SBP jacks up key rate to 11-year high of 13.75%

Central bank decision coms as Miftah heads to talks with IMF

Going beyond the market expectations, the State Bank of Pakistan (SBP) aggressively raised on Monday the key policy rate by 150 basis points (bps) to an 11-year high of 13.75% for the next six weeks.

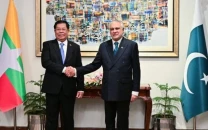

The rate hike came as Finance Minister Miftah Ismail headed to Doha to participate in talks with the International Monetary Fund (IMF) for the resumption of a $6 billion loan programme that had been stalled since early April.

The financial market participants had strongly expected a 100bps rate hike. With the latest decision, the SBP had cumulatively increased the key policy rate by 675 basis points under the current cycle of upward revision since September 2021.

The central bank had tightened the monetary policy to slow down the economic growth to a sustainable pace and control imported inflation in the country. The economic growth is projected to an unsustainable level of 5.97% in the current fiscal compared with 5.7% in the last fiscal year.

The inflation reading had spiked to a two-year high at 13.40% in April and might rise to 15% or more if the government decided to end subsidies on petroleum products and electricity to the end-consumers.

1/3 At today’s meeting, MPC decided to raise policy rate by 150bps to 13.75%. This action, together with much needed fiscal consolidation, should help moderate demand to more sustainable pace while keeping inflation expectations anchored & containing risks to external stability.

— SBP (@StateBank_Pak) May 23, 2022

Pakistan largely depends on imported goods to meet local consumption and manufacture products for the export markets as well. Therefore, the revival of the IMF loan programme is a must to boost foreign exchange reserves and reduce risk of default on import payments and foreign debt repayment.

Talking to the media, Miftah said that he would convey to the IMF that fuel and energy subsidies — which were introduced by the previous Pakistan Tehreek-e-Insaf (PTI) government — could not be reversed because the “nation cannot endure it”.

The assertion seems to have dampened hopes for a fruitful round of talks with the IMF that is calling for a rollback of all subsides. Reports suggested that the IMF had delayed resumption of the loan programme by a few days or weeks.

The minister said that Prime Minister Shehbaz Sharif and Pakistan Muslim League-Nawaz (PML-N) supremo and former prime minister Nawaz Sharif had ruled out the possibility of ending the subsidies.

The Russia-Ukraine conflict and Covid-19 pandemic have also caused a significant surge in the global commodity prices, including the petroleum products. This, along with elevated aggregated demand for imported goods in the domestic economy and subsidies on local energy products, has caused fast depletion in the country’s foreign exchange.

The foreign exchange reserves have fallen to a critical low level of $10.2 billion, providing the import cover for just six weeks. Accordingly, the country’s risk of default on international payments was on the rise.

Read More: SBP asked to reduce interest rate

“This action (150bps), together with much needed fiscal consolidation (mainly through likely end of subsidies on energy products), should help moderate demand to a more sustainable pace while keeping inflation expectations anchored and containing risks to external stability,” the SBP said in the latest Monetary Policy Statement (MPS).

“Since the last MPC (Monetary Policy Committee) meeting on April 7, provisional estimates suggest that growth in FY22 has been much stronger than expected. Meanwhile, external pressures remain elevated and the inflation outlook has deteriorated due to both home-grown and international factors.”

The aggressive hike in the rate is also aimed at supporting rupee against the US dollar. The domestic currency has devalued 8.21% or Rs15.24 in the past 12 consecutive working days to an all-time low at Rs200.93 on Monday.

“Domestically, an expansionary fiscal stance this year, exacerbated by the recent energy subsidy package, has fuelled demand and lingering policy uncertainty has compounded pressures on the exchange rate,” SBP said.

“On the external front, notwithstanding some encouraging moderation in the current account deficit during April, the rupee depreciated further due both to domestic uncertainty as well as recent strengthening of the US dollar in international markets following tightening by the Federal Reserve.”

“The MPC’s baseline outlook assumes continued engagement with the IMF, as well as reversal of fuel and electricity subsidies together with normalization of the petroleum development levy (PDL) and GST taxes on fuel during FY23,” the central bank added.

Under these assumptions, the headline inflation was likely to increase temporarily and might remain elevated throughout the next fiscal year. “Thereafter, it is expected to fall to the 5-7% target range by the end of FY24, driven by fiscal consolidation, moderating growth, normalization of global commodity prices, and beneficial base effects.”

The central bank, however, avoided projecting inflation reading in percentage terms for the ongoing fiscal year 2022 and the next fiscal year 2023. “In addition to today’s policy rate increase, the interest rates on export finance scheme (EFS) and long-term finance facility (LTFF) loans are also being raised (by 200 basis points each to 7.5% and 7%, respectively).”

Going forward, to strengthen the monetary policy transmission, these rates will be linked to the policy rate, the central bank said.

Growth in FY23

“On the back of monetary tightening and assumed fiscal consolidation, growth is expected to be moderate to 3.5-4.5% in FY23 (the next fiscal year starting July 1, 2022),” the SBP said.

Most demand indicators have remained strong since the last MPC—including sales of POL and automobiles, electricity generation, and sales tax on services—and growth in large-scale manufacturing (LSM) accelerated in March.

Both consumer and business confidence have also ticked up. With the output gap now positive, the economy would benefit from some cooling, going forward.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ