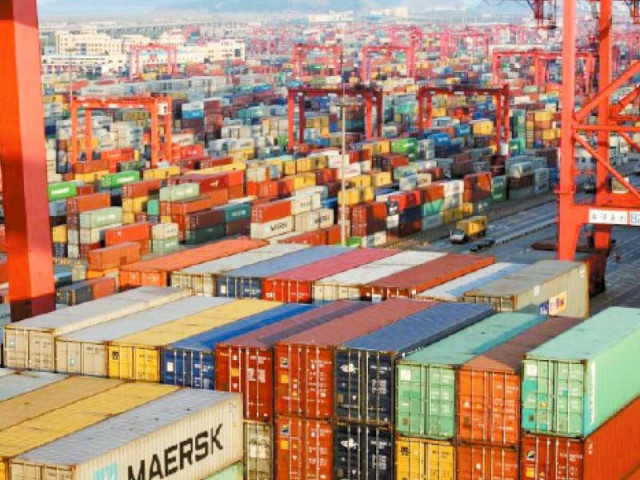

Exports fall as policymaking becomes rudderless

Businessmen say economic managers lack direction with no consultation with them

Businessmen are complaining that exports are dwindling and national economic policymaking is rudderless at a time when the country needs to take drastic steps to spur economic growth and ease the sufferings of businessmen as well as ordinary people.

Federation of Pakistan Chambers of Commerce and Industry (FPCCI) Acting President Suleman Chawla remarked that the team of economic managers lacks direction and the consultative process between the business community and government is non-existent.

“There is an unprecedented long wait before the International Monetary Fund (IMF) deal is revived,” he added.

Reiterating the FPCCI’s stance, Chawla highlighted that compared to the most major economies of the world with a share of more than 70% in regional trade, Pakistan’s trade with regional countries has never taken off and it now seems to be in reverse.

“Despite a dire need, the government has not been able to effectively compress imports and is playing hide and seek with the IMF,” commented Riazuddin, President SITE Association of Industries (SAI), while speaking to The Express Tribune.

“Whereas 75% of our imports are inelastic and cannot be substituted, last year’s import numbers give a picture of how limited our ability to curb imports is without denting the economy,” he said.

According to data, import of mineral fuels including oil was worth $17.1 billion, which was 28.4% of total imports.

Apart from that, import of machinery including computers was worth $6.3 billion, ie 10.4%, and electrical machinery and equipment was valued at $4.3 billion, or 7.2%.

Other imports included iron and steel worth $3.7 billion, or 6.1%, organic chemicals $2.8 billion (4.6%), vehicles $2.6 billion (4.3%), plastics and plastic articles $2.5 billion (4.1%) and animal and vegetable fats, oils and waxes $2.1 billion (3.5%).

“Our exports are also inelastic,” he said. “Even a devaluation of Rs100 in a short span did not result in any growth in exports.”

The SAI president lamented “we do not have a quality exportable surplus” and underlined that with no value addition, high cost of capital, prohibitive cost of doing business, low productivity and efficiency, growth in exports is next to impossible.

“This has been exacerbated by curbs on imported raw material including cotton, which has become scarce after the floods of 2022.”

Chawla said that exports and remittances, which provide foreign exchange for the country, are falling and added that exports to nine regional trade partners have declined by 18.3% in the first eight months of current fiscal year.

“Overall textile exports have declined by 11% with contraction of 30% in February 2023 on a month-on-month basis.”

Chawla stressed that the FPCCI is deeply concerned about the continued decline in exports that is snowballing into a complete nosedive, as exports declined by 3.25% in October 2023, 17.6% in November, 16.3% in December and 15.4% in January 2023.

“This is a systemic decline and needs to be arrested through a broad but effective consultative process,” he said.

The acting FPCCI chief noted that remittances hit a 32-month low in January 2023 with inflows of a mere $1.89 billion.

He added that the country’s foreign exchange reserves would have been near $15 billion currently had the government managed just one aspect of the external inflows namely worker remittances well.

If they had not declined by 20% on a year-on-year basis, it would have been the decisive factor in ensuring the successful conclusion of the IMF’s ninth review.

Chawla maintained that Pakistan’s total reserves are just above $10 billion after accounting for the reserves with commercial banks and the SBP has only $4.6 billion. “SBP’s reserves are what counts,” he added.

Recession in the West and surging energy costs are making exports unviable, remarked Arif Habib Commodities CEO Ahsan Mehanti, adding that the recent floods impacted crop yields and value-added output for exports.

Imports are falling because of a slump in the rupee but falling exports due to the surging input costs are not yielding the net trade surplus, he said.

“The government should facilitate the opening of LCs that allow the import of raw material for value-added exports and control inflationary trend to raise exports.”

The FPCCI president demanded that the government bring transparency and clarity vis-à-vis management of the external account and questioned the reasons hampering the IMF staff-level agreement.

The government should also outline subsequent steps for stabilisation of the economy if the IMF deal is finally struck, he said.

Published in The Express Tribune, March 26th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ