PSX flat as investors stay away

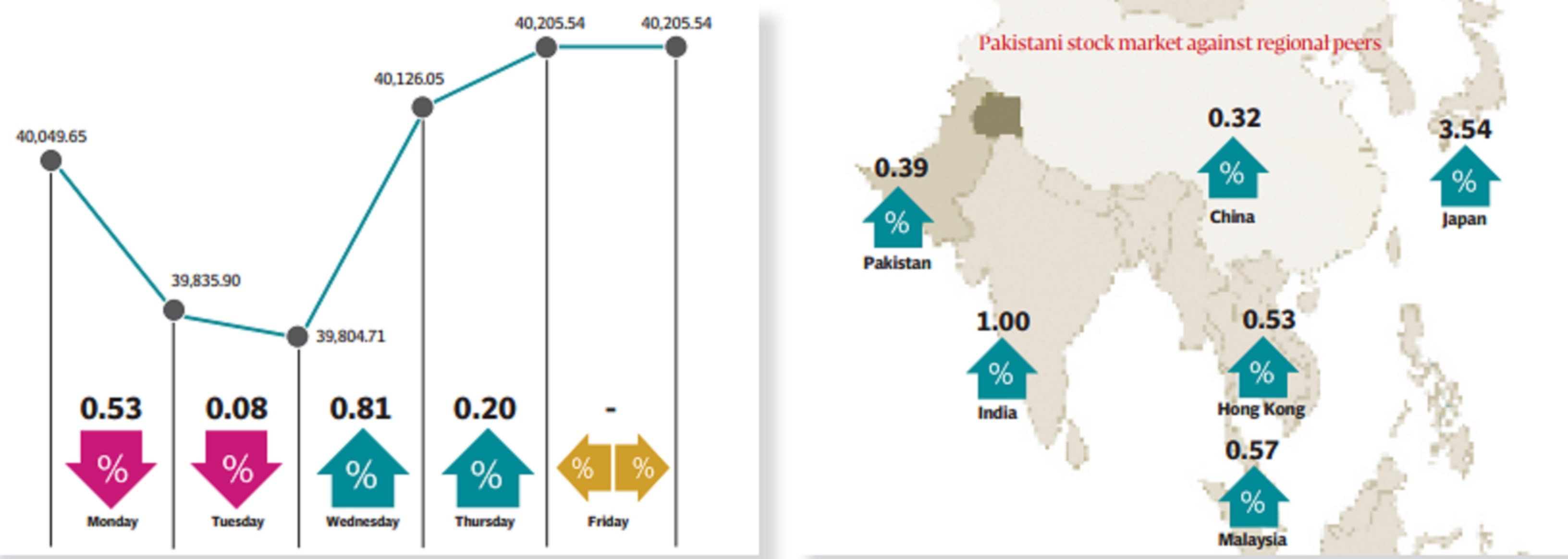

KSE-100 index edges up by 155 points, or 0.4%, at 40,206

Investors posed confidence as Pakistan Stock Exchange (PSX) extended gains in a four-day trading week with two sessions closing in the green mainly over hopes of resumption of the stalled International Monetary Fund (IMF) loan programme after assurances of financial support by friendly nations.

Bearish activity returned to the bourse on Monday as the KSE-100 index opened negative on growing political chaos with split in the top court during hearings on holding elections in Punjab and Khyber-Pakhtunkhwa coupled with an unstable economic situation, which dragged the index into the red.

Bears maintained their grip on Tuesday as well when investor interest remained muted due to persistent delay in resumption of the IMF loan programme. Furthermore, continued depreciation of the rupee prevented investors from taking fresh positions. Investor sentiment flipped on Wednesday when the United Arab Emirates (UAE) assured the IMF of providing $1 billion assistance to Pakistan and resultantly the KSE-100 index breached the 40,000 barrier.

The market maintained the positive momentum on Thursday when it closed with marginal gains before the long weekend over hopes of reaching a staff-level agreement with the IMF soon. The KSE-100 index gained 155 points, or 0.4% week-onweek, and settled at 40,206 by the end of the week. JS Global analyst Wasil Zaman, in his report, noted that political noise persisted during the outgoing week as the National Assembly passed a bill to curtail chief justice’s powers.

The market, however, remained stable, closing at 40,206, gaining 155 points week-on-week. Sectorwise, banking sector (+1.3% week-on-week) emerged as the top performer. On the news front, the government increased profit rates of different National Savings Schemes (NSS). A prolonged delay in IMF programme resumption caused the rupee to plunge to a record low at Rs288.4 to a dollar from where it recovered to 284.9 in later sessions on some positive news from the finance ministry, he added.

According to a press release of the Ministry of Finance, the director of IMF’s Middle East and Central Asia Department has shown expectation of signing the staff-level agreement soon. During the week, the government raised Rs144 billion through an auction of Pakistan Investment Bonds (PIBs) against the target of Rs100 billion. Cut-off yield on three-year PIBs rose by 34 basis points to 18.4%. Moreover, the SBP reported another decline in its foreign exchange reserves as they came in at $4 billion, down $170 million week-on-week, the JS analyst added.

Arif Habib Limited, in its report, said that the market commenced trading on a negative note, mainly because of uncertainty about the resumption of IMF programme. “However, mid-week the IMF’s director for Middle East and Central Asia Department expressed confidence that the staff-level agreement will be signed with Pakistan soon. This gave some much-needed support to the index,” it said. Additionally, Pakistan received seven-month high remittances of $2.5 billion in March 2023, attributable to seasonal inflows during Ramazan.

The rupee depreciated against the US dollar by Rs0.26, 0.09% week-onweek, closing at 284.9/$. In terms of sectors, positive contribution to the market came from technology and communication (72 points), commercial banks (64 points), oil and gas exploration companies (48 points), food and personal care products (8 points), and cement (6 points). Negative contribution came from miscellaneous (8 points), tobacco (8 points), and fertiliser (6 points). In terms of individual stocks, positive contributors were Systems Limited (70 points), Engro Fertilisers (32 points), Meezan Bank (28 points), Pakistan Petroleum (21 points) and Oil and Gas Development Company (20 points).

Negative contribution came from Pakistan Services (48 points), Engro Corporation (24 points), Millat Tractors (15 points), Dawood Hercules (15 points), and Engro Polymer and Chemicals (9 points). Foreigners’ buying continued during the week under review as they bought stocks worth $1.4 million as compared to net buying of $3.9 million last week, the AHL report added.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ