Gas supply doubles from Sindh field

Mari Petroleum says Sachal project will save $600m via LNG substitution

At a time when Pakistan’s economy is melting primarily due to energy and import crisis, an oil and gas exploration firm has doubled gas supply from a field located in Sindh and aided some reduction in the fuel import bill.

The company, however, reported recently that its exploration activities were proceeding slowly amid the re-emergence of security threat to its staff in Khyber-Pakhtunkhwa and Balochistan. Mari Petroleum Company Limited (MPCL) reported to the Pakistan Stock Exchange (PSX) on Thursday that it had completed construction activities and the phased commissioning and performance testing of gas processing facilities at the Sachal Gas Processing Complex (SGPC) phase-II located in Deharki, Sindh.

“Presently, around 95 million standard cubic feet per day (mmscfd) of pipeline specification gas is being supplied to SNGPL (Sui Northern Gas Pipelines Limited) via MPCL’s own 20-inch, 25-kilometre-long, cross-country gas transmission pipeline connecting SGPC to the SNGPL valve assembly (QV-2) at Muhammadpur,” MPCL Acting Company Secretary Muhammad Sajjad said in a notification to the PSX. About six weeks ago in January 2023, the company announced that it had begun supplying 47.5 mmscfd from the phase-II project.

In its financial statement for three months ended September 30, 2022, the exploration firm said that SGPC phase-I was commissioned in the previous year. “Phase-II will process 200 mmscfd of Goru-B gas.”

“SGPC project, upon reaching peak production, will save the national exchequer over $600 million annually through LNG substitution,” the company said in its financial statement for six months ended December 31, 2022.

MPCL’s share price increased 1.22%, or Rs17.59, and closed at Rs1,493.85 with trading in 61,136 shares at the PSX on Thursday. Post-integration SGPC phase-I and II and after commissioning of the remaining wells, the plant would reach its full potential, the notification added.

Mari Petroleum supplied 130,938 million standard cubic feet in six months (Jul-Dec 2022) – or 712 mmscfd – from its fields, which was 2% lower compared to the same period of last year. Besides, it supplied 10,542 barrels of crude oil in six months, which was 5% higher compared to the same period of last year

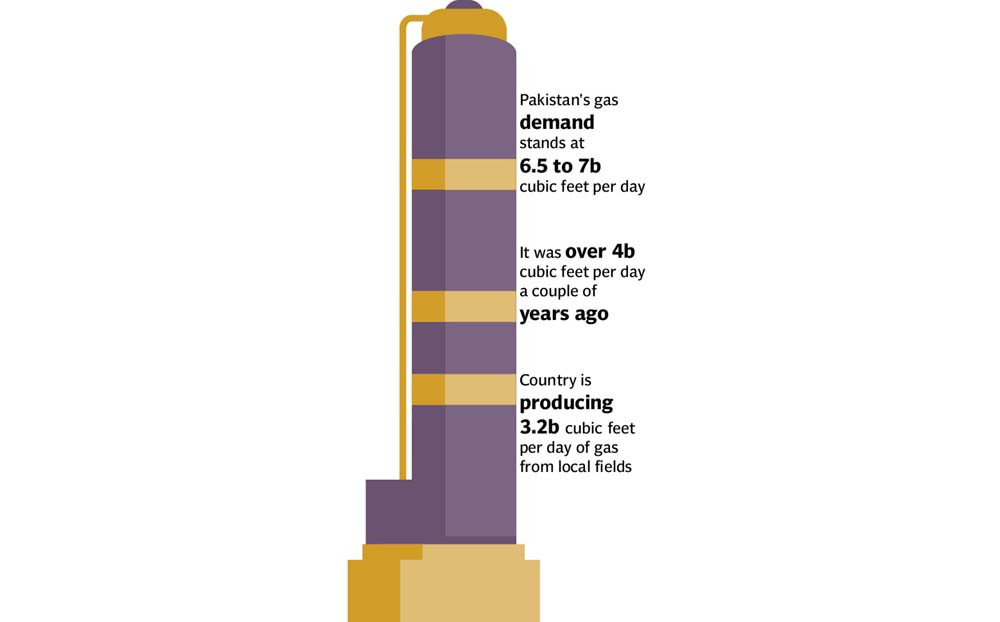

In the week ended on February 21, 2023, the overall gas production improved by 1.5% to 3,212 mmcfd after the resumption of production from Uch, according to a research house which cited Pakistan Petroleum Information Service’s (PPIS) data. Gas production had stood above 4,000 mmcfd a couple of years ago. Output has been on the wane due to an estimated 15% per year depletion in the country’s gas reserves amid no new major discovery for over two decades.

On the other hand, Pakistan’s gas needs have surged to 6.5-7 billion cubic feet per day.

Exploration firms say security threat to their staff in fields has remained a big challenge to the efforts being made for the discovery of new oil and gas reserves.

Design by Ibrahim Yahya

MPCL is operating under a high-threat environment. Security situation has deteriorated in K-P and Balochistan. So far, the company has been able to continue its operations without any major incidents mainly with the support of law enforcement agencies (LEAs), according to the December 2022 report.

“The security situation…caused delays in planned exploration activities, however, the company proactively adjusted its plans and accelerated drilling…in the Mari field area.”

With no major discovery and rise in demand, Pakistan has established two liquefied natural gas (LNG) import terminals at Port Qasim having combined capacity of over 1,300 million cubic feet per day.

However, the terminals have been partially utilised over the past couple of years due to a spike in gas prices in international markets in the wake of Russia-Ukraine conflict and the reopening of world economy after the Covid-19 induced lockdown.

The gap between demand and supply of gas is widening. Resultantly, businesses and households are facing regular outages.

Pakistan imported energy (oil and gas) worth $10.6 billion in the first seven months (Jul-Jan) of current fiscal year, which constituted almost one-third of the overall import bill of $36 billion.

Published in The Express Tribune, March 10th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ