Power generation capacity expands 11.5%

Total capacity reached 41,557MW with slight drop in hydel share

Pakistan’s electricity generation capacity increased by 11.5% and reached 41,557 megawatts in July-April 2021-22 compared to 37,261MW in the same period of previous fiscal year, revealed the Economic Survey of Pakistan 2021-22.

The hydel energy share in the total installed capacity marginally fell to 24.7% year-on-year during the first 10 months of FY22.

The contribution of re-gasified liquefied natural gas (RLNG) to the total power generation increased to 23.8% from 19.7% last year.

Coal’s share remained the same, although the installed capacity went up from 4,770MW during July-April FY21 to 5,332MW in July-April FY22. Natural gas contribution declined from 12.1% in FY21 to 8.5% in FY22.

“There is an increase in the percentage share of renewable energy, which is a good sign for the economy as well as for the environment,” said the report.

The contribution of nuclear energy expanded to 8.8% in the first 10 months of FY22 from 6.7% in the corresponding period of FY21. The share of wind energy rose from 3.31% to 4.8% while solar energy’s share edged up from 1.07% to 1.4%.

“There is a slight shift in the percentage share of different sources in electricity generation,” the report said.

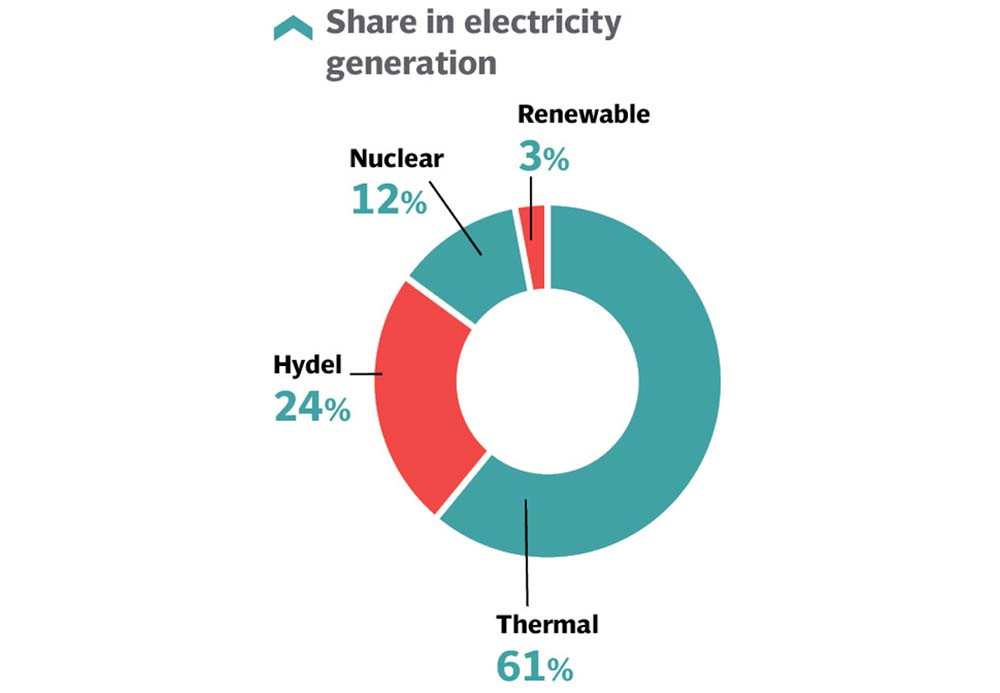

“Thermal has still the largest share in electricity generation, although its percentage contribution declined from 62.5% during July-April FY21 to 60.9% during July-April FY22.”

Similarly, the contribution of hydel energy in electricity generation decreased from 27.8% in July-April FY21 to 23.7% in July-April FY22.

However, the share of nuclear energy increased from 7.2% last year to 12.3% this year. The contribution of renewable energy inched up from 2.4% to 3.02%.

The first 10 months of current fiscal year did not see any major shift in the consumption pattern of electricity.

The share of household electricity consumption slightly declined from 49.1% in FY21 to 47% in FY22 while consumption in the commercial sector dropped to 7% from 7.4%.

However, the share of industry in electricity consumption expanded to 28% during July-April FY22 from 26.3% during July-April FY21.

The use of electricity in the agriculture sector slightly advanced to 9% from 8.9% whereas the consumption in other sectors, including public lighting, general services and other government traction decreased to 8% from 8.3%.

Energy sector scenario

According to the Economic Survey, Pakistan’s economic growth is constrained by bottlenecks in the energy sector. The country’s energy requirements are increasing and demand for energy in the coming decades will rise substantially.

Energy demand on this scale will put increasing pressure on energy resources and distribution networks, the report said.

“This is unsustainable without a fundamental transformation of the energy system. Dependency on the dominant fossil energy resources, especially oil is risky,” it said.

“Energy security is essential because the kind of disruption we have seen is a potential threat to our economic wellbeing. Exploration of the more indigenous and renewable resources is the key to energy security.”

According to the report, the government has been endeavouring to bring in transformational changes in the power system by exploring alternative sources of energy.

CPEC energy projects

Overall, 13 power projects of 11,648MW are being facilitated by the Private Power and Infrastructure Board (PPIB) under the China-Pakistan Economic Corridor (CPEC).

These include four hydroelectric power projects of 3,428MW, five Thar-coal-based projects of 3,960MW, four imported coal-based projects of 4,260MW, and a 660-kilovolt high-voltage direct current (HVDC) transmission line project.

Of these, three imported coal-based power projects of 3,960MW and one Thar coal-based power project of 660MW have been commissioned, while ±660kV Matiari-Lahore HVDC transmission line has also started functioning on a commercial basis with effect from September 1, 2021.

“This is not only the first transmission line project developed by the private sector but also the first-ever HVDC transmission line in Pakistan.”

Furthermore, another nine independent power plants (IPPs) of 7,028MW, which include four hydel IPPs of 3,428MW, four Thar coal-based IPPs of 3,300MW and one imported coal-based IPP of 300MW are at different stages of processing.

Gas sector

The indigenous supply of natural gas declined around 5% and its contribution stood at 33.1% to the total primary energy supply mix of the country.

Available statistics for July-March FY22 indicate that Pakistan has an extensive gas network of over 13,513 km of transmission, 155,679 km of distribution and 41,231 km of services gas pipelines to cater to the requirement of millions of consumers.

The number of consumers has increased from 10.3 million to more than 10.7 million across the country. “The government’s policies to enhance the indigenous gas production to meet the increasing demand for energy proved effective,” the report said.

At present, the capacity of two Floating Storage and Re-gasification Units (FSRU) for RLNG is 1,200 million cubic feet per day (mmcfd). RLNG is being imported to bridge the widening gap between demand and supply of gas in the country.

The average natural gas consumption declined from 3,723 mmcfd to about 3,565 mmcfd during July-March FY22.

It is expected that gas will be supplied to approximately 736,060 new consumers (the target is subject to approval of Ogra) during FY23.

Gas utilities have planned to invest Rs27,669 million in transmission projects, Rs77,484 million in distribution projects and Rs8,746 million in other projects, bringing total investment to Rs113,899 million during fiscal year 2022-23.

Oil sector

Pakistan generates electricity from an energy mix that includes oil, natural gas, LNG, coal and renewable sources including solar, wind, hydel, nuclear and biomass.

The energy sector is heavily dependent on imported fuel including oil and LNG and will continue to rely on its imports because of the low domestic capacity, according to the report.

Higher oil prices in the global market and massive depreciation of the Pakistani rupee make oil imports more expensive, triggering external sector pressure and widening the trade deficit. The surge in the oil import bill is attributed to the increase in value as well as increase in the quantity demanded. The oil import bill increased 95.9% to $17.03 billion in July-April FY22 compared to $8.69 billion during the corresponding period of last year.

Further breakdown showed that the import of petroleum products went up 121.15% in value and 24.18% in quantity. During July-April FY22, the import of petroleum products increased to $8.55 billion compared to $3.87 billion during July-April FY21. Crude oil imports rose 75.1% in value and 1.4% in quantity during the period under review.

Petroleum crude reached $4.22 billion in July-April FY22 against $2.41 billion in the same period in FY21. During July-March FY22, the total processed imported crude stood at one million tons while the processed local crude was recorded at 2.31 million tons.

Published in The Express Tribune, June 10th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ