Uncertainty prevailed at the Pakistan Stock Exchange (PSX) throughout the week as a lack of positive news regarding the ninth review of International Monetary Fund (IMF)’s loan programme took a toll on investor sentiment, leading the market to lose over 1,200 points and settle below the 41,000 mark.

The week kicked off on a dull note when volumes remained low due to the dump-and-run approach adopted by market participants in the wake of concerns about Pakistan’s economy.

Economic uncertainty dimmed hopes of investors about the resumption of IMF programme, which dragged the market below the 41,000-point mark.

The following session on Tuesday showed some marginal recovery, though the market remained under pressure in the absence of positive developments.

The index came under pressure on Wednesday where bears gripped the market over growing default concerns with no optimism about the revival of IMF loan programme and the slowdown in foreign direct investment (FDI).

The negative trend continued on Thursday as well in the presence of uncertainty and poor economic conditions, which drove the market into the red zone.

The final session also came under selling pressure as market players feared that Pakistan would not be able to revive the IMF’s stalled programme by the time it expired on June 30. The index closed the day in the red in a lacklustre session.

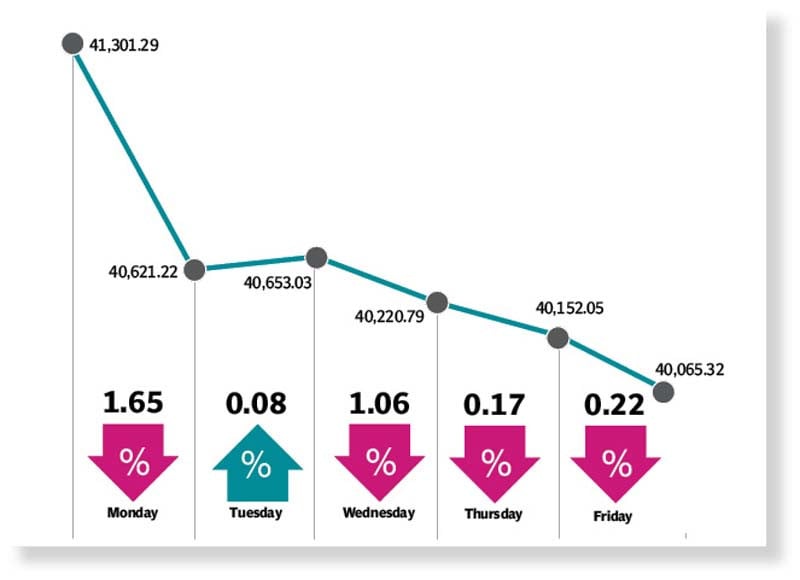

The benchmark KSE-100 index registered a decrease of 1,236 points, or 3% week-on-week (WoW), and settled at 40,065.

JS Global analyst Muhammad Waqas Ghani, in his report, noted that the KSE-100 index continued with its bearish trend as the IMF review continued to prolong.

Sector-wise, leasing companies (-14.1% WoW), transport (-10.5%) and glass companies (-8.8%) underperformed during the week.

Foreigners were net buyers ($2.9 million) with major buying witnessed in the banking sector ($1 million).

On the economic front, the current account balance registered a surplus for the third time in a row, at $255 million, for May 2023, further reducing the 11MFY23 current account deficit (CAD) to $2.94 billion. The surplus got support from a lower trade deficit.

As per State Bank’s latest update, FDI in the country plunged 21% during the first 11 months of FY23.

During the week, the government constituted three special committees to ensure success of the newly formed Special Investment Facilitation Council (SIFC), with the chief of army staff being one of the members.

In other news, PM Shehbaz Sharif, on the sidelines of Global Financing Summit in Paris, briefed the IMF MD on Pakistan’s economic outlook and sought the release of stalled funds.

State Bank’s reserves came in at $3.5 billion, a WoW decrease of $482 million, the JS analyst added.

Arif Habib Limited, in its report, said that the market experienced subdued activity throughout the week, primarily due to the prevailing uncertainty surrounding the completion of ninth review of the IMF programme.

On the economic front, Pakistan recorded a current account surplus of $255 million in May 2023, compared to a surplus of $78 million in April. Additionally, the government raised over Rs2.4 trillion through the auction of treasury bills.

Pakistani rupee appreciated against the US dollar by Rs0.46 (0.16%) on a week-on-week basis, closing the week at 286.74/$.

In terms of sectors, positive contribution to the bourse came from tobacco (14 points). Negative contribution came from commercial banks (214 points), fertiliser (194 points), technology and communication (181 points), chemical (114 points), and oil and gas exploration companies (109 points).

In terms of stocks, positive contributors were Shell Pakistan (16 points), Pakistan Tobacco (14 points), Unilever Pakistan Foods (12 points), AGP Limited (7 points), and Millat Tractors (7 points).

Negative contributors were Engro Corporation (91 points), Systems Limited (79 points), Colgate-Palmolive (Pakistan) (77 points), TRG Pakistan (73 points), and United Bank (66 points).

Published in The Express Tribune, June 25th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1728005812-0/Ashley-Hansen-(1)1728005812-0-165x106.webp)

1727242355-0/Diddy-(1)1727242355-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ