, Customs Act, 1969 and respective statutes enacted for levy and collection of sales tax on services,” the response said.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ