IMF deal inches closer after UAE $1b loan pledge

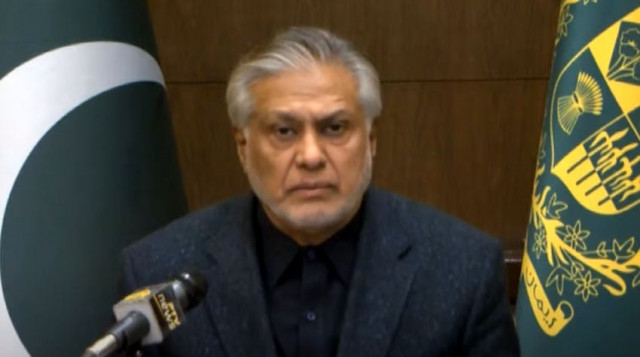

Finance Minister Ishaq Dar says Chinese bank to disburse $300m out of $1.3b facility

Pakistan on Friday announced that the UAE gave its commitment for a loan of $1 billion -- a sum that had become very crucial for the struggling $350 billion economy to inch closer towards a staff-level agreement with the International Monetary Fund (IMF).

The $1 billion might help in unlocking the IMF deal that in return would earn a certificate of “sustainable debt of Pakistan” from the global lender, at least till June 2023.

The finance minister also announced that China would transfer the remaining $300 million commercial loan tranche on Friday (April 14) -- a development that would keep the official foreign currency reserves slightly above the $4 billion level.

Dar elaborated that the UAE authorities had confirmed to the IMF for their bilateral support of $1 billion to Pakistan -- the last requisite to complete the staff-level agreement with the IMF.

Taking to his official Twitter handle, the finance minister wrote that the State Bank of Pakistan (SBP) was now “engaged for needful documentation for taking the said deposit from [the] UAE authorities”.

In January this year, Prime Minister Shehbaz Sharif had requested the UAE rulers to give another $1 billion loan to meet the external financing needs of Pakistan.

The UAE authorities were reluctant to give the cash-strapped country any fresh loans and they asked it to sell its assets instead.

With the fresh pledge, the UAE’s exposure to Pakistan would jump to $3 billion.

Saudi Arabia has already decided to increase its exposure to Pakistan to $5 billion.

The Kingdom had given $3 billion in December 2021, a sum that was rolled over again four months ago.

China, Saudi Arabia and UAE have already placed $9 billion deposits with Pakistan's central bank, an amount which the country has almost consumed and is now seeking rollovers every year.

A $1 billion Chinese deposit is maturing in June this year.

The IMF has asked Pakistan to arrange $6 billion in fresh loans, including $3 billion to be raised before reaching a staff-level agreement.

However, it is unclear whether or not the IMF has withdrawn its condition for Pakistan to arrange $2 billion from a bilateral source and the remaining $1 billion from either commercial banks or other multilateral institutions.

The finance ministry officials did not respond to a question whether the UAE commitment would satisfy the IMF or the government still had to arrange $1 billion from non-bilateral sources to reach the staff-level agreement.

Pakistan has already assured the IMF that it would no longer implement the petrol subsidy scheme, which has become another irritant in reaching the much-delayed staff-level pact.

Since early February, Pakistan has been negotiating with the IMF to revive the $6.5 billion bailout programme to secure a $1.1 billion tranche.

On Wednesday, Pakistan emphatically requested the IMF to show some flexibility and sign the staff-level agreement.

Separately, Dar announced that the SBP would also receive on Friday the third and last disbursement from the Industrial and Commercial Bank of China (ICBC) worth $300 million, out of its $1.3 billion loan.

“Out of Chinese bank’s ICBC approved facility of $1.3 billion, State Bank of Pakistan would receive back [the] third and last disbursement today in its account amounting to $300 million,” he tweeted.

Unlike the bilateral deposits with the central bank, the commercial loans have to be repaid before they are rescheduled by the Chinese banks.

On March 3, the ICBC had approved to refinance the $1.3 billion loan for Pakistan.

IMF Managing Director Kristalina Georgieva has hoped that Pakistan would avoid the path of Sri Lanka and stay on course.

“My hope is that with the goodwill of everyone, with the implementation of what has been already agreed by the Pakistani authorities, we can complete our current programme successfully,” the IMF managing director said at a news briefing in Washington on Thursday.

“We have been working very hard with the authorities in Pakistan within the context of our current programme to make sure that [the country] has the policy framework that makes it possible to avoid what you are talking about,” she added.

The IMF managing director continued that Pakistan’s debt continued to be sustainable -- a status that would require the country to stay on course and ensure fiscal discipline.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ