The Pakistan Stock Exchange (PSX) saw a dominant bullish trend as investor optimism surged on the back of China’s debt rollover of $600 million to Pakistan, expectations of a status quo in the policy rate (a major growth driver this week), and the Islamabad High Court (IHC)’s withdrawal of the Super tax levy.

Although the week commenced with a negative note, with a weak macroeconomic outlook and rupee instability against the US dollar dampening investor interest, the bears’ control briefly dragged the index down on Tuesday.

However, the bulls returned to the bourse on Wednesday following the news of the $600 million debt rollover from China and Pakistan’s assurance to the US regarding the implementation of the International Monetary Fund (IMF) loan program.

The positive momentum continued for the following two sessions; driven by investors’ positive expectations that the State Bank of Pakistan (SBP) would maintain a status quo in its monetary policy announcement.

The bullish trend was further strengthened when the IHC ruled in favour of several companies that had filed petitions against the imposition of the super tax.

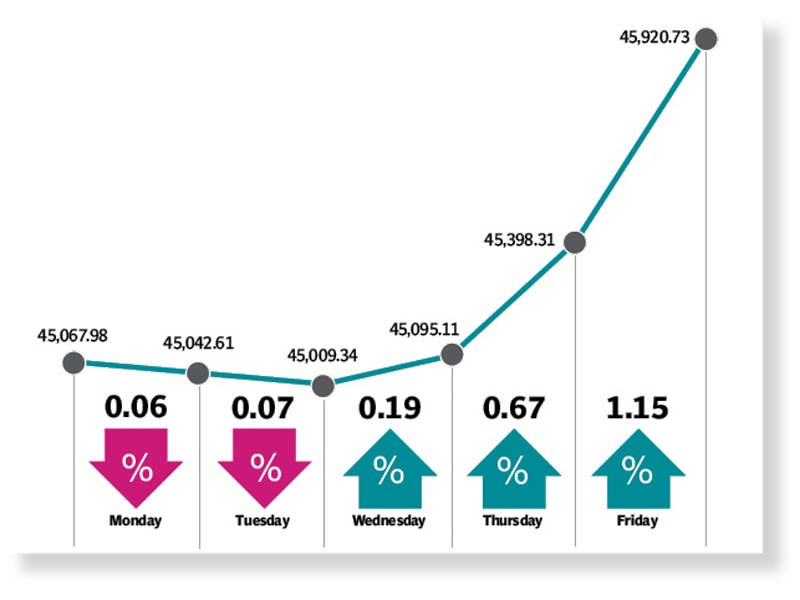

Consequently, the benchmark KSE-100 index managed to stay in the green, gaining 853 points or 1.9% compared to the previous week, settling at 45,921.

According to JS Global analyst Muhammad Waqas Ghani, the week started on a dull note, but investor optimism eventually picked up. In terms of sectors, banks (7.2% WoW), transport (2.6% WoW), and OMC sector (2.2% WoW) outperformed during the week.

On the economic front, the IMF released its latest Staff Report for Pakistan, discussing the country’s performance, key targets, and recommendations on important macro fronts, following the agreement to support Pakistan through a Stand-By Arrangement of $3 billion for nine months.

Additionally, Pakistan received a combined sum of $3 billion from Saudi Arabia and the UAE after the agreement with the IMF, resulting in the State Bank of Pakistan’s foreign exchange reserves reaching $8.7 billion, as per the latest data shared by the SBP. SBP reserves experienced a significant week-on-week surge of $4.2 billion.

However, E&P companies raised concerns about a severe cash flow crisis, with the default of Sui companies on payments totalling Rs1,317 billion. This led to profit-taking in E&P stocks in the later part of the week.

Overall, the KSE 100 index gained 1.9% WoW to close at 45,921, making it the highest weekly closing after April 25, 2022, with the resumption of the IMF program continuing to attract investor interest. The market has increased by 10.78% since the signing of the staff-level agreement with the IMF for the 9-month SBA facility.

During the week, United Bank’s result announcement triggered buying in the banking sector, providing further stimulus to the market. Significant economic numbers during the week included a current account surplus of $334 million in Jun-23, marking the fourth consecutive current account surplus, and foreign direct investment (FDI) of $114 million in Jun-23 compared to $150 million in May-23.

The average daily traded volume and value during the week stood at 357 million shares and Rs9 billion, respectively.

On the flows end, foreign corporates, banks, and insurance net purchased equities worth $4.16 million, $1.44 million, and $1.06 million, respectively. On the other hand, mutual funds and other sectors sold equities worth $4.56 million and $2.22 million, respectively.

Published in The Express Tribune, July 23rd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719660634-1/BeFunky-collage-nicole-(1)1719660634-1-405x300.webp)

1732276540-0/kim-(10)1732276540-0-165x106.webp)

1732274008-0/Ariana-Grande-and-Kristin-Chenoweth-(1)1732274008-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ