Sindh aims to collect Rs469b

Proposes Rs2.24 trillion budget outlay with overwhelming deficit of Rs37.79 billion

The Sindh government has unveiled its budget for the next fiscal year, aiming to collect revenue of Rs469.90 billion in provincial taxes. The government has set an ambitious target for itself despite the prevailing economic slowdown. The share of provincial taxes in the total tax receipts is estimated to be around 21%, which amounts to approximately Rs2.20 trillion for FY24. However, the government continues to heavily rely on federal transfers, foreign project assistance, foreign grants, and domestic borrowing to manage the province’s finances.

Under the budget layout of Rs2.24 trillion, the government has projected a budget deficit of Rs37.79 billion for FY24. The Pakistan People’s Party (PPP)-led provincial government plans to collect a significant portion of provincial taxes from indirect taxes like the General Sales Tax Provincial, which primarily affects common people. On the other hand, the share of direct taxes to be collected from wealthy individuals remains meagre in the planned FY24 budget.

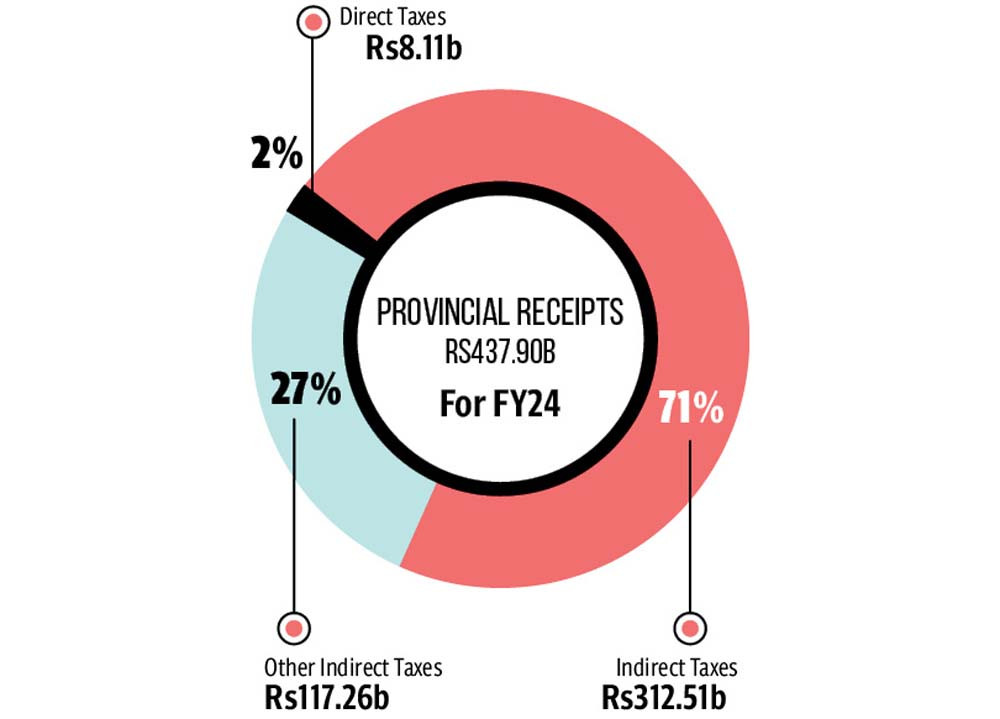

The budget document reveals that the government aims to collect Rs8.11 billion from direct taxes, which is less than 2% of the total provincial tax collection target. In contrast, indirect taxes are projected to contribute Rs312.51 billion (71% of provincial taxes), while other indirect taxes are estimated at Rs117.26 billion (27%).

Despite being a major producer of agricultural goods, producing almost 30% of the country’s total agriculture produce, the government has struggled to mobilise targeted revenue from agriculture taxes. In FY23, taxes collected from the liquor business were nine times higher at Rs8 billion compared to the meagre Rs900 million collected from agriculture taxes. This raises questions about whether people consumed more liquor than the province produced food and other agricultural products, or if consumers were more compliant in paying taxes on alcohol compared to landlords involved in agriculture production.

Nonetheless, the government has set an ambitious target of Rs3.63 billion for agriculture tax collection in FY24, compared to the Rs900 million collected in the previous year. Additionally, it aims to collect Rs12.92 billion from the liquor business in FY24, up from Rs8 billion in FY23.

The target of collecting Rs469.90 billion in provincial taxes for FY24 represents a 25.5% increase compared to the initial target of Rs374.50 billion for FY23. However, the government revised down the FY23 tax collection target to Rs358 billion, reflecting the economic slowdown.

Chief Minister Syed Murad Ali Shah attributed the decline in collection to factors such as a sluggish economy, high federal levies, and lacklustre collection of infrastructure development cess due to import restrictions. The budget for FY23-24 does not introduce any new taxes, suggesting that the government anticipates an uptick in economic activities that will help generate higher tax revenues.

Shah expressed confidence in achieving the ambitious revenue targets, stating, “We have set quite ambitious targets for next year for major revenue streams. During the last five years, fiscal reforms have been implemented to mobilise provincial revenues and reduce the budget deficit. We expect increased collection in the next financial year, and therefore, we have proposed budget estimates of Rs469.90 billion for tax revenue.”

While the government has set zero capital value tax (CVT) on immovable property for FY24, it aims to collect a staggering Rs235 billion in sales tax (General Sales Tax Provincial), a 30.5% increase compared to the previous fiscal year.

Out of the total tax receipts for FY24, the provincial government estimates federal transfers at Rs1.35 trillion, foreign project assistance and grants at Rs295.52 billion, and local repayments/loans and bank borrowing at Rs36.13 billion.

CM Shah acknowledged that federal transfers depend on the annual collection by the Federal Board of Revenue (FBR) and that national economic indicators are influenced by prevailing economic conditions, currency depreciation, and balance of payments. The budget also includes a proposed non-tax revenue of Rs32 billion for the next financial year.

Published in The Express Tribune, June 11th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ