Output of big industries dives 21%

Sharp drop in goods production sparks doubts about 0.3% economic growth rate

The manufacturing output of large industries shrank 21% year-on-year in April 2023 owing to stringent restrictions on imports and a high cost of doing business, sparking doubts about the government’s claim of 0.3% economic growth in the outgoing fiscal year.

Pakistan Bureau of Statistics (PBS) reported on Thursday that the output of large-scale manufacturing (LSM) industries contracted 21.1% in April compared to the same month of last year. Similarly, the LSM index recorded an overall negative growth of 9.4% in the first 10 months (July-April) of current fiscal year.

The LSM index has dived to a very low level which was not even noticed during the Covid-19 period. However, the government seems to be not concerned about the deteriorating state of economy.

The latest figures point to the growing chances of increase in non-performing loans as well as unemployment and poverty owing to the closure of factories.

The national data collecting agency released the LSM figures the day a German-funded book showed that the economic growth was overstated for the outgoing as well as last fiscal year.

“The GDP growth rate in 2022-23 is likely to fall to negative 1%. This represents a loss of $16 billion in gross national income,” said the book authored by renowned economist Dr Hafiz Pasha and funded by Friedrich Ebert Stiftung (FES) institute of Germany.

It stated that the industrial sector contracted 3.5%, though the government had claimed a 2.9% drop in its output.

The government also said that the economy grew 0.3% during the outgoing fiscal year, a figure that lacked credibility.

The FES book, titled “Leading Issues in the Economy of Pakistan”, claimed that the “GDP growth rate in 2021-22 is likely to be overstated”.

design: Ibrahim Yahya

“The GDP growth rate in 2021-22 is unlikely to have approached 6% and it is more likely to be closer to 4.8%,” said the book.

Pakistan’s economy is now passing through its worst period but the government’s efforts seem more focused on winning the lost political capital than putting in place a credible economic revival plan.

The LSM sector contributes nearly one-tenth to the total national output but a constant decline in its share and growth may cause a lot of problems for the government, which is already struggling to create jobs.

Curbs on imports, high interest rates, rising cost of doing business and frequent changes in taxation policies have caused irreparable damage to the manufacturing sector. Some big international brands are now thinking to wind up their businesses.

The International Monetary Fund (IMF) on Wednesday rejected Pakistan’s new populist budget, which indicated that its $6.5 billion loan programme would end without revival. This will create more trouble for industries as the government does not have a plan to lift import restrictions until it has sufficient foreign currency reserves.

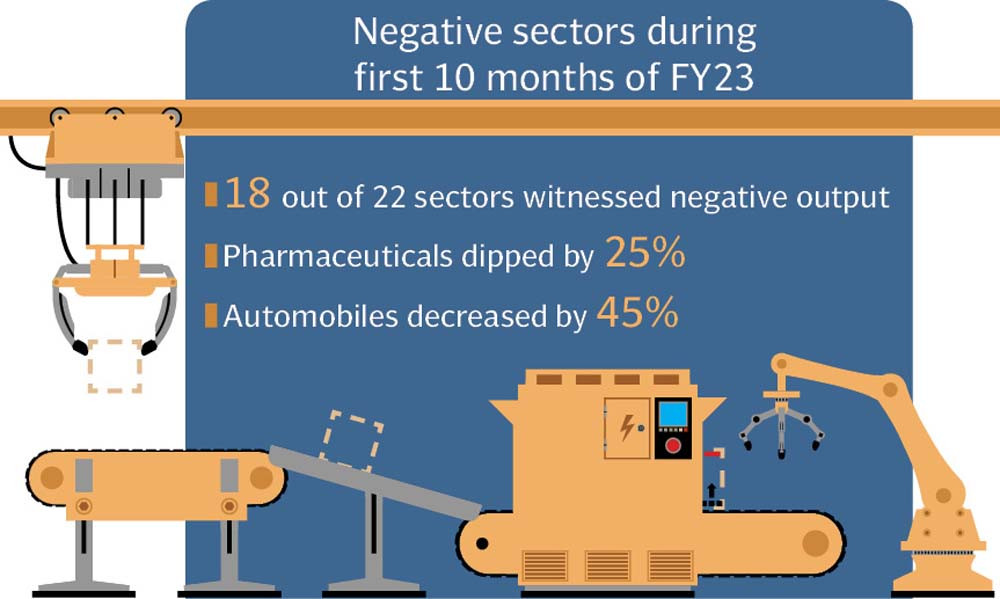

Big industries faced broad-based contraction with 18 out of 22 sectors reporting negative output in the first 10 months of current fiscal year compared to a year ago.

Only clothing, leather products, furniture and football manufacturing sectors posted increase in production in the 10-month period.

The main contributors to the overall negative growth of 9.4% were the food sector, tobacco, garments, petroleum products, chemicals, cement, pharmaceuticals, iron and steel, electrical equipment and automobiles, according to the PBS. The two industries hit hardest by the import ban were pharmaceutical and automobile, both of which contracted significantly in the first 10 months of FY23.

The pharmaceutical sector, also impacted by currency devaluation, saw a 25% dip in its output while automobile production fell 45%. The output of chemicals, non-metallic mineral products, machinery and equipment and transport equipment shrank in July-April of current fiscal year.

Private sector credit flow went down by 98% during the current fiscal year and there were chances of a massive increase in non-performing loans, said Hafiz Pasha.

Published in The Express Tribune, June 16th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ