Rs80b ‘burden’ passed on to salaried class

Govt caves into IMF demand, sets income tax rate of 2.5% for those earning up to Rs100,000 a month and 35% on Rs1m

The government has caved in to the demand of the International Monetary Fund (IMF) and passed on the burden of Rs80 billion on the salaried class by increasing their tax rates and withdrawing the relief announced hardly three weeks ago.

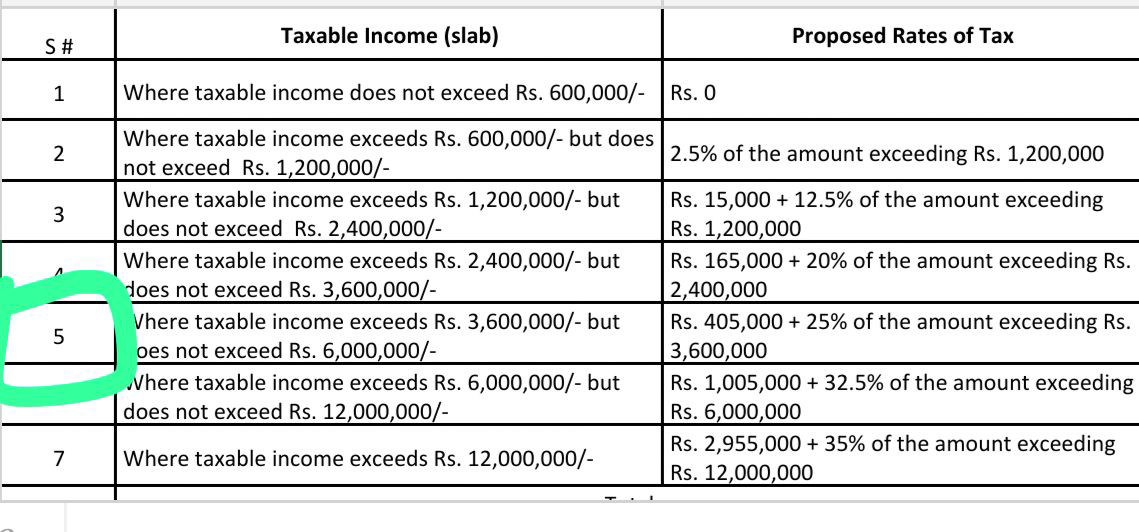

It has set the minimum income tax rate of 2.5% for those earning up to Rs100,000 a month as well as a maximum of 35% on the monthly income of over Rs1 million, according to the proposed amendments to the Finance Bill 2022.

The coalition government has reversed its two earlier decisions to exempt up to those with earning Rs100,000 a month from income tax and rolled back its move to reduce the highest income tax rate from 35% to 32.5% after the IMF refused to budge on its demand.

On June 10, Finance Minister Miftah Ismail had announced an income tax relief of Rs47 billion for the salaried class.

The coalition government has not only withdrawn the relief but also imposed Rs33 billion in net additional taxes in comparison with June 2021 for the salaried class, throwing a burden of Rs80 billion on them.

Also read: PM Shehbaz announces 10pc 'super tax' on large-scale industries

The IMF had proposed to tax the upper middle and rich income groups, which earn in the range of Rs104,000 to Rs1 million a month at a single rate of 30%, which the government did not accept.

The new rates are still lower than the initial demand that the IMF had put before the last government of the PTI.

The IMF had demanded an unjustified rate of 30% to be charged from persons earning Rs100,000 to Rs1 million a month to collect an additional Rs125 billion from the salaried class.

“We tried to get maximum concessions from the IMF for the salaried class but it did not completely accept our position,” Miftah told The Express Tribune. He added that the net additional impact on the salaried class was Rs33 billion a year.

About 1.24 million salaried people have filed income tax returns for the tax year 2021. Of them, 333,000 fall in the income tax exemption slab of Rs50,000 per month. This slab is still exempted.

The government has now proposed a 2.5% income tax rate on up to Rs100,000 monthly income as against nil tax proposed on June 10. This is still half of the rate the salaried class paid in the outgoing fiscal year.

The government has proposed a 12.5% income tax rate for people earning up to Rs200,000 a month –which is 78% higher than that proposed on June 10. The finance minister had earlier vowed that he would not put an additional burden on those with a Rs200,000 monthly income.

For the outgoing fiscal year, the salaried persons were paying 10% for up to Rs150,000 monthly income and 15% on up to Rs208,000 monthly income.

For the fourth slab carrying people of up to Rs300,000 monthly income, the government has now set 20% income tax rate as against 12.5% proposed on June 10 -- an additional burden of 60% in comparison with the three-week old rate. The existing tax rate for this income group was 17.5%.

Last month, inflation in Pakistan stood at 13.8%, which is expected to spiral due to many taxation measures like the Rs50 per litre petroleum levy.

On a monthly income of Rs500,000 -- the fifth slab -- the government has proposed 25% income tax as against the three-week old rate of 17.5%.

For people earning over Rs1 million a month, the government has proposed a 32.5% rate -- up from 22.5% from three weeks ago. For the outgoing fiscal year, the tax rate for this slab was 25%. However, the IMF had proposed a 35% rate for them earlier.

There are over 6,000 individuals, who earn up to Rs1 million a month.

Read more: PSX plunges by over 2,000 points after PM Shehbaz announces 'super tax'

For those who earn over Rs1 million a month, the government has now proposed a 35% income tax rate -- up from the three-week old rate of 32.5%. The finance minister said in the country, there were hardly 12,000 people, who had declared a monthly income of over Rs1 million.

At present, people earning over Rs1 million a month to Rs2.5 million were paying 27.5% income tax rate.

The revision in tax rates for the salaried class is expected to bring Pakistan and the IMF more closely to each other.

However, the IMF has not yet shared the draft of the Memorandum for Economic and Financial Policies (MEFP).

The government expects to receive the MEFP document either on Friday night or Monday.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ