Lucky Cement eyes expanding into telecom, power sectors

Announced net consolidated profit of Rs59.54b, up 63.5% from last year

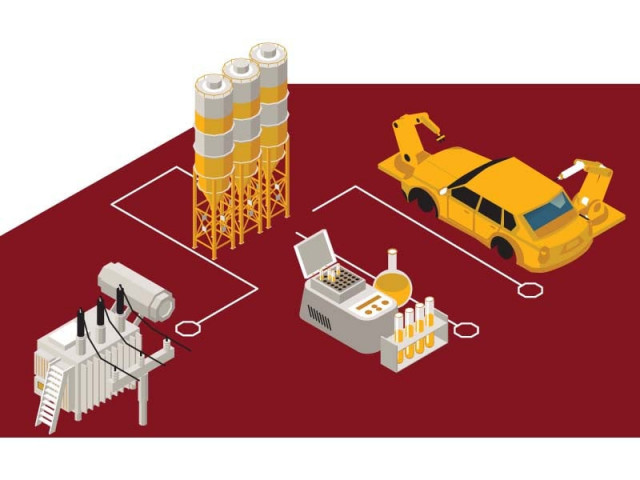

A formidable conglomerate spanning various sectors of the economy, Lucky Cement, is bracing for another challenging fiscal year in 2024. Anticipating the complexities ahead, the company is primed to seize opportunities and sustain profit growth by unveiling a strategic blueprint that encompasses the introduction of low-cost mobile phones, localised car manufacturing parts, a shift to affordable Thar coal and solar energy, expansion of cement production capacity, and astute cost management in the chemical sector.

The conglomerate announced on Tuesday an astounding net consolidated profit of Rs59.54 billion for the financially demanding year ended on June 30, 2023, leaping by 63.5% from the prior year’s Rs36.42 billion (FY22). A testament to its success, the conglomerate declared a cash dividend of Rs 18 per share.

In a comprehensive report, Lucky Cement acknowledged the persisting economic challenges marked by high inflation, escalating interest rates, and a depreciating currency that threatens to stifle cement demand in the near future. Further rupee depreciation and potential energy tariff hikes could amplify the pressure on cement sector margins, impacting export sector competitiveness.

Amidst these challenges, the company seeks hope in political stability post the impending general elections in Pakistan. Coupled with reinvestment in public sector development projects, including the ambitious China-Pakistan Economic Corridor (CPEC), these factors could reinvigorate the national economy and stimulate heightened demand within the cement sector.

Aligning with its growth strategy, the conglomerate has magnified its cement production capacity to a robust 3.15 million tonnes per annum at the Pezu Plant, on December 22, 2022, cementing its reputation as Pakistan’s foremost cement and clinker manufacturer and exporter. Furthermore, a new 1.82 MT clinker production line in Samawah, Iraq, heralds self-sufficiency in clinker availability.

Automobile, mobile phones

In the automotive and mobile phone sectors, FY24 appears uncertain due to an economic slowdown, rising raw material costs, and currency depreciation. Nonetheless, Lucky Cement says its strategic focus on operational optimisation and localisation is anticipated to mitigate reliance on imported components, safeguard margins, and heighten competitiveness.

The mobile phone industry faces similar challenges as economic slowdown and currency depreciation elevate smartphone costs, potentially curbing consumer purchasing power and demand. In response, Lucky Cement is poised to shift its focus towards producing and promoting low-cost phones, an endeavour aimed at sustaining sales volumes despite these impediments.

Power

In the power sector, a significant milestone is on the horizon for FY24: the completion of phase-III by the Sindh Engro Coal Mining Company (SECMC), enabling a full transition to 100% Thar coal operations. This transition is anticipated to yield substantial financial benefits by eliminating foreign currency expenditure on coal imports. In line with its renewable energy commitment, the company has also concluded negotiations for a 25 MW solar power project at its Karachi plant, poised for completion in the second quarter of FY24.

Chemicals

Within the realm of chemicals, Lucky Core Industries, a subsidiary of the conglomerate, anticipates challenges in the polyester, soda ash, and chemical businesses. The company, however, hopes to take a proactive approach that seeks to rationalise costs and bolster operational efficiency, ultimately shielding margins and ensuring profitability even in the face of potential demand fluctuations.

The remarkable profit surge in FY23 was catalysed in part by the disposal of a significant stake in NutriCo Morinaga (Private) Limited by Lucky Core Industries. This strategic move resulted in an after-tax gain of Rs9.6 billion. Earnings per share stood at Rs152.97 in FY23, a noteworthy increase from Rs91.22 in FY22, as per the group’s consolidated profit or loss account available at the Pakistan Stock Exchange (PSX).

Published in The Express Tribune, August 9th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ