Senate proposes 244 changes in budget

Calls for withdrawing sales tax on pharma raw material; reducing tax rate on bakery items

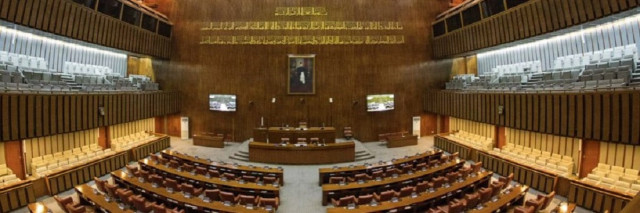

The Senate on Thursday adopted 27 recommendations related to the Finance Bill 2022-23 and proposed more than 200 recommendations for the Public Sector Development Programme (PSDP) to the National Assembly.

A total of 244 recommendations – 217 related to the development budget and 27 others – would be forwarded to the National Assembly which would then decide whether or not they would be incorporated in the money bill.

The upper house adopted the report on Finance Bill 2022-23 presented by Standing Committee on Finance Chairman Saleem Mandviwalla during a session chaired by Senate Chairman Sadiq Sanjrani.

The report recommended that the tax rate on bakery items be reduced from 17% to 7.5%, besides abolition of 17% sales tax on pharmaceutical raw materials and return of Rs40 billion in sales tax collected from pharmaceutical manufacturers from January 15.

The Senate recommended the National Assembly that this act was against the principle of sales tax and value-added tax and as such sales tax should be collected from the all sales points. However, exemption of small retailers should be based on their electricity bills.

The Senate recommended that retrospective exemption of federal excise duty (FED) for the newly merged districts (NMDs) – erstwhile Federally Administered Tribal Areas (Fata) and Provincially Administered Tribal Areas (Pata) – should be provided.

In order to promote economic prosperity and implement the true spirit of the exemptions promised, all the previously uncollected taxes on sales, including electricity bills, should also be exempted for the year 2019 to 2020, the recommendations suggested.

The Senate recommended to that the government should ensure the reduction of sugar content in sodas, juices, energy drinks and ice teas for better human health. Therefore, it recommended reduction in the tax rate on bakery items from 17% to 7.5%.

The Senate also recommended that FED rate on natural gas be enhanced from Rs10 per metric million British thermal unit (MMBTU) to Rs20 per MMBTU in view of the increase in the prices of natural gas since 2010.

The house recommended that 5% FED be levied on crude petroleum oils, adding that this FED might be collected in sales tax mode in order to avoid any possible effect on the retail price of POL products.

The upper house recommended that import of aircraft and its parts should be exempted from sale tax as neither this sales tax was recoverable or adjustable. It said that the percentage salary increase from grade 1 to 16 should be greater than the increase for grade 17 to 22.

On the budget, Federal Minister Sherry Rehman admitted that the government had presented “the IMF [International Monetary Fund] budget for which the PTI [Pakistan Tehreek-e-Insaf] deserves our thanks”.

The climate change minister told the house that so far the country had received 23 IMF budgets. “Which government of Pakistan had presented a budget without the IMF? There should be no ambiguity that this is the budget of the IMF for which we thank the PTI,” she added.

State Minister for Finance Ayesha Ghous Pasha told the lawmakers that the previous PTI government had reached an agreement with the IMF for increasing the prices. “Why should we back out [from the PTI’s agreement with IMF]? The agreement has to be fulfilled.”

During the proceedings, the PTI twice pointed out the quorum but it was found in order, therefore, the session continued. After sending the budget recommendations, the upper house of parliament was prorogued, indefinitely.

(WITH INPUT FROM APP)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ