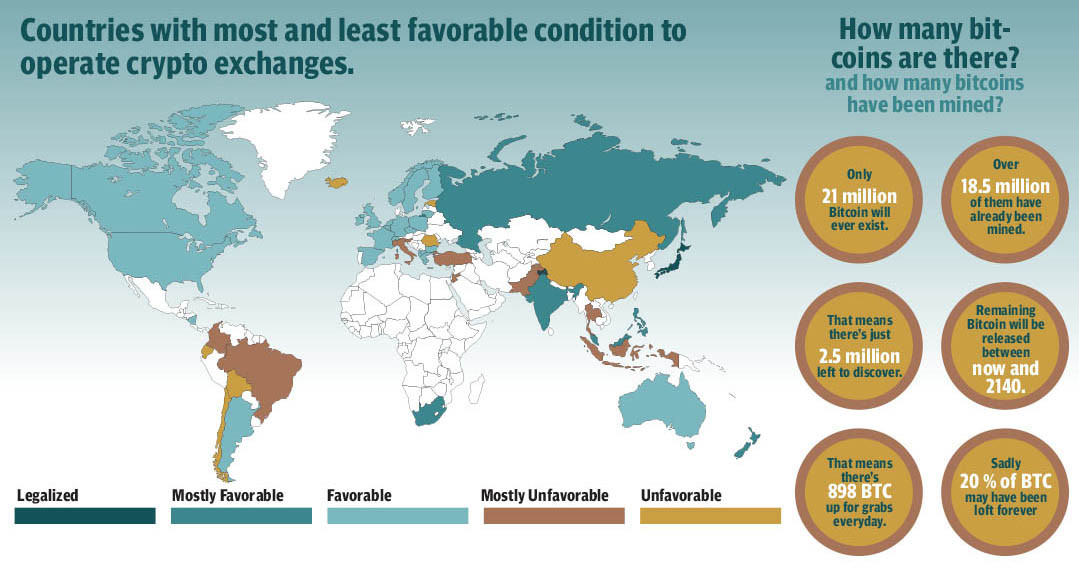

Chainalysis estimates that 20 per cent of all mined BTC has been lost, and recently an engineer has managed to hack a Trezor One wallet to recover $2 million within it. Taking into account how many crypto users may have lost by simply getting locked out of their wallets, what potential impact do these losses have on their respective ecosystems? For example, if a large percentage of tokens are lost forever. Satoshi Nakamoto has said, “Lost coins only make everyone else’s coins worth slightly more.”

A cryptocurrency is a form of digital currency that is controlled and maintained using sophisticated cryptographic primitives known as cryptography. With the creation of Bitcoin in 2009, cryptocurrency transformed from an academic concept to (virtual) reality. Whilst also Bitcoin grew in popularity in the years seeing as, it received substantial investor and media attention in April 2013, when it spiked at a record $266 per bitcoin after surging 10-fold in the previous two months. At its peak, Bitcoin had a market value of more than $2 billion, but a 50 per cent drop shortly after sparked a raging debate about the future of cryptocurrencies in general, and Bitcoin in particular. So, will alternative currencies sooner or later supersede traditional currencies and become as common as dollars and euros? It depends on the standing power of cryptocurrencies in the market.

A cryptocurrency has really no real value excluding the price a buyer is willing to pay for it at any given time. This makes it extremely vulnerable to large price swings, increasing the risk of loss for an investor. On April 11, 2013, Bitcoin, for example, fell from $260 to around $130 in a six-hour period. And $130 behind every single bitcoin evaporated with no lagging knowledge.

A rift between fiat, commodity and digital currency

Some economic observers believe that institutional money will enter the financial system, causing a significant shift in the market. Furthermore, there is a probability that crypto will be listed on the Nasdaq, which would lend legitimacy to block chain and its tools as a substitute for traditional currencies. Some believe that all cryptocurrency necessitates is an authenticated equity index fund (ETF). An ETF would undoubtedly make it easier for people to invest in cryptocurrencies, but there must still be an eagerness to invest in cryptocurrency, which may not be generated automatically by a fund.

Bitcoin is a fabricated currency. With each new block that is mined, new Bitcoins are created, increasing the coin's circulation supply. Since newly minted Bitcoins are fungible, existing coin holders are diluted as supply increases. However, Bitcoin is programmed in such a way that the issuance or dilution of Bitcoin decreases over time, i.e. the creation of new Bitcoins is halved every four years. This supply shock is expected to increase demand for Bitcoin, causing its value to rise.

Crypto regulation framework

Since cryptocurrency regulation is still to be ascertained, the value of cryptocurrencies is strongly influenced by projected future regulatory oversight. For example, in an extreme case, the US government could forbid its citizens from owning cryptocurrencies, similar to how gold ownership was prohibited in the 1930s. In such a case, ownership of cryptocurrency would most likely shift offshore, but their value would be severely harmed. But still, the numbers will remain unknown about supply and demand, and number of cryptocurrencies mined and lost every minute.

It is critical to understand that when it comes to cryptocurrencies, you are your own bank. One of the core values underlying the existence of cryptocurrencies is the desire to reclaim control from intermediaries and centralised parties. However, in order to achieve widespread adoption, crypto wallet interfaces must become simple and easy to understand while keeping the user's security in mind.

There are custodial and non-custodial wallets. In custodial wallets, you do not have control over your private keys, which means that the company holds your coin, and if they are hacked, your wallet is likely to be compromised as well. Though custodial wallets have the advantage of centralised security, you can easily reset your password just like any other application. The private keys are in your possession with non-custodial wallets. The service exists solely to provide you with a more user-friendly interface for interacting with your private key.

“The best approach for scaling adoption with security would be to educate people on how to keep themselves secure and create minimalistic yet effective interfaces,” said Jawad Nayyar, co-founder and chief vision officer of DAO PropTech. “It should not be necessary to make the user feel that they are interacting with blockchain or private keys. It should be just like using another financial application.”

One can only speculate in the myriad of crypto, but not invest in them. There is no rational way to determine the value of bitcoin or any of the other various cryptocurrencies because traditional finance tools cannot be used to calculate the intrinsic value (or true value) of the alleged asset. And if you cannot calculate the true value of an asset, meaning you cannot determine how folds the asset grows or lost within a particular period of time.

How cryptocurrencies are born?

Cryptocurrencies are created digitally via a mining process that presupposes the use of powerful computers to handle complicated coding and squish statistics. They are currently being created at a rate of 25 each 10 minutes, with a ceiling of 21 million expected to be reached in year 2140. These pivotal point stands cryptocurrency tall from the fiat currency, which is backed by the full faith and credit of its government. But what not is known is the amount of cryptocurrency that is lost over the period of time. Nonetheless, given the volatility of this modern concept, there is a probability of a crash. Many experts have stated that in the event of a cryptocurrency market collapse, retail investors would bear the brunt of the losses.

“For now, a meaningful drop in the market value of cryptocurrencies would be just a ripple across the financial services industry,” said Mohamed Damak, sector lead at S&P Global Ratings. But it is still too small to disrupt stability or affect the creditworthiness of banks we rate."

Some of the inherent restrictions of cryptocurrencies, namely the fact that one's digital wealth can be erased by a computer crash or that a virtual vault can be ransacked by a hacker, may be overcome in time by technological advances. What will be more difficult to overcome is the fundamental paradox that cryptocurrencies face: the more popular they become, the more regulation and government scrutiny they are likely to face, eroding the fundamental premise for their existence.

While the number of enterprises acknowledging cryptocurrencies has risen sharply, they remain a small minority. To become more widely used, cryptocurrencies must first gain widespread consumer acceptance. However, their relative complexity in comparison to traditional currencies will likely deter most people, with the exception of the technologically savvy. A cryptocurrency that aspires to be a central to modern banking system may be required to meet widely disparate criteria. It would have to be mathematically complex (to avoid fraud and hacker attacks), but simple for consumers to understand; decentralised, but with adequate consumer safeguards and protection; and maintain user anonymity without acting as a conduit for tax evasion, money laundering, and other nefarious activities.

Is there a business opportunity in recoveries?

There's no reason not to. As the cryptocurrency market expands, so will the demand for firms that specialise in recovering lost coins. There are numerous stories from around the world of people who have used cryptocurrency recovery services after losing their wallet keys or forgetting their PINs. This industry has a lot of potential as long as there are cryptocurrencies.

Given how difficult these criteria are to meet, is it possible that the most popular cryptocurrency in a few years’ time will have characteristics that fall somewhere between heavily regulated fiat currencies and today's cryptocurrencies? While that prospect appears remote, there is little doubt that, as the leading cryptocurrency at the moment, Bitcoin's success or failure in dealing with the challenges it faces may determine the fortunes of other cryptocurrencies in the years ahead.