Analysis: Pakistan moves toward deal-or-default endgame

Country in need of massive support as economy spirals out of control

Pakistan's full-blown economic turmoil, from its biggest-ever currency devaluation to a rash of emergency spending cuts, offers the clearest sign yet that the nuclear-armed nation faces the risk of a default unless it receives massive support.

Pushed to the brink by last year's devastating floods, the country has reserves of just $3.7 billion remaining, or barely enough for three weeks of essential imports, while hotly contested elections are due by November.

It desperately needs the International Monetary Fund to release an overdue tranche of $1.1 billion, leaving $1.4 billion remaining in a stalled bailout programme set to end in June.

Although an emergency IMF mission has arrived in Pakistan, there are no guarantees amid a growing number of headaches after November's suspension of disbursements from the current package, which was topped up to $7 billion after the floods.

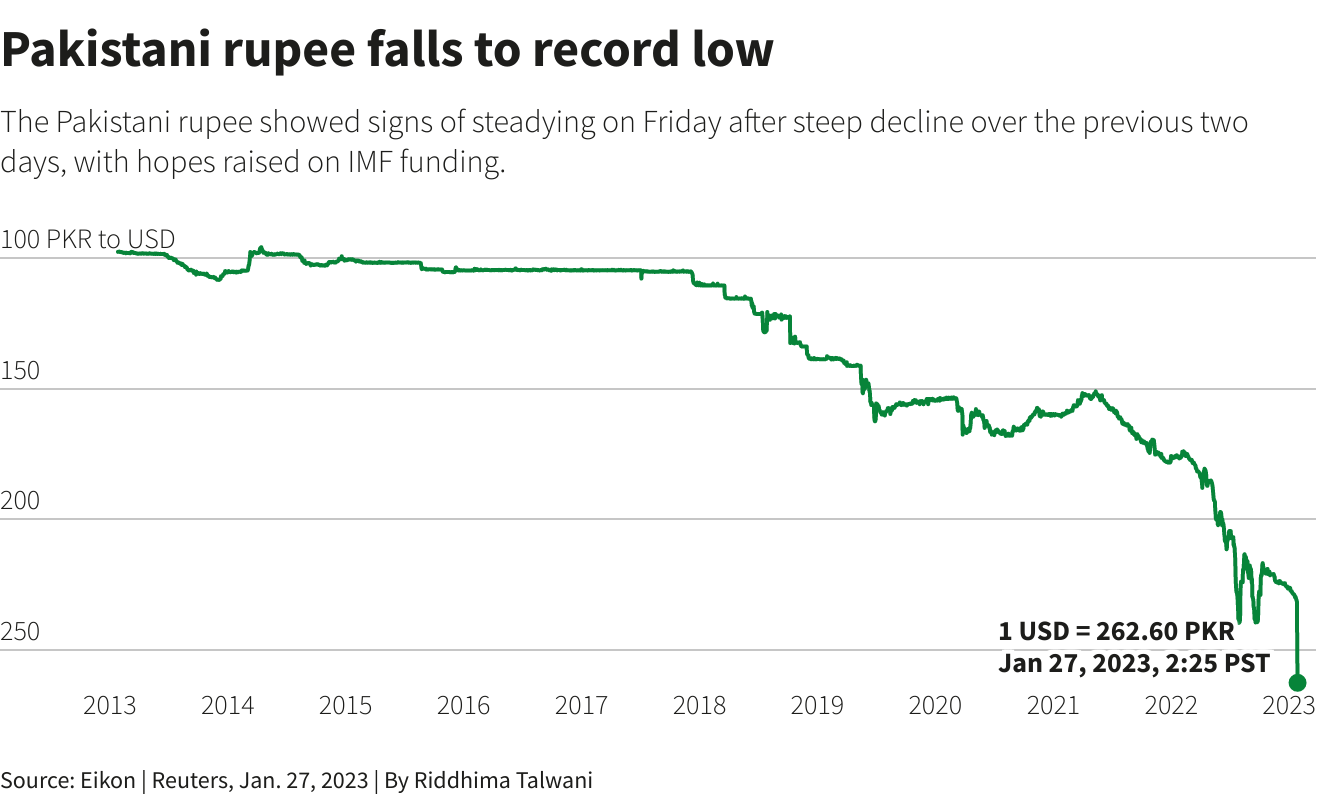

A devaluation of 15% in the rupee and a rise last week in fuel prices could help eliminate some key snags, particularly as tax measures are apparently imminent.

Yet pressure is building as the bailout programme cannot be extended beyond June and the elections loom.

"If they don't get those (IMF) funds, default risk increases materially," said Kathryn Exum, the co-head of sovereign research at distressed debt specialist fund Gramercy, which expects more of a debt "reprofiling" rather than a mass write-off.

Former finance minister, Miftah Ismail, who successfully negotiated an extension to last year's programme before being sacked in the political tumult, also thinks the IMF is the only logical option.

"If the IMF doesn't come in, we're looking at a default," Ismail said, adding that another support package, the country's 24th, would then be needed. "I can't imagine Pakistan not going on a back-to-back IMF programme."

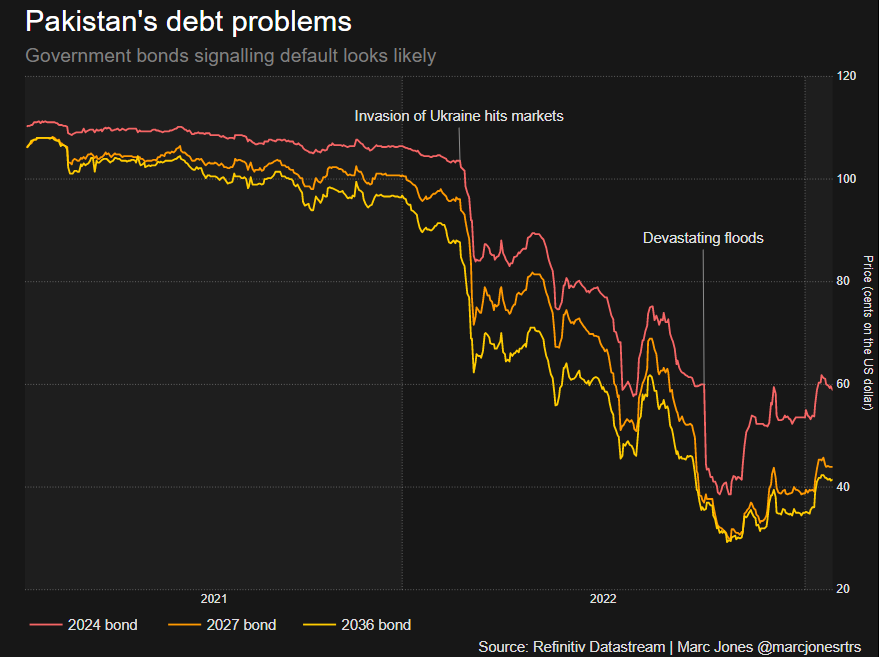

Pakistan's debt problems

Prime Minister Shehbaz Sharif’s main election challenger is former cricket star Imran Khan, who was removed from the job last April but retains popularity. Each blames the other for the crisis, although finances have long been strained.

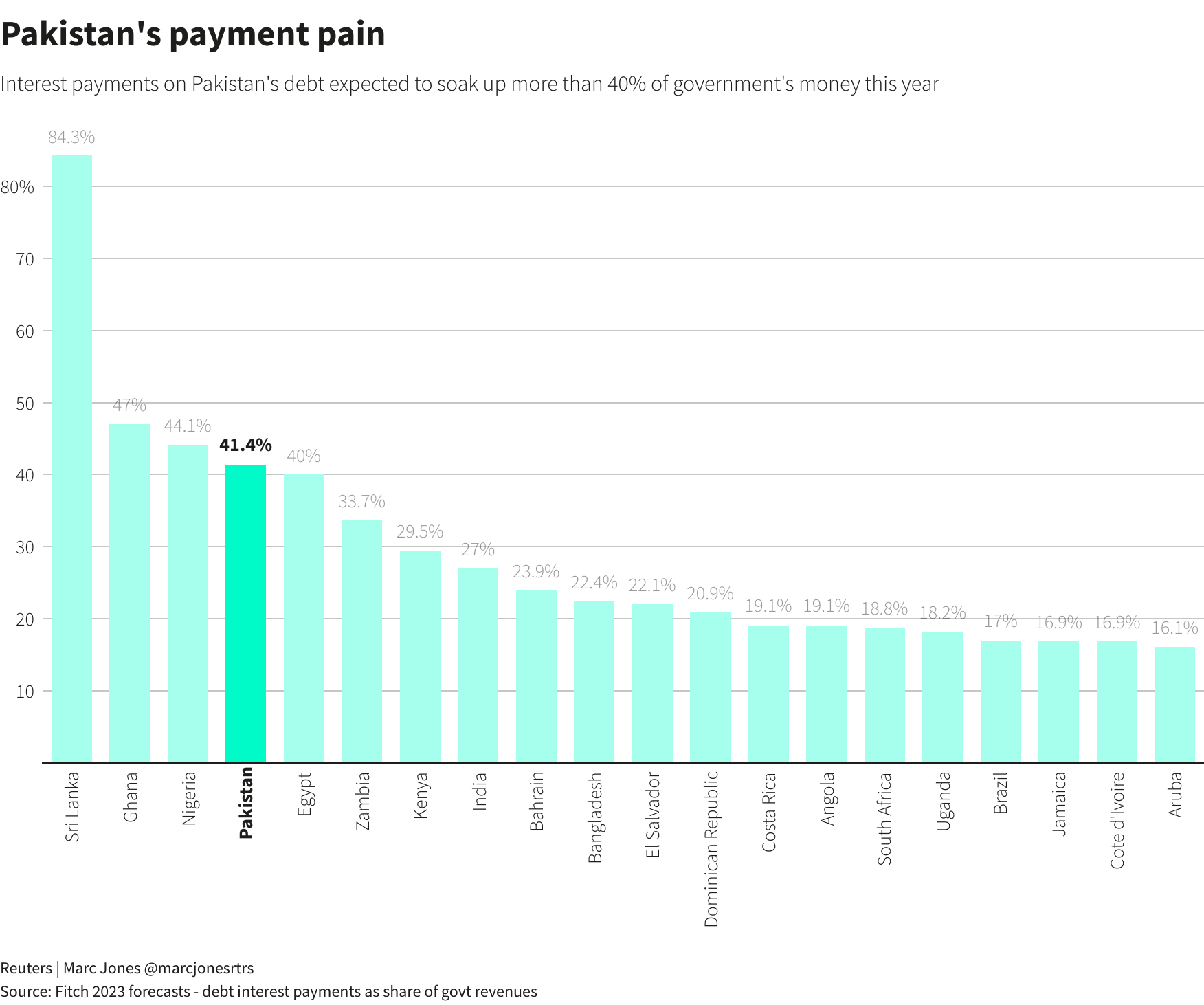

With Pakistan's debt-to-GDP ratio in a danger zone of 70%, and between 40% and 50% of government revenues earmarked for interest payments this year, only default-stricken Sri Lanka, Ghana, and Nigeria are worse off.

"There is just a long-term indebtedness problem," said Jeff Grills, the head of emerging markets debt at Aegon Asset Management, who held Pakistan bonds until the floods hit.

"It is more a question of when they need to restructure, rather than if."

Most of Pakistan's bonds are still trading at less than half their face value.

Reuters Graphics

Difficult Times

Such a restructuring of Pakistan's bonds would represent its first international default since 1999, according to the Bank of Canada-Bank of England Sovereign default Database.

With just $8.6 billion worth of such bonds, compared to the $30 billion Pakistan owes to China, Ismail said Islamabad might be better off "just going to those countries that we owe a lot, or to the institutions we owe a lot, and trying and get some more long-term loans."

Shehbaz is optimistic that the IMF will resume disbursements. "An agreement with the IMF, God willing, will be done," he said at an event last week in Islamabad, the capital. "We will soon be out of difficult times."

Multilateral and bilateral financing pledges for Pakistan's rebuilding efforts after the floods also depend on a green light from the IMF.

But even domestic analysts believe the government will find matters tough, as the IMF is likely to demand significant belt-tightening that is bound to be unpopular with voters already grappling with decades-high inflation and fewer job prospects.

IMF officials have been eager to support poorer countries and Pakistan promises to be a crucial partner for the West, but paying out gets trickier when a programme is close to its end and a new government could come in and try and tear up a deal.

If the disbursements do not arrive by June, there could be a six-month gap before the new government takes office during which Pakistan would be starved of funds, effectively pushing its population of 220 million to the brink.

The lack of reserves will make it to tough to stay afloat.

Just $500 million of interest or 'coupon' payments are due on Pakistan's international bonds this year, but the chief of the central bank chief has said $3 billion is needed to meet overall external debt payments.

The political timing is also critical. After the government's tenure ends in August, a special caretaker government will take charge for up to 90 days to ensure free and fair elections.

However, the caretaker government is not empowered to sign an IMF pact, raising the question of whether the government and opposition can cooperate on a joint pledge to push through any IMF demands in order to avert a default.

"If something happens with the disbursement and then the elections get in the way, they might have a problem," Gramercy's Exum added.

Reuters Graphics

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ