Bulls toss bourse above 43,000 mark

Benchmark KSE-100 index gains 1,237 points to settle at 43,093

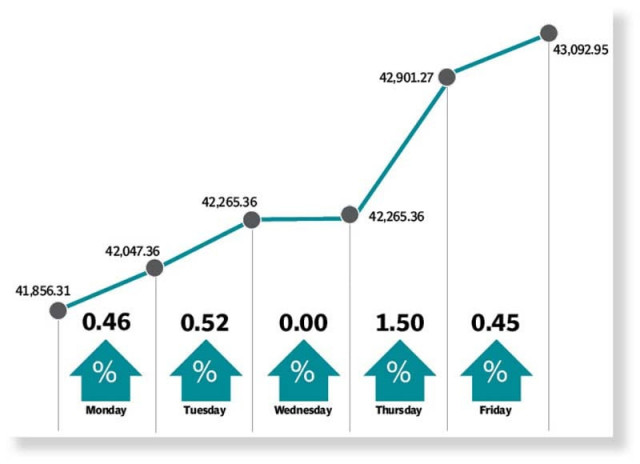

Pakistan Stock Exchange (PSX) made an impressive performance throughout the outgoing week as the benchmark KSE-100 index racked up gains of over 1,200 points, crossing the 43,000-point mark and hitting the highest level since August 2022.

The market closed all trading sessions in the positive territory. On Monday, the week started off on an enthusiastic note as investors anticipated a $7.75 billion financing from Saudi Arabia and China. As a result, bulls held their firm grip over the bourse. Stocks maintained the positive momentum on Tuesday as well following reports of likely visit of Saudi crown prince to Pakistan later in November, which gave a boost to the buying activity.

Investors remained cheerful on Thursday with the approval of a loan of $500 million by the Asian Infrastructure Investment Bank (AIIB). The uptrend was further fuelled by a decline in international coal and oil prices, which helped the KSE-100 index race towards the 43,000-point mark.

Buoyed by finance minister’s announcement of a $13 billion financial package from China and Saudi Arabia, the market jumped to the highest level since August by breaching the 43,000 mark on Friday.

Continued stability of Pakistani rupee against the US dollar further boosted the confidence of market participants. The index closed up by 1,237 points, or 2.95%, at 43,093 compared to the previous week.

“KSE-100 continued its upward trajectory throughout the week, closing at 43,093 points, up 3%,” said JS Global analyst Wasil Zaman in a report.

Sector-wise performance showed that banks (3.4%) and oil and gas exploration firms (6.8%) were among the key outperformers whereas food (0.3%) and chemical (0.5%) sectors emerged as main underperformers during the week, he said.

“Foreigners turned net sellers ($4.6 million) with the highest selling witnessed in banks ($5.3 million) and IT companies ($1 million).” On the news front, fiscal deficit for 1QFY23 rose to Rs809 billion, which equalled 1% of GDP against 0.7% in the same period of last year. On the other hand, SBP’s foreign currency reserves decreased by $956 million week-on-week to $7.96 billion owing to external debt payments.

Roshan Digital Account (RDA) inflows increased to $5.3 billion by the end of October 2022, up $146 million month-on-month with a majority of investment going into Naya Pakistan Certificates (63%).

As per Finance Minister Ishaq Dar, Pakistan managed to secure a financial support of $13 billion from friendly countries with assurances of investment worth $20 billion, the JS Global analyst said.

The starting date for the ninth review of IMF programme remained unclear (it was officially scheduled for November 3, 2022) as the government was yet to finalise its economic framework (a requirement of the fund). “The meeting is now expected to take place by the end of November,” the JS analyst said. Arif Habib Limited, in its report, said that the stock market commenced trading on a positive note on the back of expectations of $13 billion financing from China ($9 billion) and Saudi Arabia ($4 billion).

The momentum continued during the week over reports of Saudi Crown Prince Mohammad bin Salman’s expected visit to Pakistan on November 21, who may announce various investment projects, it said.

Pakistani rupee was slightly down against the greenback, closing at Rs221.95 (lower by 0.1% week-on-week).

The market closed at 43,093, gaining 1,237 points (or 2.95% week-on-week).

In terms of sectors, positive contribution came from commercial banks (368 points), oil and gas exploration companies (285 points), technology and communications (205 points), cement (80 points) and power generation and distribution (76 points).

Negative contribution came from miscellaneous (87 points), automobile parts and accessories (3 points), and food and personal care products (2 points).

Stock-wise positive contributors were TRG Pakistan (176 points), Oil and Gas Development Company (130 points), Pakistan Petroleum (119 points), Meezan Bank (106 points) and Bank Alfalah (56 points). Negative contribution came from Pakistan Services (81 points), Rafhan Maize Products (29 points), Shifa International Hospitals (6 points), Standard Chartered Bank (3 points) and Interloop Limited (3 points).

Foreigners’ selling continued during the week, which came in at $4.7 million compared to net selling of $1.6 million last week. Major selling was witnessed in banks ($5.3 million), technology and communications ($1.1 million) and other sectors ($0.4 million).

On the domestic front, buying was reported by mutual funds ($3.6 million) followed by banks/ DFIs ($3 million).

Published in The Express Tribune, November 13th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ