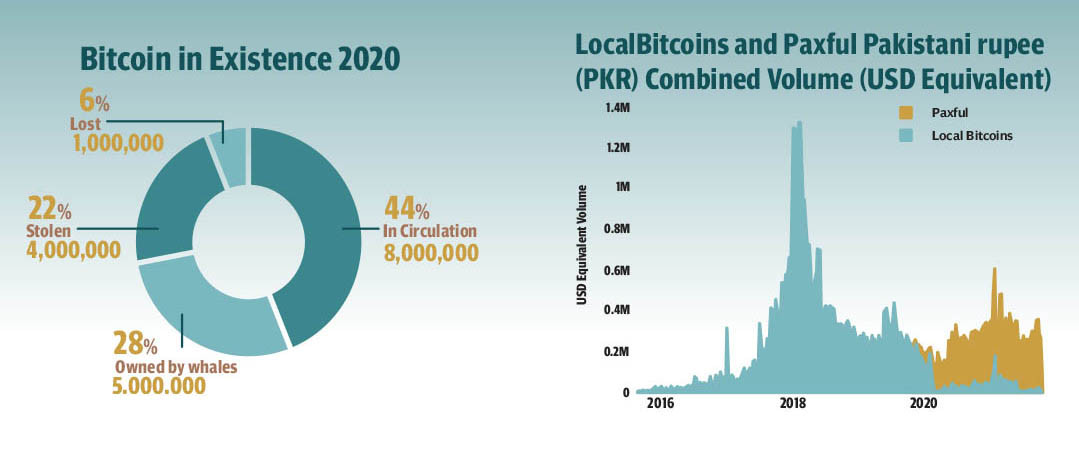

Pakistan is one of the fastest-growing economies with a youth bulge of 65 per cent, rapid technology adaptation, and a government trying to enable a business-friendly legislative framework. The latest data from Sensor Tower shows that Binance, KuCoin, Crypto Blockfolio, OKeX, and are the top cryptocurrency exchanges in Pakistan, among Android and iOS users. These exchanges haven’t taken any proactive measures to capitalise on this huge opportunity presented by the sixth most populous country with the third-highest global crypto adoption. Most exchanges operate either through ghost partners without any regulatory effort. As many as a thousand Pakistani traders are listed on cryptocurrency exchanges based outside of Pakistan. Localbitcoins.com is one of the leading platform on crypto exchanges, which facilitates a bulk of Pakistanis.

Bitcoin and cryptocurrency mining were flourishing in Pakistan until April 2018 when the government banned trading and mining the virtual currencies. There is still a growing mining industry despite the fact that many mining farms have been shut down since this ban was implemented. Bitcoin mining pools like ViaBTC, Braiins and Slush Pool saw an increase in the number of people mining bitcoin and other crypto currencies at home as a result of the ban. The cryptocurrency market is highly volatile, and because of its high volatility, we’ve seen a lot of hesitation from businesses, regulators, and consumers in embracing the asset. There’s no doubt that crypto currencies are a highly risky asset class, which is why more and more exchanges are thriving in countries with least favorable circumstances.

The adoption of cryptocurrencies has begun to gain traction in the country. For the first time, Pakistan has been ranked third on Chainalysis' 2021 Global Crypto Adoption Index. Plans for cryptocurrency mining farms were announced earlier this year by Khyber Pakhtunkhwa province. A committee has been set up at the federal level to look into the regulation of crypto-currencies. These are encouraging signs. However, there is still much to be done, and there is only a brief window of opportunity to do so.

Crypto currencies regulations in Pakistan

DeFi is transforming industries and job roles, opening up new markets for businesses to tap into. DeFi will continue to face obstacles in the form of legal, logistical, and regulatory obstacles to overcome. Block chain technology closes the gaps in security, transparency, authentication, and automation that currently exist in our current systems. Despite the fact that it is still speculative, cryptocurrency is a thriving financial industry in South Asia; especially in India, following the same steps by Pakistan.

“The stablecoins market has been doing fairly well, boasting a market cap of $166 billion and a daily trading volume of $72 billion,” said Haroon Baig, Co-Founder of Emperors Bazaar and former Microsoft employee. “Although the market is majorly dominated by fiat-backed stablecoins like Tether, USD Coin, and Binance USD, algorithmic stablecoins like Terra’s UST have been doing extremely well, projecting a market cap worth over $10 billion. Considering the growth that Terra has shown in the past year in the DeFi sector with nearly $18 billion in total value locked.”

Since their inception as a Ponzi scheme, crypto currencies have progressed from being a gambling tool and a highly volatile asset to finally being recognised as a legitimate virtual asset of value in the region over the course of five years. In times of monetary expansion, high inflation, and significant currency depreciation, the private sector is now considering crypto as a hedge against such economic adversaries, according to the Wall Street Journal.

The government, on the other hand, is divided on the subject. Members of parliament and legislators are frequently seen expressing support for the underlying technology, emphasising the advantages of transparency and decentralisation in their speeches. When regulations are not in place, the bureaucracy is forced to issue blanket statements against the moment in order to curtail terrorism financing and widespread fraud, which are both on the rise. At this point, the country is ready for a concerted corporate effort to gain legal legitimacy for the time being.

“A large unbanked population means that the opportunity for disruptive fin-tech innovations is huge,” said Jawwad Nayyar, co-founder and chief vision officer of DAO PropTech. “Pakistan has one of the largest freelancer’s communities as well as a huge untapped digital remittance services market that can benefit a lot from frictionless DeFi solutions. The freelance and digital remittance services market account for more than $22 billion.”

Many companies are currently working on innovative block chain-based solutions, including electronic voting systems, supply chain management, encrypted identity system implementations, and innovative real estate technology (prop Tech) implementations. Explaining to the regulators that we stand for the same values that they are attempting to uphold appears to be an uphill battle at this point. However, we are confident that we will achieve this goal in due course, and financial democratisation is something that our people desperately require.

Frictionless DeFi solutions and South Asian market potential

Defi solutions provides lenders with an end-to-end, comprehensive solution for the loan or lease lifecycle. Defi's market-leading solution, which works in partnership with captives, banks, credit unions, and finance companies, enables lenders to exceed the expectations of their borrowers. Defi sets new standards for flexibility, configurability, and scalability in the origination and servicing of loans, starting with digital engagement and continuing through the entire lending process (by your experts or ours). Defi solutions is backed by Warburg Pincus, Bain Capital Ventures, and Fiserv, among other investors.

The exchanges named Warburg Pincus, Bain Capital Ventures, and Fiserv are among top exchanges which are operating, entering or already providing hybrid operations in South Asia; mainly India and Pakistan. This place Defi solutions in ideal place to enable lender innovation that attracts and satisfies borrowers in the marketplace. This can be a moon shot in the PropTech domain.

“With the current and pending large-scale servicing implementations, we will have reached a critical mass of clients who are using both our origination and servicing platforms, as well as one or more components of our business process outsourcing,” said Charles Sutherland, Defi solutions Chief Strategy Officer. “Take advantage of this momentum, as well as the ongoing work on Defi organisation, to deliver a modern, cloud-based capability that is unified, cohesive, and efficient.”

Culturally speaking, paper-based fiat assets, created by the institutional monopolistic power, are considered iniquitous. Thus, there is support for the DeFi movement within Intelligential including entrepreneurs, legislators, parliamentarians, tech lovers, and people at large. A consolidated effort to explain the merits of crypto currencies and block chain might be a game-changer for developing countries like Pakistan in the age of Web 3.0.

A possible framework of exchanges in Pakistan

A regulatory framework for this asset class should be developed in Pakistan at the earliest possible opportunity. A lack of an appropriate legal framework causes the demand for cryptocurrency to shift towards unregulated or underground operators. The general public is forced to use unregulated platforms where they have little protection as an investor because they have no other option. Pakistan has the potential to attract block-chain companies, which have lower risk thresholds than traditional financial services companies. These businesses will make certain that, in order to comply with local regulations, they put in place appropriate KYC/AML policies and procedures. It will also benefit the tax net, just as investing in other asset classes such as stocks, commodities, and bonds will benefit the tax net. Despite the difficulties, Pakistan's cryptocurrency boom shows no signs of slowing down any time soon. There are a plethora of Pakistan-based social media groups that teach people how to trade and mine cryptocurrency, some of which have tens of thousands of followers on Facebook.

For Pakistanis to take part in the Bitcoin revolution, there are a variety of options available to them. The benefits are extensive and far outweigh the costs by a large margin. There is an urgent need to develop a national cryptocurrency strategy and to position the country as an early adopter of the cryptocurrency ecosystem. The time has come to take action. Thriving different crypto exchanges in Pakistan open avenues of various trading options, including initial public offerings (IPOs), while also trying to define digital tokens. It's an interesting possibility conceptually. When the real question is that it comes to determining whether any of this will have a long-term impact.