China has granted Pakistan a rollover of $2 billion in State Administration of Foreign Exchange (SAFE) deposits for a period of one year -- helping the country in meeting one of the requirements set by the International Monetary Fund (IMF) for it to meet its external financing needs and move towards a staff-level agreement.

The rollover is not a loan but a financial deposit to be kept at Pakistan’s central bank.

Finance ministry officials hoped that Pakistan would soon receive financing from Saudi Arabia and the United Arab Emirates as well amid the looming threat of the country defaulting on its external repayments.

They added that a sum of $300 million was expected to be received from China this month, pushing the country’s foreign reserves past the amount of $5 billion.

One of the requirements under the IMF's Memorandum of Economic and Financial Policies (MEFP) is related to the Net International Reserves (NIR), which can only be fulfilled after receiving assurances from friendly countries to fund a balance of payment gap.

Read more: New fuel pricing scheme needs to be agreed before IMF deal

Pakistan has assured the IMF that it would raise its foreign exchange reserves to $10 billion by the end of June.

The IMF wants the country to receive assurances for up to $7 billion to fund this fiscal year’s balance of payments gap.

Pakistan is awaiting a tranche of $1.1 billion from the IMF that has been delayed since November over matters related to fiscal policy adjustments.

The tranche is part of a $6.5 billion bailout package the IMF approved in 2019.

Analysts believe that the bailout package is critical for Pakistan to avert defaulting on external payment obligations.

Both Pakistan and the IMF were still in the process of finalising the details about the source of financing of $6 billion when Islamabad gave a shock to the global lender by announcing a Rs50 per litre petrol subsidy.

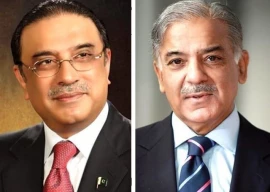

Finance Minister Ishaq Dar wanted that the IMF should consider Pakistan’s request for a loan in its March 24 meeting.

However, both sides have been unable to reach a staff-level agreement since February 9.

Prime Minister Shehbaz Sharif’s decision to give a petrol subsidy created another credibility challenge in the eyes of the IMF.

The government will have to move decisively on the IMF front, as it needs to make $4.1 billion debt repayments in the last quarter of this fiscal year.

1725967717-0/Untitled-design-(3)1725967717-0-165x106.webp)

1730564373-0/Express-Tribune-Web-(19)1730564373-0-270x192.webp)

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ