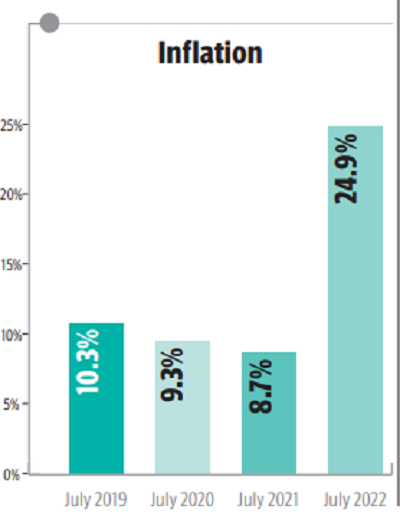

Inflation rate highest since Great Recession

It’s highest increase since October 2008 amid steep fall in rupee’s value against dollar

The consumer price in Pakistan rose to nearly 25% in July – the highest surge since October 2008 – as people suffered from the double-edged sword of food and energy prices with transport inflation peaking to a record 65%.

The annual inflation rate increased to 24.9% in July 2022, the Pakistan Bureau of Statistic reported on Monday, beating the expectations of the Ministry of Finance that four days ago had projected around 21% inflation.

It was the highest increase in consumer prices since October 2008 amid a steep slide in the value of the rupee that slipped to a record low of Rs239 to a dollar. This will contribute to a big price shock which will be felt in the coming months.

Transport prices recorded the biggest increase of nearly 65% on back of petrol prices that saw 94.4% increase in urban areas and almost 100% in rural areas, followed by food and non-alcoholic beverages.

The monthly inflation rate jumped 4.3% in July over June–probably the second highest increase in a single month in the history of Pakistan.

Amid skyrocketing prices, the government on Sunday directed the Federal Board of Revenue to prepare a mini-budget of Rs30 billion to compensate the supplementary grant of the same value that the Economic Coordination Committee of the Cabinet approved for the Pakistan State Oil.

However, the people no more have the capacity to bear the burden of additional taxes, as they have been forced to pay record petrol, electricity and gas prices in addition to an increase in their tax burden in the budget.

The core inflation, calculated after excluding the volatile energy and food prices, also surged to 12% last month in urban areas and 14.6% in rural areas, which may become an excuse for the State Bank of Pakistan to further increase the interest rates.

The government committed with the International Monetary Fund to keep the real interest rates positive.

The PBS reported that the CPI-based inflation rate increased to 23.6% in urban areas –a jump of another 3.8% in a single month. In villages and towns, the inflation rate skyrocketed to nearly 27% -- an increase of 3.3% in just one month.

The constant double-digit inflation in the country has eroded the people’s purchasing power and the decision to slap more taxes may now force them to reprioritise their expenses from health and education to meet essential food needs.

The pace of food inflation surged to 27.4% from 24% a month ago in cities and to nearly 30% in villages and towns last month, according to the PBS.

The real cost of inflation is on political stability and high inflation can cause a serious damage to social stability, according to the KTrade Securities. The most famous example of course is Germany post-WW-I. Even the recent Arab Spring was caused by high food inflation, it added.

The prices of both non-perishable and perishable food products increased significantly last month. The food group prices surged over 29% in July compared to the same month a year ago. Prices of perishable food items increased 33%, according to the PBS.

The low-middle and middle-income groups started crumbling under an unbearable increase in the cost of living.

The SBP had increased the key policy rate to 15% to curb inflation and correct external sector imbalances.

The central bank so far failed to contain inflation despite almost doubling the interest rates.

The federal government set the inflation target at 11.5% for this fiscal year but the SBP distanced itself from the official target, saying that the inflation may remain in the range of 18% to 20% during the current fiscal year.

The prices of all essential products seemed to slip out of the control of authorities, particularly crucial kitchen items like edible oil. The prices of onions jumped 100% last month compared to a year ago, followed by a 90% increase in the rates of pulses in the rural areas and 83% for various types of ghee and cooking oil, according to the PBS.

The rates of petrol were almost double in June over a year ago, followed by 87% increase in prices of electricity.

The alcoholic beverages and tobacco group prices soared 22.5%, clothing and footwear 14.6%, housing, water, electricity and gas fuels group prices surged 22% and transport 65%. The cost of hotels also increased 25% last month, according to the PBS.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ