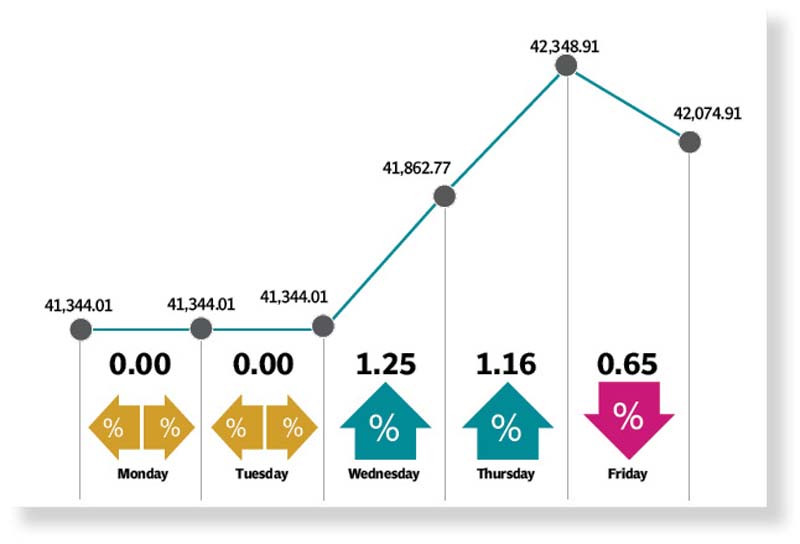

The Pakistan Stock Exchange (PSX) ended the week on a positive note as the benchmark KSE-100 index recorded an increase of 1.8% week-on-week

at 42,075.

Investor sentiment at the bourse remained buoyant throughout the week as the KSE-100 index commenced the week on a positive note with the news of a staff-level agreement between the government and the International Monetary Fund (IMF) later.

A loan of $1.2 billion would be released under the Extended Fund Facility following the approval of IMF Executive Board, which aided the index to gain 500 points.

Investors cherished the news of a major reduction in petroleum product prices, approved by PM Shehbaz, which further lifted the KSE-100 index.

Despite persistent depreciation of the rupee against the US dollar, the anxiously waiting investors welcomed the revival of the IMF loan programme.

However, profit-taking pulled the stock market down in the closing session, but the bourse managed to end the week on a bullish note.

Pakistan equities closed the three-day week on a positive note at 42,075, reporting an increase of 1.8% week-on-week, said JS Global analyst

Faisal Irfan. Volumes also showed a strong rebound with an average of 178 million shares traded during the week, an increase of 97% on a week-on-week basis.

Among key outperformers during the week were oil marketing companies (+5% WoW), engineering (+4.1%) and cement (+3%) sectors.

Investors celebrated the resumption of the much-awaited IMF programme as Pakistan reached the staff level agreement for the release of $1.17 billion, added the analyst. Moreover, the size of the programme also increased by $1 billion to $7 billion, with the facility ending in June 2023, subject to approval by the board.

Along with that, international oil prices remained volatile, where Brent crude touched a recent low of $94.78 per barrel (Sept contract) before closing the week at above $100 per barrel.

In order to pass on the impact of decline in international oil prices and provide relief, petrol and diesel prices were reduced in the country. All these positive developments overshadowed the 125bps increase in the State Bank’s policy rate in the previous week. Arif Habib Limited, in its report, said that the three-day week commenced on a positive note given the government reached a staff-level agreement with the IMF, which would enable the disbursement of $1.2b under the Extended Fund Facility.

Alongside this, the approval by PM Shehbaz of the reduction in petroleum prices (MS and HSD down by Rs18.50/litre and Rs40.54/litre respectively) was also welcomed by the market.

On the other hand, the Pakistani rupee further depreciated after staging a brief recovery post-announcement of IMF deal (closing the week at Rs210.95), leading to bearish momentum on the last trading day of the week.

The index closed at 42,075 points, gaining 731 points (or 1.8%) week-on-week.

In terms of sectors, positive contribution came from commercial banks (194 points), cement (99 points), technology and communication (93 points), fertiliser (85 points) and oil and gas exploration companies (82 points).

On the flip side, the sectors which contributed negatively included automobile assemblers (22 points) and pharmaceuticals (9 points). Meanwhile, stock-wise positive contributors were Meezan Bank (84 points), Systems Limited (70 points), Pakistan State Oil Company (53 points), Lucky Cement (45 points) and Pakistan Petroleum (39 points).

However, negative contribution came from Colgate-Palmolive Pakistan (17 points), Abbott Laboratories (15 points), Millat Tractors (10 points), Pakistan Oilfields (10 points) and EFU General Insurance (9 points).

Foreign buying was witnessed during the week, clocking in at $1.40m compared to net buying of $1.63m last week.

Major buying was witnessed in all other sectors ($0.43m) and banks ($0.36m). On the local front, selling was reported by banks/ DFIs ($1.43m) followed by insurance

companies ($1.13m). Average volumes clocked in at 178m shares (up 97% WoW) while average traded value settled at $31m

(up 108% WoW).

Among other major news, SBP raised markup rates on EFS and LTFF, K-E got Rs9.52/unit tariff hike, Morinaga Milk sought to increase its share in NMPL, PIA inducted second Airbus 320 aircraft into fleet and FBR projected 9.5% tax-to-GDP ratio.

Published in The Express Tribune, July 17th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

-(14)1720679028-0/(image-blakelively-on-Instagram)-(14)1720679028-0-405x300.webp)

1731028448-0/Untitled-design-(37)1731028448-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ