Rupee slide, inflation pull PSX deep into red

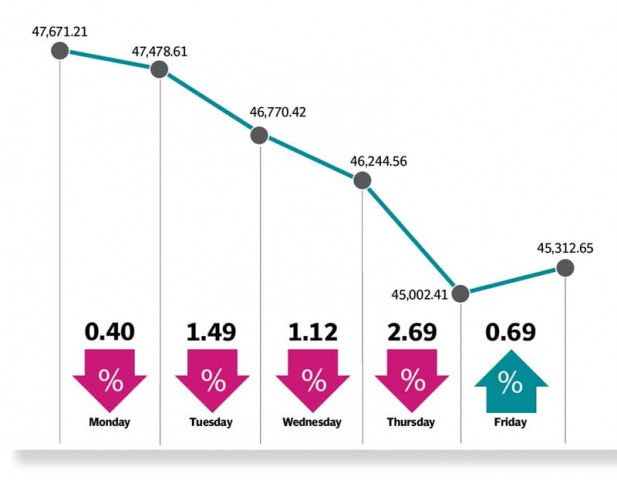

Benchmark KSE-100 index plunges 2,359 points, or 4.9%, at 45,313

In one of the worst trading weeks, the Pakistan Stock Exchange plunged over 2,300 points as political and economic developments weighed on market sentiment, prompting jittery investors to quickly offload their stockholdings in a broad sell-off.

There was widespread anxiety as policymakers failed to tackle dollar shortage and arrest rupee’s slide. Besides, rising utility tariffs, exorbitant food prices and protests over inflated electricity bills further fuelled the market’s slump. The turmoil was compounded by political instability, caused by fears of delay in next general elections.

On Monday, the trading week started on a dull tone because of growing political noise over potential delay in polls and fear of unrest. As a result, the KSE-100 index registered a decrease of 193 points.

Read PSX crashes by over 1,750 points as rupee continues to struggle against USD

The downtrend persisted the next day as well with investors remaining under pressure over free fall of the rupee and speculation about an aggressive hike of 200-300 basis points in the key policy rate. The bourse registered a hefty decline of 708 points on Tuesday. Factors such as rupee depreciation and an uncontrollable inflation undermined investor interest on Wednesday when the market fell over 500 points. Besides, circular debt crisis and Moody’s report pointing to a weak infrastructure also aided the bearish mood.

The KSE-100 index extended the bearish run on Thursday, plummeting over 1,200 points in the fifth straight session of losses. It was mainly dragged down by a poor economic situation and uncertainty about the outcome of widespread protests over inflated electricity bills.

However, the bourse turned around on Friday over investor optimism about a positive outcome of the IMF’s condition of avoiding power subsidy. As a result, the index gained 310 points. The benchmark KSE-100 index closed the week down by 2,359 points, or 4.9%, at 45,313 compared to the previous week. It was the largest weekly decline since late November 2021.

JS Global analyst Muhammad Waqas Ghani, in his report, commented that the week commenced on a dull note at the PSX as the bearish momentum continued.

“Investors aimed to lock in profits due to uncertain developments on both the political and economic fronts,” he said.

During the week, Pakistani rupee continued to depreciate with the inter-bank PKR/$ rate losing 1.5% week-on-week. On the other hand, another 6% increase was announced for petroleum product prices for the first half of September 2023. Meanwhile, the federal cabinet could not arrive at a decision on providing relief in electricity bills as it found it difficult to extend any concession without the IMF’s consent.

Pakistan also engaged in virtual talks with the IMF on reducing the energy sector circular debt. The finance ministry presented a relief proposal for power consumers to the IMF team, which requested for additional information.

According to provisional data, the Federal Board of Revenue (FBR) clocked Rs1.2 trillion in tax collection in the first two months of FY24, surpassing the target of Rs1.18 trillion. However, the State Bank’s foreign currency reserves declined by $81 million to $7.85 billion on account of debt repayments, added the JS analyst.

Arif Habib Limited, in its report, said that the stock market started off trading on a negative note amid ambiguity about general elections, macroeconomic uncertainty, currency devaluation and inflation worries. Furthermore, market talk of an emergency monetary policy committee meeting also dampened investor sentiment. Moreover, Pakistani rupee further depreciated during the week, closing at Rs305.47 with a loss of Rs4.46, or 1.5% week-on-week.

Sector-wise, negative contribution to the market came from commercial banks (524 points), cement (333 points), oil and gas exploration companies (285 points), technology and communication (247 points) and fertiliser (216 points).

Foreigners’ buying continued during the week under review, which came in at $3.3 million compared to net buying of $1.7 million last week.

Published in The Express Tribune, September 3rd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ