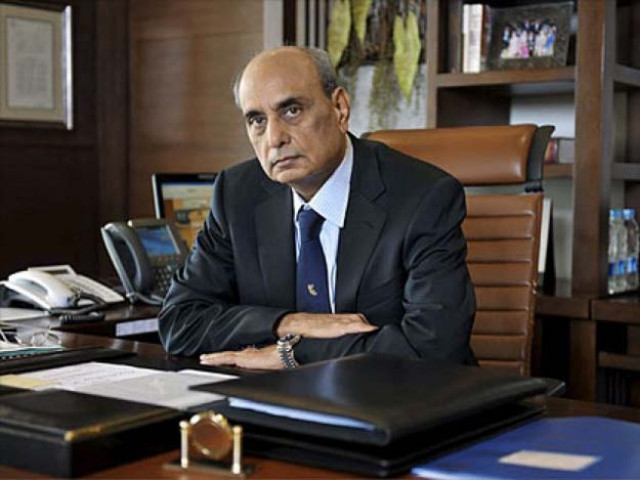

Govt must curtail expenditures: Mansha

Industrialist says country’s biggest problem is overstaffing at govt departments

One of the leading businessmen of the country, Mian Muhammad Mansha, has said the federal government has no funds at its disposal and that it collects money so that it may pay salaries of government employees.

“We always talk about widening the tax net but nobody talks about reducing the expenditures,” Mansha said while talking to the hosts of Express News’ programme The Review. “[However,} despite this emphasis on widening the scope of the tax net, only 1% people in the country are filers,” he added.

Talking with reference to a $3 billion loan programme whose initial approval Pakistan managed to clinch from the International Monetary Fund (IMF) last week, he said the IMF package will help in bringing discipline to the system.

“But the important question is what we are supposed to do next?” he asked.

On June 29, the IMF reached a staff-level pact with Pakistan on a $3 billion stand-by arrangement, a decision long awaited by the country which is teetering on the brink of default.

The deal, subject to approval by the IMF board in July, came hours before the current agreement with the IMF expired on June 30. Although essentially a bridge loan, it offers much respite to Pakistan, which is battling an acute balance of payments crisis and falling foreign exchange reserves.

Mansha said the government will have to lower the interest rate. He said in order to reduce the interest rate, the government will first have to privatize state owned entities. “The biggest issue for Pakistan’s economy is overstaffing at government departments,” he said.

He said the power distribution companies (DISCOs) suffer immense losses due to non-recovery. “The distribution companies in Hyderabad, Sukkur, Quetta and Khyber Pakhtunkhwa recover only 24% [of their expenditures]. There is a lot of scope for improvement.”

Mansha said he paid Rs9.5 billion in taxes only for one of the banks that he owns. He said the government has imposed a number of taxes including a super tax on banks. “Your economy will remain under stress if you don’t strengthen your banks,” he said.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ