PSX falls on monetary tightening fears

KIBOR touching 13-year high, anticipation of spike in inflation sparked stock selling

Despite a positive start, the Pakistan Stock Exchange failed to sustain the bullish momentum in the outgoing week and succumbed to profit-taking primarily owing to the dismal macroeconomic cues.

Jittery investors mainly stayed on the sidelines on concerns over another interest rate hike in the upcoming monetary policy announcement, given that the Karachi Inter-bank Offered Rate (Kibor) had hit a 13-year high. It sparked fears among market players as they rushed to book profits.

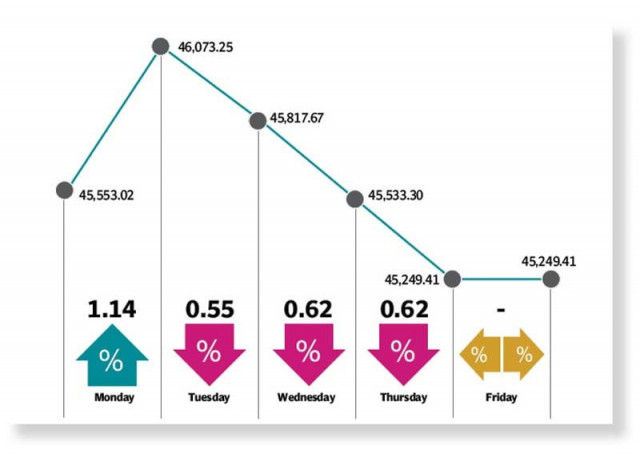

Resultantly, the benchmark KSE-100 index closed the week with a fall of 303.61 points, or 0.67%, at 45,249 points.

“The week commenced in the green zone as investors welcomed better-than-expected corporate results along with a successful agreement with the IMF (International Monetary Fund) to extend the stalled bailout programme,” a report of Arif Habib Limited stated.

However, the momentum could not be sustained amid concerns over further monetary tightening, given that Kibor touched a 13-year high, signalling another interest rate hike, it added.

The week began on a positive note, as the benchmark index surged by around 520 points on the first trading day.

Investors were seen cheering the news of successful completion of talks with the IMF about the loan programme. Pakistan and the IMF agreed to extend the stalled bailout package by up to one year and also increase the loan size to $8 billion.

Subsequently, the market participants took fresh positions across the board and notched up handsome gains.

However, the index failed to sustain the bullish momentum as it declined throughout the remaining days of the week by around 824 points cumulatively.

The surge in Kibor rate to a 13-year high in anticipation of a further hike in inflation reading coupled with uncertainty about the resumption of IMF programme hurt the investors’ sentiment and they opted to book profits across the board.

Moreover, the rise in Kibor rate also sparked concerns about a likely increase in the benchmark policy rate in the upcoming monetary policy announcement, which kept the trading environment dull throughout the remaining days of the week.

“Next week, trading will take place for only one day, given the Eid holidays,” stated the Arif Habib Limited report.

“Once the market resumes trading, we believe stocks will take account of various key events next month such as monetary policy meeting and further update on technical-level talks with the IMF,” the report said, adding “the current visit of the prime minister to Saudi Arabia can also lead to some material announcements.”

During the week under review, average daily traded volume increased 14% week-on-week to 257 million shares, while average daily traded value declined 10% week-on-week to $36 million.

In terms of sectors, positive contribution came from commercial banks (84 points), fertiliser (61 points), chemical (45 points), automobile assemblers (8 points) and leather and tanneries (2 points).

On the flip side, sectors which contributed negatively included cement (117 points), technology and communication (99 points), oil and gas exploration (69 points), power generation and distribution (68 points) and engineering (33 points).

Meanwhile, stock-wise positive contributors were Engro Fertilisers (69 points), Engro Corporation (40 points), Lotte Chemical Pakistan Limited (37 points), Engro Polymer and Chemicals (37 points) and MCB Bank (30 points).

However, negative contribution came from TRG Pakistan (67 points), Hub Power Company (55 points), Lucky Cement (51 points), Pakistan Petroleum Limited (38 points) and Fauji Fertiliser Company (28 points).

Foreign buying was witnessed during the week, which came in at $3.17 million as compared to net selling of $0.97 million in the previous week. Major buying was witnessed in technology and communication ($1.64 million) and textile composite ($1.01 million).

On the local front, selling was reported by insurance companies ($6.71 million), followed by mutual funds ($4.87 million).

Other major news of the week included foreign inflows into domestic bonds drying up to zero in April 2022, T-bill yields rising sharply amid chatter of interest rate hike, Hub Power Company raising the issue of acute shortage of furnace oil in the country and the prime minister’s letter to Russian President Vladimir Putin for boosting ties.

Published in The Express Tribune, April 30th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ