Following the rally in Pakistan’s global Eurobonds, the country’s risk of default, as measured by credit default swaps (CDS), has reached a six-month low at 46.76% after the successful achievement of a $3 billion International Monetary Fund (IMF) deal last week. This improvement signifies a significant restoration of global investors’ confidence in the domestic economy and paves the way for Islamabad to return to international bond markets in the near future to raise new debt financing and boost foreign exchange reserves.

The government has set a target of raising $1.5 billion through the issuance of Eurobonds and/or Sukuk in global markets during the current fiscal year 2024.

Credit default swaps (CDS) are insurance products that global investors purchase to protect against potential losses in the event of the government’s failure to repay international bonds upon maturity.

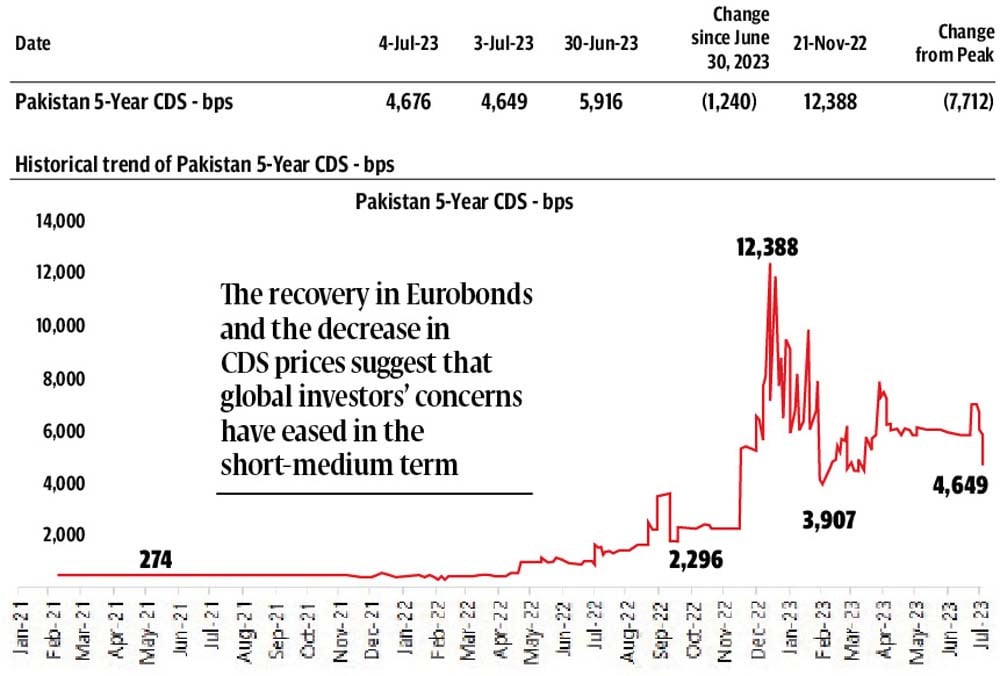

Head of Research at Arif Habib Limited, Tahir Abbas revealed that the five-year CDS dropped by 12.40 percentage points to 46.76% on Tuesday following the unexpected achievement of the $3 billion IMF deal on Friday. This marks a significant recovery of 77.12 percentage points over the past eight months, compared to the record high of 123.88% reached on November 21, 2022, when Pakistan’s $6.5 billion loan programme derailed and remained stalled until its premature end on June 30, 2023.

Despite this recovery, the 5-year CDS price of 46.76% remains elevated compared to the mere 2.75% recorded in March 2021, when the country had stable foreign exchange reserves, unlike the critically low level of $4 billion currently.

However, while the risk of default has decreased, the Pakistani currency failed to sustain Tuesday’s gains against the US dollar in the domestic interbank market on Wednesday. This is attributed to the high demand for foreign currency to clear import backlog and make payments for liberalised imports under the IMF programme. The currency dropped 0.71%, or Rs1.97, to Rs277.41 against the US dollar in the interbank market on Wednesday, after experiencing a significant rebound of 3.83% on Tuesday.

In the open market, the rupee retreated by Rs1 to Rs281/$ compared to the previous day’s rate of Rs280/$, as reported by the Exchange Companies Association of Pakistan (ECAP).

It is worth noting that Pakistan’s 10-year Eurobond, valued at $1 billion and maturing in April 2024, regained 55% in value following the IMF program rally, reaching a one-year high at 80 cents on the dollar on Tuesday. This comes after the bond had hovered at 51.5 cents before Pakistan signed the staff level agreement (SLA) with the IMF for the $3 billion loan. The recovery in Eurobonds and the decrease in CDS prices suggest that global investors’ concerns regarding Pakistan’s economy have eased in the short to medium term, aligning with the duration of the current IMF programme, which spans three quarters.

However, there are several other factors that will guide the government on the appropriate timing to return to global bond markets to raise new funds. This includes the revision of Pakistan’s credit ratings by global rating agencies like Moody’s and Fitch, which currently rate the country at a junk level. Improvements in the ratings are necessary to secure new funds at favourable terms in the global bond markets. It is anticipated that the rating agencies will reassess Pakistan’s creditworthiness over the next three to six months, observing the country’s performance under the new IMF deal.

Additionally, factors such as the global interest rate scenario and liquidity position will influence Pakistan’s decision on when to launch new bonds in global markets, said Abbas. While global interest rates are expected to remain high in the short run to combat inflation, a reversal in rates could increase liquidity in the markets later on.

Pakistan had previously issued international bonds at a rate of around 7-8% return. As for the Pakistani rupee, Abbas stated that Wednesday’s drop was merely a correction following the significant pullback in its value the previous day. He believes that the highly anticipated approval of the new $3 billion IMF programme by the Executive Board on July 12, as well as the first tranche of the IMF loan, will help the currency regain further ground against the US dollar.

Furthermore, capital inflows from other global creditors and friendly countries, amounting to around $3-4 billion throughout FY24, are expected to continue supporting the rupee. In the short run, the currency may stabilise at around Rs270-275/$.

Published in The Express Tribune, July 6th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ