Govt unveils Rs9.5 trillion federal budget for 2022-23

Salaries of govt officers increased by 15%; pensions 5%; Rs740b new taxes proposed

With one eye on the International Monetary Fund and the other on voters, Finance Minister Miftah Ismail on Friday proposed a Rs9.5 trillion inflationary budget amid a daunting challenge to meet ambitious targets.

The new budget for fiscal year 2022-23 provides solace to the salaried class whose tax burden has been significantly lessened in addition to 15% increase in salaries of the inflation-stricken government employees.

پبلک سیکٹر ڈویلپمنٹ پروگرام کے تحت ترقیاتی کاموں کیلئے 800 ارب روپے مختص۔#Budget_for_economic_stability#معاشی_استحکام_کا_بجٹ pic.twitter.com/e3pLabQGqt

— Government of Pakistan (@GovtofPakistan) June 10, 2022

But his single measure – the proposal to slap Rs50 per litre petroleum levy for additional Rs300 billion income – has not only overshadowed some good measures but may also make it challenging for the coalition partners to defend the budget.

The government has proposed Rs740 billion new taxes, including Rs440 billion tax measures proposed by the Federal Board of Revenue. Some of the major relief measures will be offset by the increase in petroleum prices rates due to a Rs50 per litre levy along with 17% sales tax.

While unveiling the first budget of the coalition government in an unusually calm atmosphere, Miftah has attempted to tax the holy cows –the realty sector, the wealthiest people while also forcing the commercial banks to cough more painlessly earned money.

Read more: Country’s defence budget allocation mere pennies compared to India

The retailers have been taxed at the fixed rate through electricity bills while wealthiest Pakistanis holding offshore assets will pay annually 1% of the value of their foreign assets in taxes.

The tax burden on registration of luxury cars of above 1,600cc has been doubled while the rates on sales, purchase and gains made on the properties have been significantly increased.

No measures have been announced to curtail the current account deficit or the imports as the finance minister sets the current account deficit target at only 2.2% of the Gross Domestic Product (GDP).

“The coalition government has taken difficult decisions and the process of taking these difficult steps has not yet been completed,” Miftah said in his budget speech.

“These are difficult times brought upon us by recent years of economic mismanagement. Through this budget, my government will steer our way out of these challenges by taking tough decisions while minimising the impact on vulnerable segments.”

The coalition government caved in to the IMF’s demand to exhibit primary budget surplus, pitching it at Rs152 billion by planning fiscal consolidation of nearly Rs1.8 trillion or 2.2% of the GDP in the next fiscal year. It is the steepest consolidation that is proposed in an election year amid heightening political uncertainty and tough IMF negotiations.

The IMF talks have so far remained inconclusive and it may take some time after the finance minister announced certain measures contrary to the desire of the global lender.

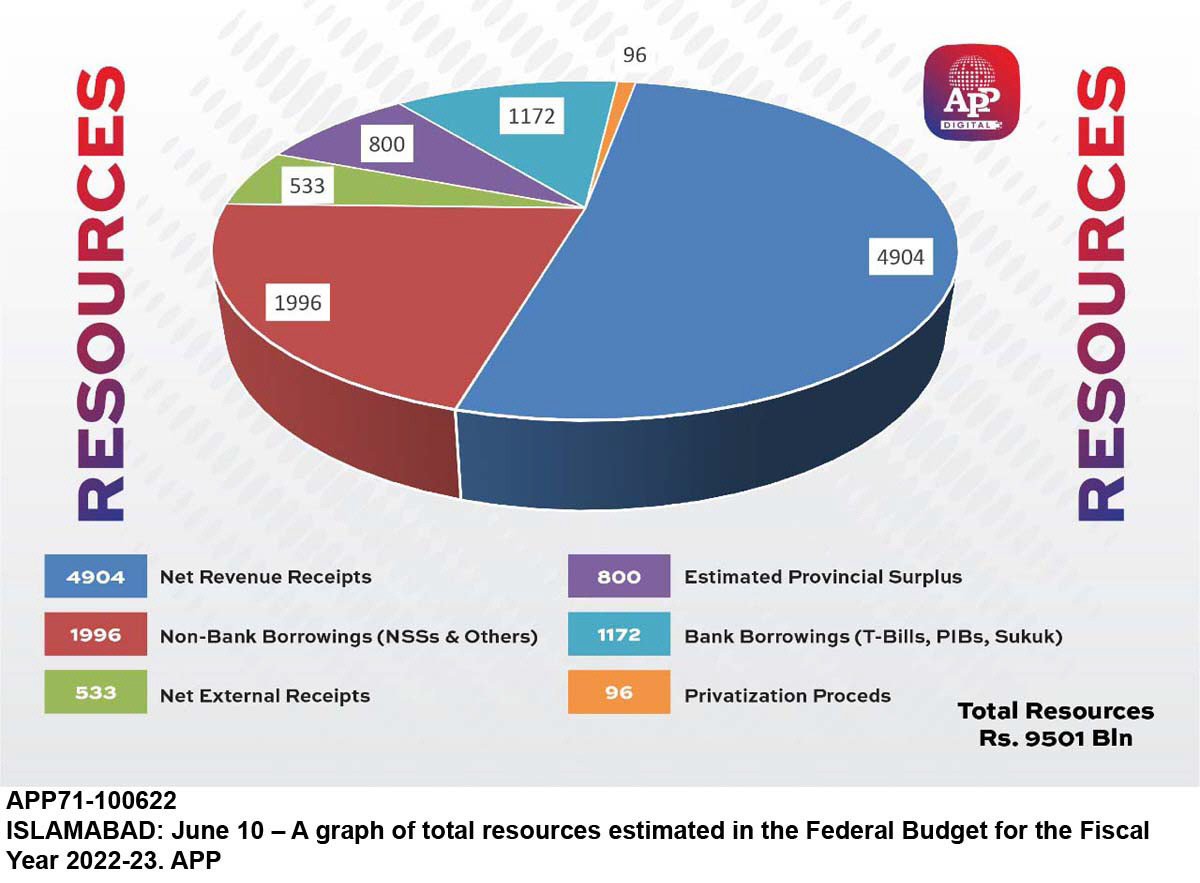

While setting the inflation target at 11.5%, Miftah said that the total size of the 2022-23 budget will be Rs9.5 trillion –higher by only 4.6%, which makes the expenses forecast unrealistic from day one. It will be very difficult for the government to virtually freeze expenses in the next fiscal year when there will be a significant increase in cost of living.

Read more: IT exports surge to $1.9 billion, have potential to grow further

The increase in prices of electricity, gas and petroleum products would also jack up the cost of the military and the civilian government, which has not been truly reflected in the budget figures proposed by the finance minister.

The gross revenue target has been set at Rs9 trillion – higher by 23% that the government wants to achieve through combination of taxes and non-tax measures, including the petroleum levy on petrol and high speed diesel.

Unlike in the past, the budget speech had been delivered in a calm setting, thanks to the absence of real opposition from the house –the Pakistan Tehreek-e-Insaf.

A major challenge that the finance minister has set for himself is to deliver a primary budget surplus of Rs152 billion, particularly when the provincial governments have announced big development budgets that leave little room for Rs800 billion cash surpluses of four federating units, as budgeted by him.

The finance minister said that the government would focus on agriculture, productivity enhancement and exports promotion in the next budget.

1654876009-0/WhatsApp-Image-2022-06-10-at-8-45-03-PM-(1)1654876009-0.jpeg)

The budgetary framework is projecting about 0.2% of the GDP primary budget surplus – showing that its net income will be more than the expenditure, excluding debt servicing cost. Earlier, during the Doha round of talks, the government had presented a primary budget deficit framework, which the IMF did not agree to.

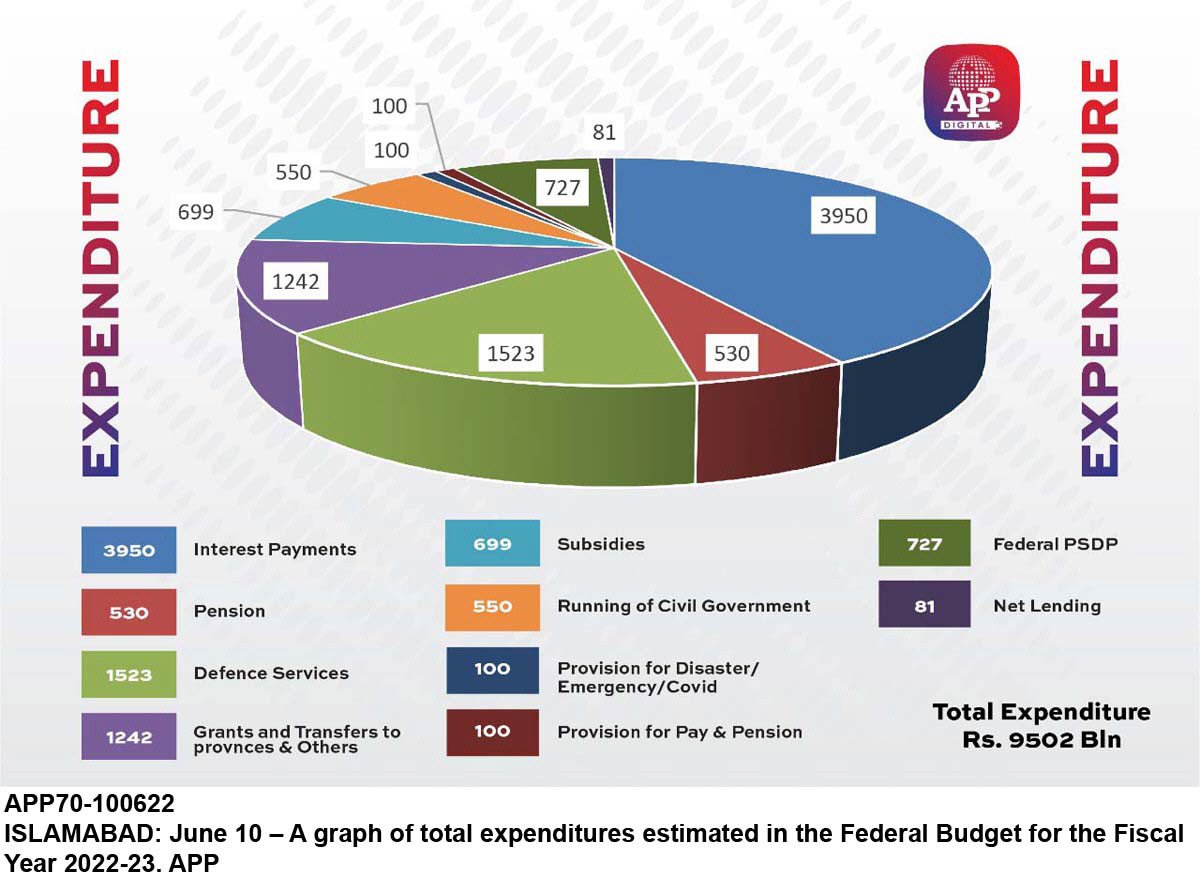

A major chunk of the new budget –the Rs5.45 trillion or nearly 58% of the budget – will be spent only on two heads – debt servicing and defence. There is an alarming increase of over Rs806 billion or 26% increase in debt servicing cost in just a year. In the outgoing fiscal year, the share of these two components was half of the total budget. The defence services share remained constant but the debt servicing has gone out of control.

The domestic debt servicing will eat up nearly Rs3.5 trillion while another Rs511 billion will be given for foreign debt servicing. The average interest rate in the next fiscal year is estimated at 14%, which would take away what the government will earn in additional revenues.

Although the government will be aiming at Rs152 billion primary budget surplus target, the finance ministry will still borrow Rs4.6 trillion to run its operations, thanks to nearly Rs3.95 trillion debt servicing cost in fiscal year 2022-23. This will be the highest-ever debt servicing cost in the history of Pakistan.

The Rs1.75 trillion or equal to 2.2% of the GDP steeper adjustment will be challenging in an election year and chances for slippages will remain high.

The Rs9.5 trillion size of the budget is higher by nearly Rs418 billion or 4.6% over this year’s revised budget of over Rs9 trillion. There was an increase of 11% in expenditure if compared with the original budget of Rs8.5 trillion, which now has become redundant.

The current expenditures are targeted to grow only 3% to Rs8.7 trillion against the revised estimates.

The defence budget is estimated around Rs1.523 trillion –up by Rs43 billion or 3% over the revised budget of the outgoing fiscal year. The Ministry of Defence has already taken a Rs110 billion supplementary budget for the outgoing fiscal year.

The government has drastically cut subsidies that are estimated at Rs699 billion in the next fiscal year.

Also read: With Rs9.5tr outlay, govt to rely on loans

These are down by Rs815 billion or 54% over this year’s revised estimates. The cost of pensions is Rs530 billion and the running of the civil government will consume only Rs550 billion. The Rs550 billion cost appears low due to increase in cost of utilities under the IMF programme.

The government proposed Rs727 billion for the Public Sector Development Programme for the next fiscal year, although Planning Minister Ahsan Iqbal unveiled the draft PSDP of Rs800 billion. The government has pitched the budget deficit target of 4.9% of the total size of the economy, or Rs3.8 trillion.

But the major challenge for the finance minister will be arranging a record $41 billion in foreign loans in next fiscal year to remain afloat. “Pakistan will require repaying $21 billion foreign loans, it will need another $12 billion for current account deficit financing and $8 billion more for increasing foreign exchange reserves to $18 billion,” the finance minister said.

The government has estimated receiving $16 billion in foreign loans in the next fiscal year for budgetary purposes. The Federal Board of Revenue’s tax target has been set at Rs7 trillion that is higher by 17% over the revised estimates. The non-tax revenue receipts are projected at Rs2 trillion, which will require 52% growth, indicating that the government will restore petroleum levy rates.

The petroleum levy collection target has been set at Rs750 billion on back of the Rs50 per litre levy. This is the second unrealistic target after the primary budget surplus. For the outgoing fiscal year, the previous government had set Rs610 billion levy collection target but the revised collection figure is now shown at Rs135 billion.

Also read: Ministries face steep budget cut

The imports by the commercial importers have also been taxed at 4% rate, which can stoke inflation.

The gross revenue receipts are estimated at Rs9 trillion for next fiscal year – up by nearly one-fourth or Rs1.7 trillion. The provinces will get Rs4.1 trillion as their share, leaving the federal government with Rs4.9 trillion net revenues. The net income of the federal government is expected to be Rs600 billion less than expenditure on defence and debt servicing.

With addtional input from APP and Radio Pakistan

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ