Sugar prices up by a staggering 59%

Sharp price hike plus exports lead to record sales for domestic sugar companies

The Pakistani nation has been burdened by a staggering 59% increase in sugar prices over the last 10 months, soaring to Rs140/kg, as a result of the government’s decision to allow sugar exports in the past. The sharp price hike proved advantageous for domestic listed sugar companies, propelling them to achieve record sales of Rs235 billion and a net profit of Rs14 billion in the first nine months (Jul-Mar) of the previous fiscal year 2023, according to data compiled by Topline Research.

This astonishing growth in revenue and profit reflects the food price surges during challenging times and provides an explanation for the inflation reading, which reached a six-decade high of 38% in the previous fiscal year that ended on June 30, 2023.

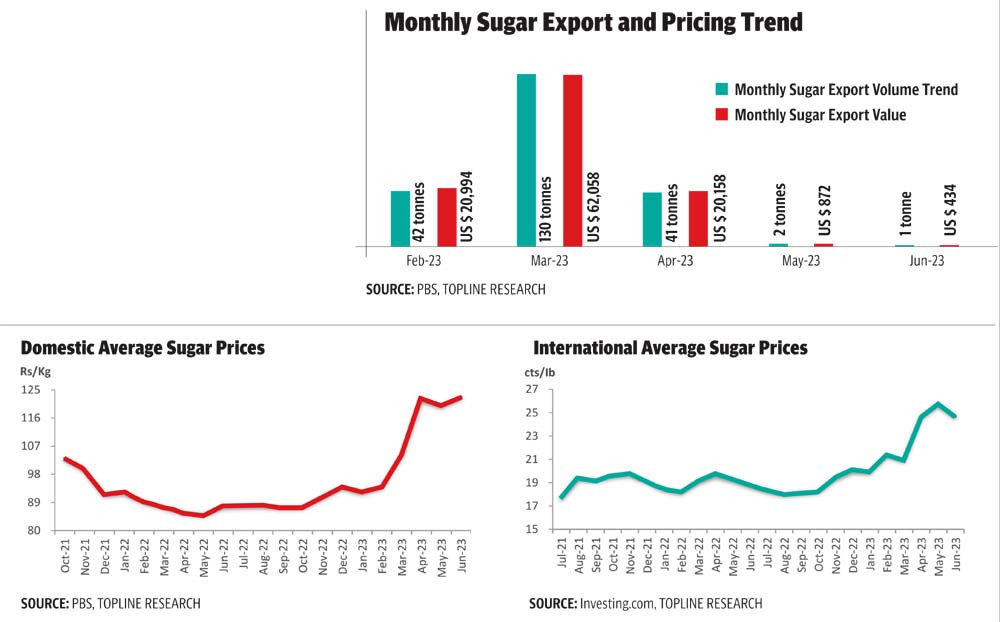

The government’s move to allow sugar exports in January 2023, permitting the industry to export 250,000 tonnes until the end of June 2023, was aimed at attracting US dollars to improve foreign exchange reserves and balance the country’s international payments. However, poor oversight on exports led to a sugar shortage in the domestic market, prompting traders to import the commodity back from global markets to meet local demand, impacting foreign exchange reserves.

The sugar shortage was exacerbated by a low sugarcane output due to historical devastating floods in 2022. Traders imported 6,105 tonnes of sugar worth $5.64 million in FY23, according to data from the Pakistan Bureau of Statistics (PBS). Despite being a sugar-surplus producing country, the import volume remained significantly lower compared to the previous fiscal year 2022.

Analyst Sunny Kumar from Topline Research stated that the sugar sector’s profits are showing signs of “strong growth” after many years. Listed sugar companies’ earnings increased by 23% YoY to reach a record high of Rs14 billion during the nine months of fiscal year 2023 (Oct-2022 to Jun-2023). The rise in earnings is attributed to increased sugar volumes and prices.

Design: Mohsin Alam

Net sales of the sector surged 25% YoY to Rs235 billion in 9MFY23, driven by the export of 216,000 tonnes of sugar and a 13% YoY increase in average domestic prices. The opening up of exports put pressure on domestic prices, leading to a 40% price increase from Rs88/kg in October 2022 to Rs123/kg in Jun-2023. Presently, sugar prices continue to rise and have reached Rs140/kg.

A report from the US Department of Agriculture (USDA) on Pakistan’s sugar industry, published on April 12, 2023, forecasts sugar production in 2023/24 at 7.05 million tonnes, 3% higher than the 2022/23 estimate. The marginal increase is attributed to expectations of a recovery in cane area harvested compared to the flood-damaged crop of 2022/23.

Sugar consumption in 2023/24 is forecasted to be 6.3 million tonnes, 3% higher than 2022/23, reflecting population growth. Sugar exports in 2023/24 are expected to be 800,000 tonnes, slightly less than 2022/23, as the government seeks to curb exports, fearing domestic shortages and price hikes, said the report.

Regarding the federal government’s decision to allow 250,000 tonnes of sugar exports in January 2023, subject to the condition of recovering proceeds in dollars from sugar exporters within 60 days from when letters of credit (LCs) are opened, the sector exported 172,000 tonnes in the second quarter of FY23 and an additional 44,000 tonnes in the third quarter, totalling 216,000 tonnes according to PBS, said Kumar.

During the review period, ethanol, a by-product of sugar, experienced improved performance in 9MFY23 due to favourable ethanol selling prices in the international market and rupee devaluation against the US dollar.

While the sector’s average gross margins improved to 16.4% in 9MFY23 compared to 15.9% in the same period of the previous fiscal year 2022, selling and distribution expenses rose by 46% YoY in line with increased volumetric sales and the inflationary environment.

However, the finance cost has limited earnings growth, jumping by 82% YoY to Rs16.5 billion in 9MFY23 compared to Rs9.1 billion in 9MFY22, primarily due to higher interest rates and increased borrowing for working capital.

Published in The Express Tribune, August 4th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ