Farmers lack access to credit

Agriculturalists underline need for revamp of farm credit system

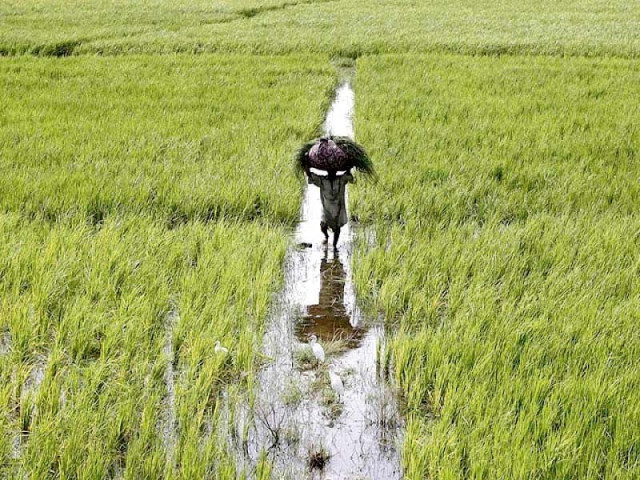

The agriculture credit system needs to be revamped to meet financial needs of the sector and ensure the development of rural areas in the country, said agriculturalists.

Russia’s invasion of Ukraine has disrupted the global supply chain to a point where Pakistani farmers would lose a great deal, largely because of increase in prices in the international market, Pakistan Businesses Forum Vice President Ahmad Jawad said while talking to The Express Tribune.

However, a bigger concern is the lack of access to the formal financial sector and the role played by banks.

“Bankers have no institutional means at their disposal to gather meaningful data of farms and rural businesses,” he said.

“With non-existent formal financing, agricultural transformation is not possible. So, our population will continue to face food supply issues. Farmers are at the mercy of the local money lenders, though they at least bring some liquidity to farm operations.”

“The agricultural economy of Pakistan is estimated at $69 billion while only $800 million is given in agricultural credit,” remarked Mahmood Nawaz Shah, Senior Vice President of Sindh Abadgar Board (SAB).

In a recent meeting, a high official of the State Bank of Pakistan (SBP) admitted that the credit disbursement target of Rs1.7 trillion had not been met.

“On the one hand, the need for agricultural credit was higher than the previous year, but the disbursement was lower than the target, which indicates serious issues in the banking system,” Shah said.

“Agricultural finance condition is very critical,” said Aamer Hayat Bhandara, Co-founder of Agriculture Republic, while talking to The Express Tribune. “Most of the small and medium-sized farmers are not given loans by the banks, especially the public sector banks.”

In the absence of financing from the formal channels, “the farmers are compelled to go to the middleman, who manipulates them in many ways, including very high financing rates,” said Bhandara.

He pointed out that banks demanded many documents that made the process cumbersome and they also asked the farmers to pledge their land for getting the loan.

He asked the government to make policies to help the farmers borrow money without pledging their land, which was their only source of income.

Bhandara suggested that banks could issue credit cards for six months that could provide the farmers with the running cost.

For example, the farmers have to use tube wells that run on electricity and to pay the electricity bill they again go to the middleman for these small expenditures as banks issue loans for fertilisers, seeds and machinery only.

Sindh Chamber of Agriculture President Miran Mohammed Shah said that agriculture financing had reached the point of disaster.

“On the pretext of no recovery, farmers of any level (as per acreage or as per income) are not entertained by the financial institutions,” he said.

“Keeping the commercial banks aside, even the agricultural bank (Zarai Taraqiati Bank Limited - ZTBL), created for giving financing to the farmers for the development of their crops and yields, has stopped advancing loans to the sector.”

He pointed out that a major reason behind the decline of agriculture sector was the unavailability of financing to the farmers.

“Schemes for giving subsidies on agricultural implements and inputs fail just because the farmers do not have the capital to take advantage of these schemes,” he pointed out.

Miran Shah called for the restructuring of the financing policy and the restoration of credit supply to the farmers.

“There is a policy of the State Bank, which requires the allocation of a certain percentage for agricultural loans. But the commercial banks are violating this policy,” he said.

“This policy needs to be revived and implemented on the lines of the housing loan scheme. ZTBL should be made more effective in this regard. Their one window system through the revenue hierarchy gives substantial support to the farmers.”

Published in The Express Tribune, June 26th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ