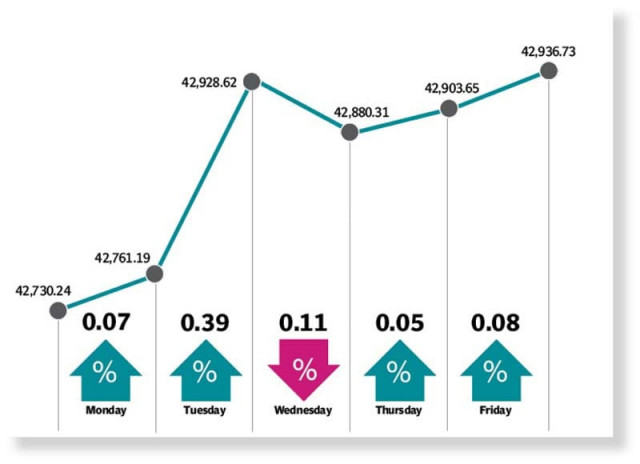

Stocks gain ground in range-bound trading

Benchmark KSE-100 index rises 206 points to settle at 42,937

Pakistan Stock Exchange experienced a range-bound trading week as the benchmark KSE-100 index swayed between positive and negative territories.

Investor sentiment largely remained subdued due to major encouraging and discouraging national developments. The index managed to close the week in the green.

The week began on a positive note with marginal gains in a lacklustre session as market participants mostly stood on sidelines ahead of the appointment of new Chief of the Army Staff (COAS).

Positive trend continued in the next session and activity accelerated as investor confidence grew over the MSCI semi-annual review, which lifted the KSE-100 index close to the 43,000-point mark.

After remaining range bound, the index failed to achieve positive momentum on Wednesday. The upcoming monetary policy announcement, scheduled for November 25 (Friday), played a major role in the flat close of market.

The bourse continued its range-bound activity as investors chose to remain sidelined observing developments regarding the appointment of COAS. Despite remaining under pressure and swaying between negative and positive territories, the index managed to notch up some gains.

On the last trading day of the week, the investors cherished clarity on the political front following the appointment of Lt General Asim Munir as the COAS but trading remained dull ahead of the monetary policy announcement.

The KSE-100 index closed the week up by 206 points, or 0.48%, at 42,937 compared to the previous week.

“After posting a sharp decline last week owing to political uncertainty and delay in talks with the IMF, the KSE-100 index registered a recovery during the outgoing week,” said JS Global analyst Muhammad Waqas Ghani in a report.

The week started with the encouraging current account deficit (CAD) number as despite lower remittances, CAD for October 2022 came in at $567 million, well below the monthly average of $1.2 billion in CY22 to date due to a lower trade deficit, it said.

The market, however, remained volatile as investors waited for clarity on the political front. “It was reflected in the drop in volumes, which declined 14% week-on-week.”

The KSE-100 index closed up by 0.5% week-on-week. Key performers were technology (4.2%) and auto (1.6%) sectors, while power sector (-3.8%) was the key underperformer.

On the news front, MSCI added four companies in the recent rebalancing of its Frontier Market Index, which kept those stocks in the limelight.

The five-year Credit Default Swap showed great volatility during the week on the back of political noise. Finance minister, on the other hand, reiterated that the country did not face any risk of default.

“The week ended with SBP’s announcement of increase in policy rate by 100 basis points to 16%,” the JS analyst said.

Arif Habib Limited, in its report, said that the market commenced trading on a positive note, however, uncertainty prevailed throughout the week due to political concerns.

In addition, Pakistani rupee depreciated against the greenback, dropping by Rs0.28, or 0.13%, week-on-week settling at Rs223.94.

CAD declined by 68% year-on-year, primarily due to a decline in imports, which went down by 23% year-on-year.

The market closed at 42,937, gaining 206 points (or 0.48%) week-on-week. In terms of sectors, positive contribution came from technology and communications (202 points), fertiliser (114 points), E&P (26 points), banks (26 points) and miscellaneous (17 points).

Negative contribution came from power (31 points), cement (20 points) and glass (14 points).

Stock-wise, positive contributors were Systems Limited (147 points), Engro Corporation (92 points), TRG Pakistan (53 points), Dawood Hercules (36 points) and Indus Motor (27 points).

Negative contribution came from Hub Power (120 points), Millat Tractors (28 points), Fatima Fertiliser (14 points), Lucky Cement (11 points) and GHGL (11 points).

Foreigners’ selling continued during the week, which came in at $1.11 million compared to net selling of $2.06 million last week.

Average volumes came in at 160 million shares, down by 14% week-on-week, while average value settled at $25 million, down by 10%.

Published in The Express Tribune, November 27th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ