Trade gap shrinks to $21.3 billion in Jul-Feb

PBS says gap between imports-exports was recorded at $21.3b, down by $10.6b

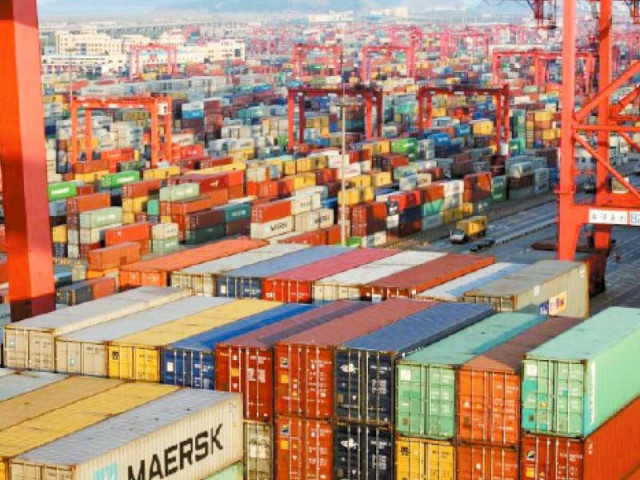

Pakistan has managed to cut its trade deficit by one-third to $21.3 billion during the first eight months of this fiscal year by slowing imports drastically, in a move that has delayed the looming default since foreign inflows remained at barely $6 billion.

The two separate bulletins of external trade and foreign inflows suggest that Pakistan’s economic woes will not end soon – neither have exports picked up nor has the been able to acquire foreign loans.

The Pakistan of Bureau of Statistics (PBS), on Wednesday, reported that, “From July through February of the current fiscal year, the gap between imports and exports was recorded at $21.3 billion, down by $10.6 billion, or 33.2%, compared to the same period last year.”

The worrisome aspect was a dip in exports, as the drop in imports is only a temporary phenomenon caused by administrative restrictions.

According to the PBS, exports stood at $18.8 billion, down by $1.8 billion, or 8.7%, during the July-February period. The annual export target of nearly $38 billion has become irrelevant due to the poor performance – also admitted by the government before the IMF last month.

Pakistan has lost more in exports than the $1.1 billion, which it is eyeing to receive from the IMF upon completion of the 9th programme review.

Imports amounted to $40 billion during the first eight months, down by $12.4 billion, or one-fourth, the PBS report stated.

The reduction, however, came in wake of administrative controls, which forced banks not to clear letters of credit (LC) and created other administrative hurdles. The IMF has already asked Pakistan to withdraw its instructions issued to the banks for priority allocation of the sacred foreign currency.

The government told the IMF that as against the annual estimates of $65.5 billion, imports may remain around $55.5 billion to $57.5 billion. The new figure is about $8 billion less than previous estimates – this will offset the impact of a reduction of $13.5 billion in the non-debt creating inflows.

Loan disbursements

The statistics compiled by the Ministry of Economic Affairs showed that during the first seven months (July-January) foreign creditors gave only $6 billion in loans. The disbursements were equal to a mere 27% of the annual estimate of $22.6 billion.

The lower-than-budgeted inflows have taken a heavy toll on the country’s foreign exchange reserves, currently standing at in a dangerous territory at less than $4 billion. China is expected to inject three more loan tranches totalling $1.3 billion this month to stabilise the reserves.

The ministry’s bulletin showed that multilateral creditors gave just $3.4 billion in loans in the last seven months –equalling only 45% of the annual target. The Asian Development Bank (ADB) released $1.9 billion, the World Bank gave $750 million and the Asian Infrastructure Investment Bank (AIIB) disbursed $536 million.

Bilateral creditors disbursed $792 million – mainly Saudi Arabia that released $690 million against the oil on deferred payments facility. Commercial loan disbursements remained at a mere $200 million while the IMF’s disbursements stood at $1.2 billion.

These foreign inflows cannot get a big boost until the IMF revives its derailed $6.5 billion programme.

The PBS stated that on a year-on-year basis, exports showed contraction of 19% in February and stood at $2.3 billion against $2.8 billion in the same month of the previous year – a dip of $529 million.

Imports dropped by $1.84 billion, or nearly 32%, in February, compared to the same month a year ago. The yearly trade deficit narrowed by 44% to $1.7 billion in February, showing a reduction of $1.3 billion.

On a monthly basis, exports increased by a marginal 2.7% while imports plunged 18%. As a result, the monthly trade deficit shrank 35%.

Published in The Express Tribune, March 2nd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ