Stocks flat on mix of positive, negative news

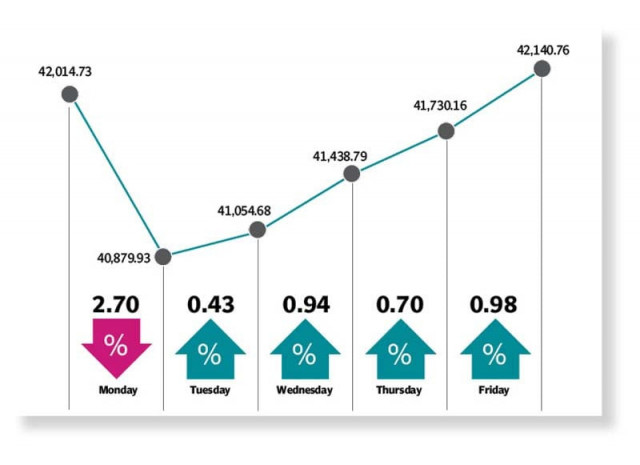

Benchmark KSE-100 index edges up 126 points at 42,141

The Pakistan Stock Exchange opened the week on a negative note, witnessing a bloodbath over the lack of satisfaction by the International Monetary Fund (IMF) with the federal budget for 2022-23. Owing to this, the market plunged by 1,135 points day-on-day.

However, positivity was witnessed at the bourse later and the KSE-100 index gained ground over speculation of elimination of Pakistan from the FATF grey list.

Still, many investors preferred to remain on the sidelines amid concerns over the revival of IMF programme. The investors further lost hope over the continuous depreciation of the rupee.

Pakistani rupee continued to drop throughout the week against the US dollar, hitting the all-time low at around 208 while the SBP’s forex reserves dropped to $8.99 billion.

Later, positive investors’ sentiment helped pull the KSE index in the green zone as the government took measures such as the hike in petroleum product prices to clinch the IMF deal.

Furthermore, the government approved increase in electricity prices by Rs7 per unit in phases to meet the IMF’s demand, which boosted the investors’ interest.

The investors remained optimistic about the news of China agreeing to roll over loans worth $2.3 billion and extending further assistance of $2.5 billion to $2.8 billion, which lifted the index.

Positive news of Pakistan’s removal from the FATF grey list provided stimulus to the market. Bulls tossed the index above 42,000 points to close the week in the green zone.

Arif Habib Limited, in its report, said that the market opened on a negative note amid concerns over the dissatisfaction expressed by the IMF with measures taken in the federal budget for 2022-23, whereby the market plunged by 1,135 points day-on-day.

After the bloodbath, the market sentiment turned positive amid expectation of exclusion of Pakistan from the FATF’s grey list.

Furthermore, the government increased prices of MS and HSD by Rs24.03/litre and Rs59.16/litre respectively, while completely eliminating the remaining subsidies, fulfilling one of the major conditions of the IMF.

However, the Pakistani rupee continued to plummet throughout the week against the US dollar, closing at Rs208.

The market closed at 42,141 points, up by 126 points (0.3%) week-on-week.

In terms of sectors, positive contribution came from E&P (116pts), cement (90pts), OMCs (80pts), power generation (56pts) and engineering (51pts).

On the flip side, sectors which contributed negatively included commercial banks (263pts), chemical (34pts) and technology (33pts).

Meanwhile, stock-wise positive contributors were Hubco (51pts), PSO (50pts), Pakistan Oilfields (36pts), Pakistan Petroleum (32pts) and OGDC (31pts).

However, negative contribution came from UBL (75pts), Meezan Bank (71pts), Bank AL Habib (46pts), MCB (44pts) and Standard Chartered Bank (34pts).

Foreign selling was witnessed during the week, which came in at $1.91 million compared to net selling of $0.42 million last week.

Major selling was witnessed in banks ($1.4 million) and fertiliser ($1.1 million).

On the local front, buying was reported by companies ($10.5 million) followed by individuals ($5.8 million).

Average volumes clocked in at 174m shares (up 3% WoW) while average traded value settled at $25m (up 16% WoW).

Among other major news, Nepra okayed Rs1.55/unit tariff hike for DISCOs, textile exports surged by 28.6% in July-May, OGDC discovered gas in Sindh and in Jul-Apr period banks disbursed over Rs1tr agri-credit.

Topline Securities, in its report, said that the KSE-100 index closed flat on a week-on-week basis.

The week started off on a negative note on news flow that the IMF had expressed concern over the recently announced budget for FY23. However, recovery was observed in the latter session on the back of hike in petroleum product prices, news that the government was reviewing slab rates of personal income tax for aligning those with the IMF demand and approval of Economic Coordination Committee to increase electricity prices by Rs13/unit in phases in line with the IMF demand, Topline added.

By the end of the outgoing week, expectation of positive news on account of FATF review also provided stimulus to the market.

Average daily traded volume and value during the week stood at 174m shares (up by 2.5% on WoW basis) and Rs5.3b (up by 20% on WoW basis) respectively.

On the flows end, companies and individuals purchased equities worth a net $10.2m and $3.7m respectively, whereas insurance, mutual funds and broker proprietary sold equities worth $8.92m, $8.81m and $6.3m respectively.

Published in The Express Tribune, June 19th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ