A Senate panel on Thursday endorsed the Rs170 billion mini-budget with a razor-thin 3-2 majority but recommended the government reduce the proposed federal excise duty rates on juices by half aimed at addressing the concerns of the industry.

The Senate Standing Committee on Finance also opposed a move to give authority to the Federal Board of Revenue (FBR) to increase the tax burden through notifications without first seeking approval from the Parliament.

Pakistan Peoples Party (PPP) Senator Saleem Mandviwalla chaired the meeting and admitted that the supplementary finance bill “will only burden the taxpayers,” proposing the government take measures to bring non-taxpayers under the ambit of the FBR.

Only three committee members attended the meeting in addition to the chairman. The committee approved the bill with a 3-2 majority, as the Pakistan Tehreek-i-Insaaf (PTI) Senator Mohsin Aziz opposed the mini-budget with some modifications.

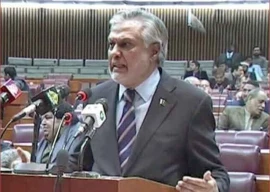

Finance Minister Ishaq Dar had tabled the Finance Bill in the National Assembly (NA) a day earlier with an aim to get the NA’s approval to the budget being introduced as part of the understanding with the International Monetary Fund (IMF).

Senator Aziz questioned the government’s claim that the fiscal impact of these measures was only Rs170 billion, saying that the actual annual impact was more than Rs510 billion.

The Finance (Supplementary) Bill 2023 laid in the house on February 15, 2023, brings about an increase in the general sales tax (GST) from 17% to 18% apart from increasing the federal excise duty on sugary items, tobacco, airline tickets, marriage halls, and cement.

The government has already enforced the increase in GST through an administrative approval from the federal cabinet. Now, however, it has proposed giving similar powers to the FBR.

PML-N Senator Saadia Abbasi rejected the proposal authorising the FBR to increase the sales tax rates being covered under the third schedule of the Sales Tax Act.

FBR Chairman Asim Ahmad stated that FBR had not been empowered earlier to increase the sales tax rate on these items, which is why the government proposed the amendment to empower the FBR to increase tax on items bearing a retail price.

The delegation of such powers, however, would be tantamount to cutting the hands of the legislators and leaving the destiny of the nation in the hands of bureaucrats who, even during an economic crisis, are hell-bent on buying luxury vehicles.

Senator Mandviwalla said that “The Aviation Ministry has expressed reservations about levying a 20% tax on business class and first class tickets or Rs50,000, whichever is higher.”

The aviation ministry commented that the proposed tax was not workable because the fare of tickets was not static and varied from time to time. Senator Mandviwalla then suggested that instead of imposing a 20% tax, a definite amount should be fixed for each destination.

Senator Aziz suggested that instead of increasing taxes on luxury items being imported, they should just be banned. “An increase in taxes will only encourage smuggling of these items,” he said.

Minister of State for Finance, Dr Aisha Ghaus Pasha explained that the government did want to ban the import of luxury items but could not do so because of the restrictions imposed by the World Trade Organisation (WTO).

“As far as the smuggling of these luxury items is concerned, the FBR, in collaboration with Frontier Corps and other agencies, is trying to curb smuggling along the western border,” said Pasha.

The FBR, however, does not have the mandate to man the international borders.

Furthermore, representatives from Murree Brewery and Shezan Enterprises protested that the government has imposed Federal Excise duty (FED) on sugary fruit juices and squashes at the rate of 10% and called the sudden increase unjustifiable.

The FBR chairman commented that “sugary drinks are injurious to health and owing to the World Health Organisation (WHO) recommendations in this regard, the government has increased the FED on carbonated water from 13% to 20%.”

The committee recommended that the FED on fruit juices be decreased from 10% to 5%.

While discussing the proposed tax on functions and gatherings, the FBR chairman said that individuals have to pay a 10% tax in advance to avail the services of banquet halls.

Senator Mandviwalla expounded that a majority of banquet halls across the country are not even registered with the FBR and that the tax machinery should make efforts to have the marriage halls registered and plug the glaring loophole leading to tax evasion.

Published in The Express Tribune, February 17th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (4)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ