Pakistan has officially upgraded to a middle-income country on the global map. However, the nation’s piling debt for non-development purposes has compromised its infrastructure and human development, inviting devastating floods in 2022 and decelerating economic growth.

In an effort to improve the situation, Pakistan has begun mobilising infrastructure investment from local banks as foreign investment remains choked, waiting for the revival of the International Monetary Fund (IMF) loan program worth $6.5 billion.

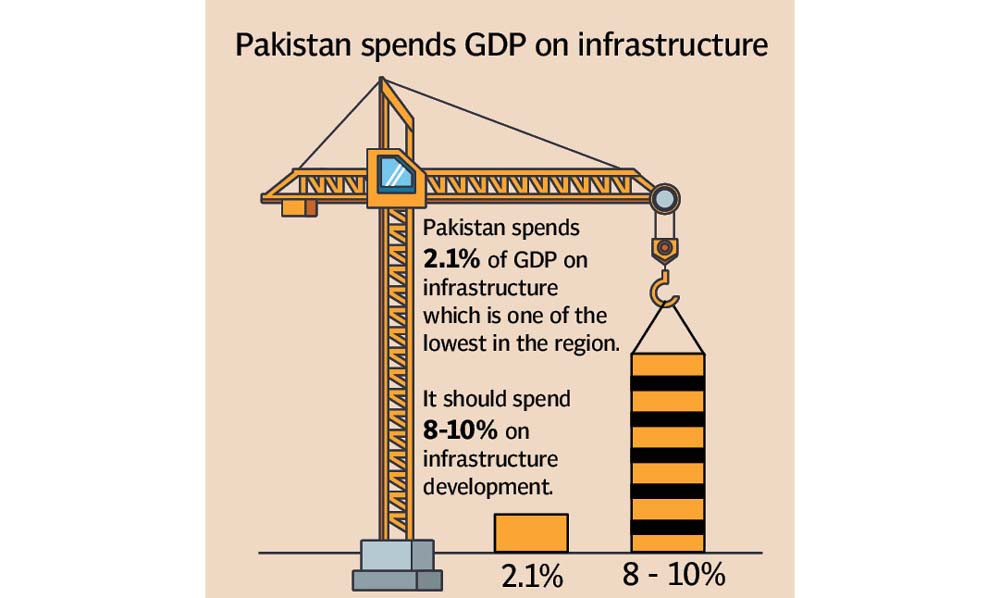

At the “Infrastructure Summit 2023 – Building for Impact,” organised by the Nutshell Group and InfraZamin, State Bank of Pakistan (SBP) Governor Jameel Ahmad spoke about the importance of infrastructure spending, stating that Pakistan’s current spending of 2.1% of Gross Domestic Product (GDP) is amongst the lowest in the region and well below the national GPD level requirement of 8% to 10%.

According to Ahmad, “Infrastructure development is considered an essential requirement for the economic growth of any country owing to its linkages with different sectors of the economy. Investment in infrastructure like energy, telecommunications, safe drinking water and sanitation, transportation network, health, and education helps increase competitiveness, improve productivity, facilitate economic development, and enhance social wellbeing of the society.”

Speaking at the summit, InfraZamin CEO Maheen Rehman highlighted the devastation caused by the 2022 summer floods in Pakistan. She stated that “this was a preventable situation if we had just invested in our agriculture irrigation infrastructure better.”

Rehman also discussed the challenges faced by Pakistan’s debt issues, which have become increasingly urgent in the absence of the resumption of the IMF loan program. “Pakistan is at a crossroads,” she said, adding that the world has grown weary of aiding the country over the decades.

To address the financing challenges, Rehman emphasised the importance of mobilising local financing for infrastructure projects, citing India and Bangladesh as examples of countries that have successfully done so and emerged on the world economic map. “We need to be able to use our local banks and local capital markets, develop our bond markets more significantly so that this financing can happen in the Pakistani currency as opposed to a foreign currency,” she said.

InfraZamin and its parent company, Private Infrastructure Development Group (PIDG), which is an initiative among six European countries including the UK, provide financial guarantees for local banks and have recently kicked off supporting infrastructure projects. Despite the challenges faced by Pakistan,

PIDG has recently begun offering its services in Pakistan with a focus on utilising local markets and currency financing, according to Rehman. “We are taking a look at how infrastructure spending can be better managed using local markets… so using local currency financing… Pakistani rupee-based financing,” she explained.

The British High Commission Islamabad Development Director, Jo Moir, expressed concern about Pakistan’s current economic situation, stating that “inflation has surged to 30% year-on-year, the Pakistani rupee has weakened to historic levels, the interest rate has risen to 20%, and credit extended by the banking sector to the government has surged.” Moir highlighted that the British High Commission and PIDG have identified three priority areas for international support, including “fostering climate innovation and early-stage risk capital, working to create innovative financial instruments within the capital markets and unlocking international climate finance.”

In response to concerns raised by Rehman about reduced foreign aid flows to Pakistan, Moir argued that aid reductions could be viewed as a positive development given the country’s progress in becoming a middle-income nation. “Pakistan is not the same country that it was 20 years ago. There has been enormous progress against many of the sustainable development goals and that has been the growth here in terms of markets. So, there are good reasons that aid has reduced,” she explained. Finally, development director pointed to the urgent need for investment in Pakistan’s infrastructure, particularly in light of the country’s vulnerability to climate risks. The 2022 floods, which caused an estimated Rs3.2 trillion to Rs3.5 trillion in damages, are a stark reminder of this need. “The World Bank has estimated needs at $348 billion in Pakistan between 2023 and 2030,” she said.

Published in The Express Tribune, March 15th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ