Few winners as market climbs 1.6%

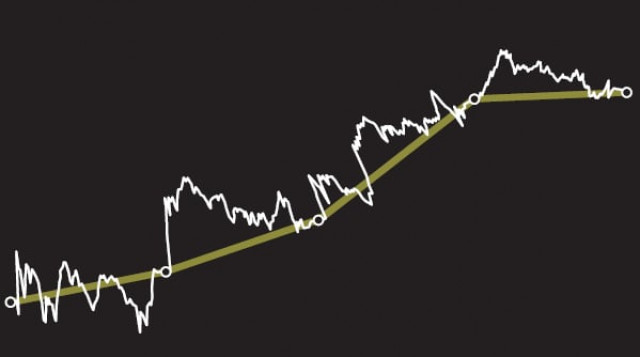

The market continued its upward climb as the benchmark KSE-100 index rose 1.6 per cent.

Although the market has climbed five per cent since the start of the month, there have been few winners as volumes have remained low in light of budget uncertainties and implementation of the Capital Gains Tax.

The CGT continues to be the dominant issue on investors’ minds and sentiments remained weak, despite some positive movement regarding introduction of the margin financing product.

The market’s gains during the week were largely restricted to stocks of blue-chip oil companies, foremost among them being the Oil and Gas Development Company (OGDC) which has a weight of more than 24 per cent on the KSE-100 index.

Any upward movement in OGDC’s stock is strong enough to push the market into the green zone and such was the case this week, when the company’s scrip climbed by 5.4 per cent. OGDC’s gain was the primary driver of the market’s growth this week and clouded the fact that most of the listed stocks on the KSE-100 index had performed poorly.

The highlight of the week was the return of foreign investors who purchased $21.6m worth of stocks, up from $4.9m in the previous week, representing an increase of 340 per cent. Foreign buying was restricted to heavyweight names like the OGDC and Engro Corporation, which also rose two per cent during the week.

On the whole, the few companies that witnessed foreign interest were the winners of the week, while the remaining scrips fared poorly and the market would have certainly been in the red had it not been for foreign buying.

The market opened the week on a positive note, and rose by 0.06 per cent on Monday. The momentum was maintained on Tuesday as the Karachi Stock Exchange management announced that a body had been constituted for finalising the details of the margin financing product and the recommendation would be submitted within 15 days.

The market managed to close all five sessions of the week in the green to slowly climb by 1.57 per cent overall, closing at 9,796 points on Friday. However, average trading volumes, which have been subdued since the start of the month, fell by a further 28 per cent and stood at a lowly 78 million shares, reflecting weak sentiments of local investors who still await clarification regarding CGT modalities.

Barring the buying witnessed in the blue-chip companies, most of the activity was restricted to second and third-tier stocks like Lotte Pakistan, Worldcall Telecom and Jehangir Siddiqui & Company. As a result, average traded value fell sharply by 31 per cent to Rs2.59 billion per day during the week.

Total market capitalisation of the KSE increased by 1.3 per cent to Rs2.75 trillion by the end of the week. As already mentioned, foreigners were net buyers of more than $21 million by the end of the week, but their buying was largely offset by the heavy selling by companies and local investors.

As we head towards the start of fiscal year 2010-11 from July 1, the finance bill has been ratified and further clarifications regarding the CGT will be issued, which could have both a positive or negative impact depending on what the final decision is.

Analysts at KASB Securities believe that the market’s movement next week will be hard to predict, but one thing for certain is that volumes will remain low as investors await clarity. They also pointed out that CGT implementation might also be delayed due to lack of operational readiness on part of the KSE and the revenue collection board.

Published in The Express Tribune, June 27th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ