The Pakistan Stock Exchange remained in the red zone throughout the week amid growing economic and political turmoil coupled with the impact of revised estimates of flood damage.

The week kicked off on a negative note, with the benchmark KSE-100 index drifting away from the 42,000-point mark despite $3 billion worth of deposits by Saudi Arabia. Assurance from the International Monetary Fund (IMF) about flood relief efforts also failed to excite investors.

The market maintained the bearish momentum for two more days as rupee depreciation continued to put pressure on the bourse. The currency weakened against the greenback and hit an all-time low at Rs240 on Wednesday. Furthermore, political uncertainty exacerbated the market’s decline as PTI chief Imran Khan announced the start of a fresh movement, which fuelled profit-taking at the bourse.

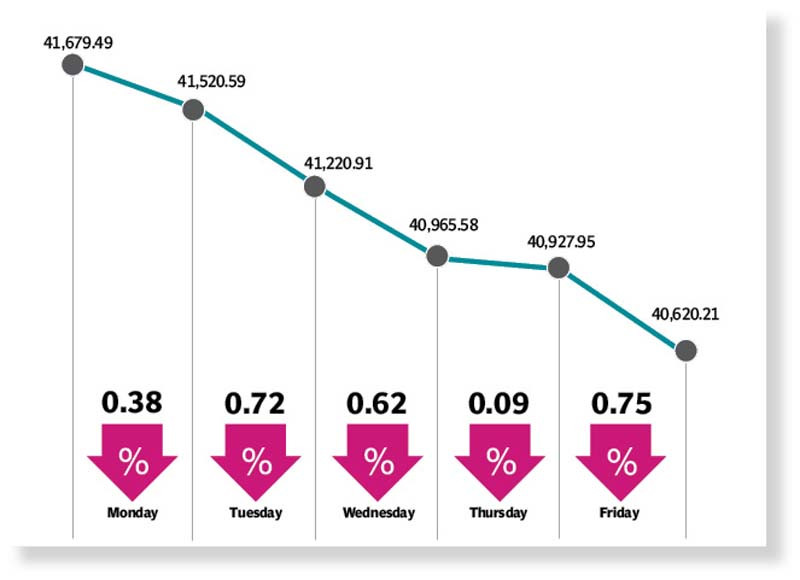

However, Khan’s apology before court helped the KSE-100 index recover partially but it remained under pressure in the absence of positive triggers. Though the domestic currency appreciated slightly against the US dollar gaining 0.03% in the inter-bank market, the bourse failed to recoup losses and dropped below the 41,000-point mark. The week closed at 40,620, down 1,059 points from the previous week.

“The KSE-100 witnessed a downward trend throughout the week amid economic and political concerns compounded by the ongoing impact assessment of floods,” said JS Global analyst Wasil Zaman.

Average daily volumes dipped 9% with 166 million shares traded during the week. Key underperformers were exploration and production (-6.3%), refinery (-5.9%) and power sectors (-5.5%). On the news front, latest estimate of flood damage came in at $30 billion while cotton arrivals declined 19% year-on-year by mid-September 2022.

Large-scale manufacturing (LSM) output for July declined 16% month-on-month while current account deficit for August contracted 42% month-on-month to $703 million. Foreign currency reserves during last week declined $248 million to $14.1 billion. Petrol prices were hiked by Rs1.45 to Rs237.43 per litre by the government, citing fluctuating global oil prices and exchange rate movement.

As a result of monetary tightening, external imbalances and impact of floods, the ADB revised downwards its GDP growth forecast for Pakistan to 3.5% for FY23 from earlier projection of 4.5%, the report added. Arif Habib Limited, in its report, said that the stock market opened the week on a positive note given rollover of Saudi Fund’s $3 billion till next year while the IMF assured Pakistan of support for flood relief and reconstruction.

However, the momentum could not be sustained owing to the “bleeding” State Bank’s foreign currency reserves (which fell $278 million week-on-week), causing further depreciation of Pakistani rupee against the greenback (which closed at Rs239.65 at end of the week).

In addition to that, foreign direct investment (FDI) plummeted 26% year-on-year during 2MFY23. Meanwhile, the investors opted for value buying amid expectation of receiving $1.5 billion, $0.5 billion and $0.2 billion from the ADB, Asian Infrastructure Investment Bank and Japanese government respectively. Moreover, the World Bank is expected to give flood-related support of $1.7 billion. Apart from that, the current account deficit reduced by 54% year-on-year in August 2022, which further cushioned the overall decline in the KSE-100 index during the week.

The market closed at 40,620, shedding 1,059 points (or 2.5%) week-on-week. In terms of sectors, positive contribution came from tobacco (15 points) and automobile parts (2 points).

Negative contribution came from E&P (251 points), banks (246 points), cement (123 points), power (74 points) and OMCs (73 points). Meanwhile, stock-wise positive contributors were TRG Pakistan (21 points), Pakistan Tobacco (15 points), Unity Foods (8 points), Fauji Fertiliser Company (6 points) and Ibrahim Fibres (4 points).

Negative contribution came from Pakistan Petroleum (117 points), Oil and Gas Development Company (84 points), Lucky Cement (83 points), Meezan Bank (66 points) and Habib Metropolitan Bank (51 points). Foreign buying was witnessed during the week, which came in at $5.09 million compared to net buying of $13.8 million last week. Major buying was witnessed in technology ($6.6 million), E&P ($0.5 million), cement ($0.5 million) and OGMCs ($0.3 million).

On the domestic front, selling was reported by insurance firms ($3.3 million), followed by mutual funds ($2.4 million).

Average daily volumes came in at 166 million shares (down 9% week-on-week) while average daily traded value settled at $26 million (down 13% week-on-week).

Published in The Express Tribune, September 25th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ