The inflow of workers’ remittances sent home by overseas Pakistanis improved by 5% to almost $2 billion in February. This, however, was comparatively low, as a portion of non-residents continued to dispatch the funds through informal channels due to the availability of a better rupee-dollar exchange rate.

Overseas Pakistanis send the funds in foreign currency notes through official channels, like banks and exchange companies, or illegal hawala-hundi operators. The funds are paid in equivalent rupee amounts to the recipients in the country. Therefore, an attractive exchange rate remains a tool available with both markets – formal and informal – to attract remittances.

The State Bank of Pakistan (SBP) reported, on Friday, that remittances have bounced back to $1.99 billion in February after hitting a 32-month low at $1.89 billion last month.

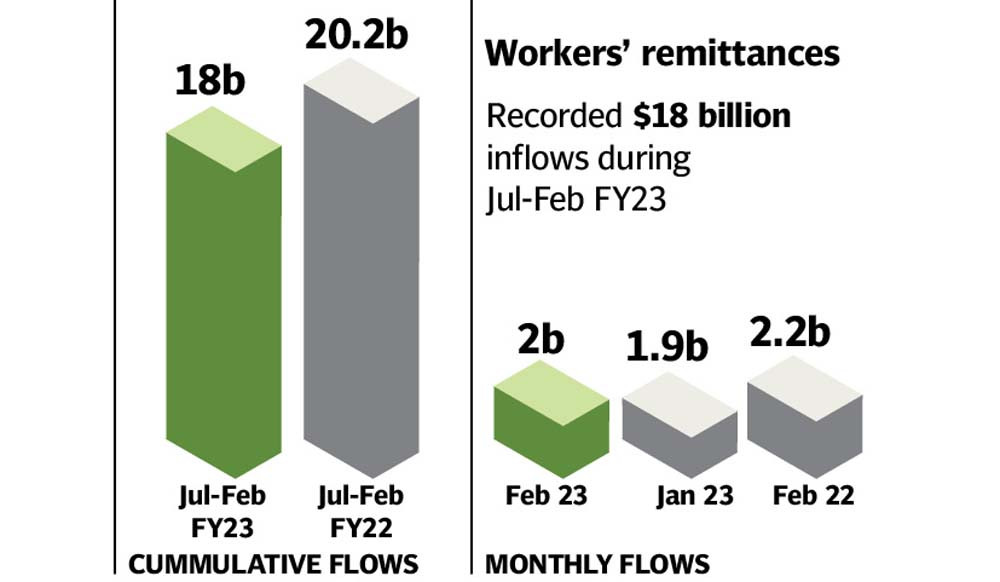

Remittances, however, dropped by 9.5% to $1.99 billion in February compared to $2.19 billion in the same month of the last year.

Cumulatively, in the first eight-months (Jul-Feb) of the current fiscal year, inflows declined 11% to $18 billion compared to the same period of the last year, according to data from the central bank.

To recall, remittances hit a record high of $3.12 billion in a single month in April 2022 and maintained mostly around $2.50 billion a month, on average, in the past two and half years.

Speaking to The Express Tribune, KASB Securities Head of Research Yousuf Rahman said, “The black currency market is still offering Rs20 more on the rupee-dollar exchange rate at Rs300/$ compared to $280/$ in the interbank market. This has convinced a portion of non-resident Pakistanis to continue dispatching the funds through illegal hawala-hundi operators.”

Earlier, the gap between the two markets had widened to Rs30-40, with the informal channels offering a higher price all of December 2022 and January 2023. The price, however, came down after the IMF showed concern on the widening gap in late January and then again, this month.

The currency saw the top two historical devaluations of Rs25 against the US dollar in late January and then Rs19 in March in the interbank market.

In net, the currency has cumulatively lost almost 18% or around Rs50 since late January to Rs281/$ on Friday. It hit a record low at Rs285.09/$ on March 2, 2023.

The partial reduction in the gap to Rs20 in the exchange rate convinced some of the overseas Pakistanis to return to the formal channels. “This has helped to improve flows through the official channels in February,” said Rahman.

“The remittances should further improve to about $2.3 billion to $2.4 billion in March after a notable improvement in the exchange-rate in the interbank market these days…and ahead of the holy month of Ramzan when people need more funds to cope with a seasonal spike in commodity prices in the country,” he said.

Remittances usually peak in Ramzan, Eidul Fitr and Eidul Azha every year. This year, Ramzan and Eidul Fitr are scheduled to fall in March and April, respectively. Eidul Azha will fall in July.

Topline Securities CEO Mohammad Sohail said, “Remittances were up 5% month-on-month to $2 billion despite fewer working days in February.”

According to Alpha Beta Core Head of Research Khurram Schehzad, remittances recovered due to the improvement in the rates being offered by official channels. “Pakistan would have not lost this precious foreign exchange earlier if rates were more market-driven,” lamented Schehzad.

Financial experts believe the changing scenario in the global economy has little to do with the fluctuation in the receipt of workers’ remittances through official channels. A majority of overseas Pakistanis (around 70%) live in Saudi Arabia and the United Arab Emirates. The two Gulf economies have remained in a good position due to the availability of higher prices to their petroleum oil and gas in world markets.

Country-wise remittances

Pakistanis residing in Saudi Arabia sent $455 million in February – 12% higher compared to $408 million in January 2023.

From the UAE, the non-residents sent 20% more remittances at $324 million in the month compared to $269 million last month. The funds slowed down by 4% to $317 million from the United Kingdom compared to $330 million last month, but improved by 2% to $245 million from EU countries compared to $240 million in the previous month.

Remittances increased by 3% to $219 million from the United States compared to $214 million in January 2023, but dropped by 1% to $427 million from other countries in February 2023 compared to $433 million in January 2023.

Published in The Express Tribune, March 11th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ